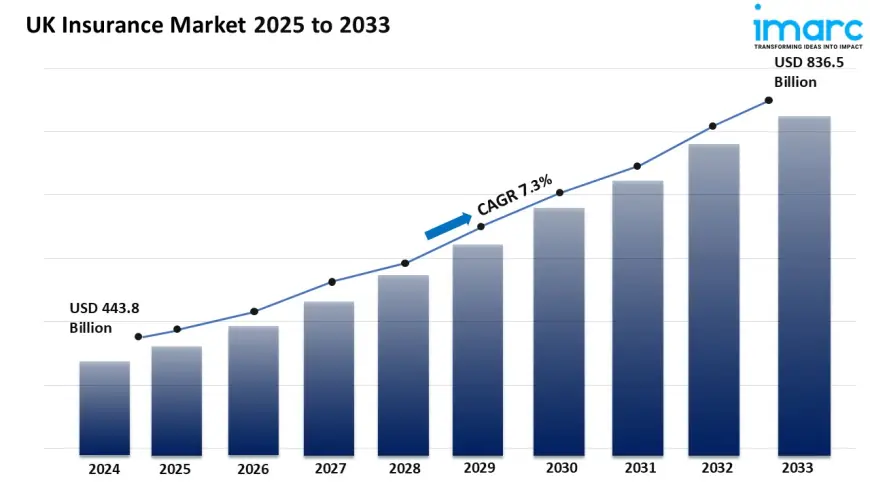

UK Insurance Sector Grows at 7.3% CAGR Amid Rising Coverage Needs 2025-2033

UK insurance market

United Kingdom Insurance Market Overview

Market Size in 2024: USD 443.8 Billion

Market Forecast in 2033: USD 836.5 Billion

Market Growth Rate (2025–2033): 7.3%

The United Kingdom insurance market size reached USD 443.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 836.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.3% during 2025–2033.

Rising Demand for Life and Non-Life Coverage

The UK insurance market is growing steadily. This is because more people want life and non-life insurance products. Life insurance policies stay popular for protecting wealth and planning inheritances. Non-life segments, like motor, property, and health insurance, keep growing. This growth is due to changing lifestyles and new regulations.

Digital Transformation Driving Customer Experience

The industry is quickly using digital tools. AI aids underwriting, chatbots support customer service, and blockchain simplifies claims processing. These technologies are enhancing efficiency, reducing fraud, and improving policyholder experiences. Insurtech startups are also accelerating innovation and competition across the market.

Regulatory Initiatives and Financial Resilience

The FCA and PRA are making helpful changes to regulations. These reforms boost transparency, protect customers, and enhance financial resilience.

Expanding Retirement and Health Coverage

More people in the UK need life insurance. This is due to an aging population and longer life expectancies. This includes coverage linked to pensions and private health plans. Insurers now provide flexible and personalized solutions. These options meet the needs of millennials and Gen Z in the insurance market.

Request Free Sample Report:

https://www.imarcgroup.com/uk-insurance-market%20/requestsample

United Kingdom Insurance Market News

- June 2025 – Aviva introduced a new digital life insurance platform aimed at simplifying underwriting processes for SMEs.

- March 2025 – AXA UK launched a modular cyber-insurance product tailored for small businesses.

- December 2024 – The FCA proposed new guidelines to enhance consumer understanding of bundled insurance policies.

- September 2024 – Legal & General reported a 12% YoY rise in life insurance premiums driven by rising retirement planning needs.

United Kingdom Insurance Market Segmentation:

Type Insights:

- Life Insurance

- Non-life Insurance

- Automobile Insurance

- Fire Insurance

- Liability Insurance

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Explore the Full Report with Charts, Table of Contents, and List of Figures:

https://www.imarcgroup.com/request?type=report&id=24847&flag=C

Key Highlights of the Report:

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No (D): +91-120-433-0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0