URA to enforce e-invoices, e-receipts solutions in January 2021 after 6 months grace period.

To trigger demand for the e-receipts/invoices, communication has been sent to various tax payer categories especially B2B, B2G, Consumers should also demand for them, the use of EFRIS kakasa mobile app is highly encouraged . You can validate the e-invoice using the web portal and a mobile app.

Under the Electronic Fiscal Receipting and Invoicing System (EFRIS) Uganda Revenue Authority (URA) is set to roll out the EFRIS a self-enforcing solution that will enable taxpayers to integrate their billing and accounting systems to the solution. The solution has been embraced by Business to Business (B2B) and Business to Government (B2G) categories.

This follows a grace period since July 2020 when URA implemented the EFRIS which extension was requested by various tax payers. E-invoice and E-Receipt is a new application that allows one to safely, easily and at no cost issue electronic tax documents and check their validity, by registering with URA to the EFRIS solution.

According to The Assistant Commissioner, Process Management at URA, James Odong, the system is designed to improve business efficiencies and reduce the cost of compliance through improved record keeping among taxpayers, truck and authenticate transaction in real time, fast truck payment of refund claims among other benefits.

“The purpose of this initiative is to put in pace a framework for the implementation of a solution that will manage the issuance of e-receipts/invoices and enforce the usage by tax payers required to do so and to promote a platform to facilitate the prefilling of returns” he said.

He said that EFRIS will curb issuance of after sale invoices for final customers to third parties to claim false input tax credit, claims of non-existing import and exports, fictitious purchases with no physical movement of goods and unverifiable claims by taxpayers due to loss of records among others.

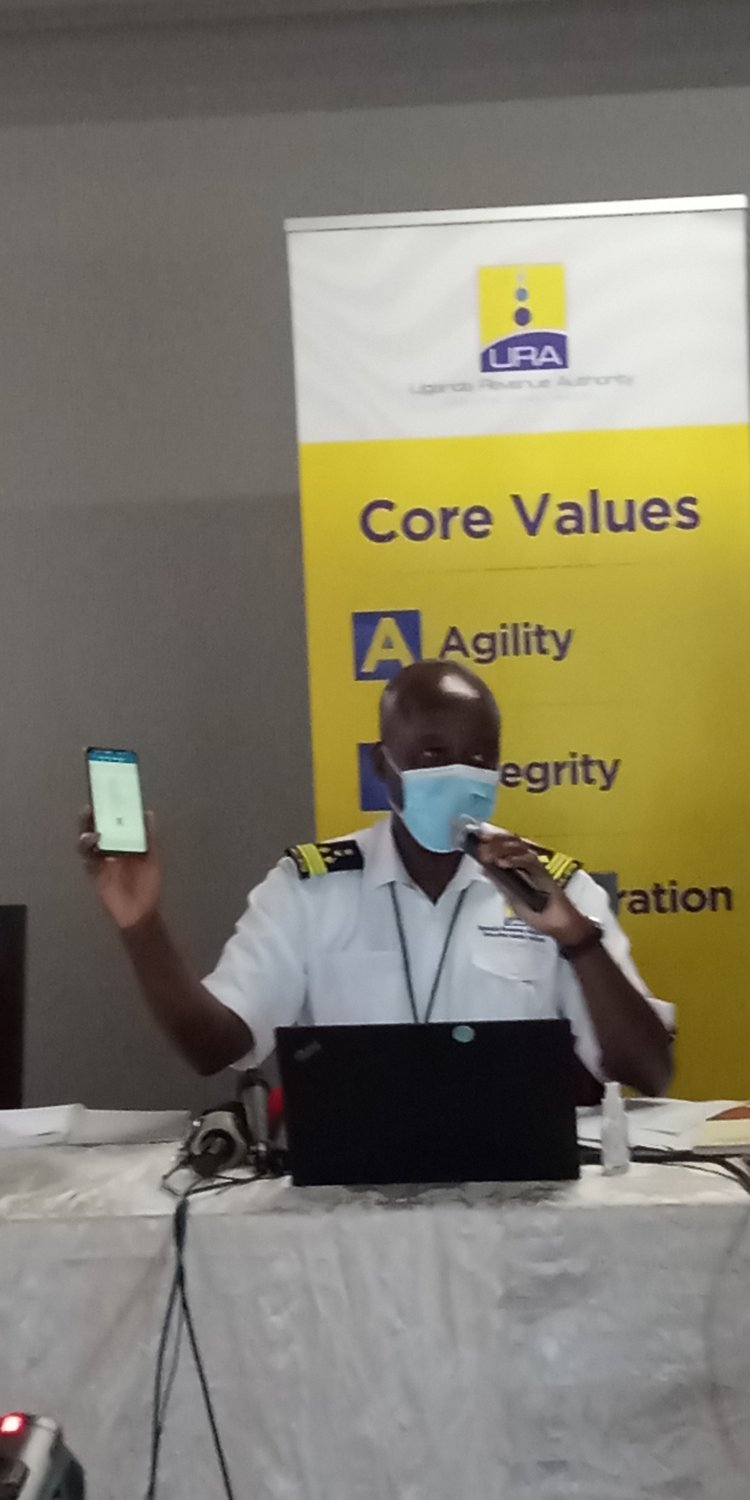

While demonstrating how the system works when issuing e-invoice/receipt, during a press briefing (in picture above) at URA headquarters on Friday, 17th December 2020, Hassan Wassajja from the EFRIS Domestic Tax Department explained that when a sale is made, transactional details will be captured in the seller’s system invoicing system (ERP), encrypted and transmitted to URA in real time to generate e-receipts and e-invoices.

He cautioned tax payers on the EFRIS solution to use software from URA accredited Software vendors before starting to issue e-invoices/receipts. He for instance demonstrated that in order to verify the authenticity of an e-invoice, a mobile app known as “kakasa EFRIS” can be used to scan the QR Code on a physical invoice.

“Every purchaser or consumer is advised to check the validity of an e-invoce or receipt. For verification of an e-invoice, a mobile app on google play “kakasa EFRIS” can be used to scan the QR Code. If its not genuine it will not be verified and issued and will report no-compliance option” he said

According to URA, there are over 18,000 already VAT registered on EFRIS with URA to update their details on the stock account to know their transactions easily. Over 4,000 users have been trained in the use of EFRIS for the last 4 months while other training manuals are available on the URA portal, and You tube. URA have also engaged stakeholders especially business networking business owners including UMA, KACITA, CHADA, USOA, Free zone authority among others.

What's Your Reaction?

Like

1

Like

1

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0