Supply Chain Finance Market Resilience: Supporting Global Supply Chains

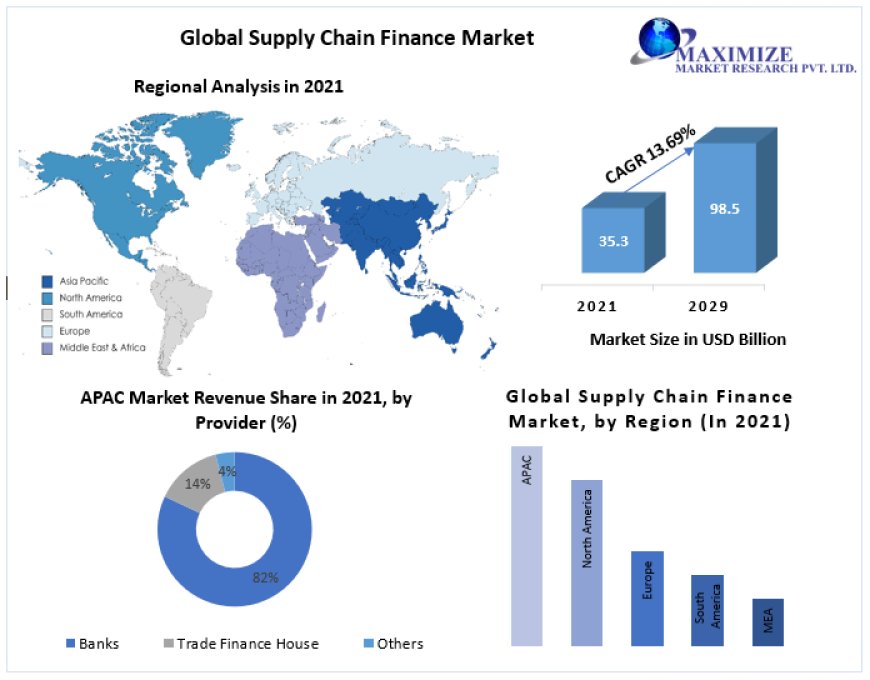

Supply Chain Finance Market was valued at USD 35.3 Billion in 2021 and is expected to reach USD 98.5 Billion by 2029, exhibiting a CAGR of 13.69 % during the forecast period (2022-2029)

The Supply Chain Finance Market report provides insights into the current state and growth projections of the market. Here are the key highlights from the report:

Market Overview:

- The Supply Chain Finance Market was valued at USD 35.3 billion in 2021 and is expected to reach USD 98.5 billion by 2029.

- The market is exhibiting a CAGR of 13.69% during the forecast period from 2022 to 2029.

Request for the samples-https://www.maximizemarketresearch.com/request-sample/168082

Market Dynamics:

- Supply chain finance (SCF) is a growing industry that includes all funding opportunities along a supply chain, with a primary focus on consumer-driven financing.

- Globalization and offshore production have expanded supply chains, leading to a decrease in capital availability for many businesses.

- Increased pressure to improve cash flow and longer payment terms from large customers have put pressure on suppliers

Segment Analysis:

- In 2021, the domestic segment held the largest market share, with expectations to continue to dominate the market.

- The banking sector had the largest market share in 2021, accounting for almost 85% of the global supply chain finance market.

- The fastest CAGR is expected in the overseas category during the forecast period.

Request for the samples-https://www.maximizemarketresearch.com/request-sample/168082

Key Players

• IBM

• Ripple

• Rubix by Deloitte

• Accenture

• Distributed Ledger Technologies

• Oklink

• Nasdaq Linq

• Oracle

• AWS

• Citi Bank

• ELayaway

• HSBC

• Ant Financial

• JD Financial

• Qihoo 360

• Tencent

• Baidu

• Huawei

• Bitspark

• SAP

• ALIBABA

Request for the samples-https://www.maximizemarketresearch.com/request-sample/168082

Market Growth:

- The supply chain finance market reached USD 1,311 billion in 2020, a 35% increase from 2019.

- Only 10% of the total global market is currently satisfied with supply chain finance, indicating a significant potential for expansion.

- The market is expected to continue to grow rapidly at a rate of approximately 20-30% annually in the upcoming years, with a 10% growth rate in 2020.

- The US and Western Europe are witnessing the fastest growth in supply chain finance initiatives, with Asia, particularly China and India, expected to hold the most promise in the future.

Trending Factors:

- Optimizing regulation and compliance issues are a growing concern, with businesses focusing on compliance resolutions as a top automation priority.

- Innovations in risk management, such as real-time threat and fraud detection, are becoming crucial for better supply chain management.

- Recognizing shifting customer needs and behaviors is essential for adapting to new industry demands.

- The interaction between human capabilities and advanced technologies is crucial for businesses' success.

Regional Analysis:

- The Asia-Pacific (APAC) region is expected to witness significant growth due to its export-led economic model and rising importance in global trade.

- The APAC region is at the forefront of supply chain finance development, with growth driven by increased consumer consumption.

Key Players:

- Major key players in the supply chain finance market include IBM, Ripple, Rubix by Deloitte, Accenture, Distributed Ledger Technologies, and others.

The report offers a comprehensive analysis of the Supply Chain Finance Market, its growth potential, and the driving factors in different regions and segments. It is a valuable resource for understanding the current state and future trends in the supply chain finance industry.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

???? mailto:sales@maximizemarketresearch.com

???? https://www.maximizemarketresearch.com

Social Links:

| Twitter | LinkedIn | Facebook | Instagram |

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0