Asia Pacific Emerges as Key Consumer of Enzymes in Spices and Seasonings Market

Spices and Seasonings Market By Product Type (Spices, Pepper, Ginger, Cinnamon, Others, Herbs, Garlic, Oregano, Others, Salt And Salt Substitutes), By Form (Whole, Powder, Crushed), By Application (Meat and Poultry Products, Snacks and Convenience Food, Soups, Sauces and Dressings, Bakery and Confectionery, Frozen Products, Beverages, Others), By Distribution (Channel, Foodservice, Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

Overview :

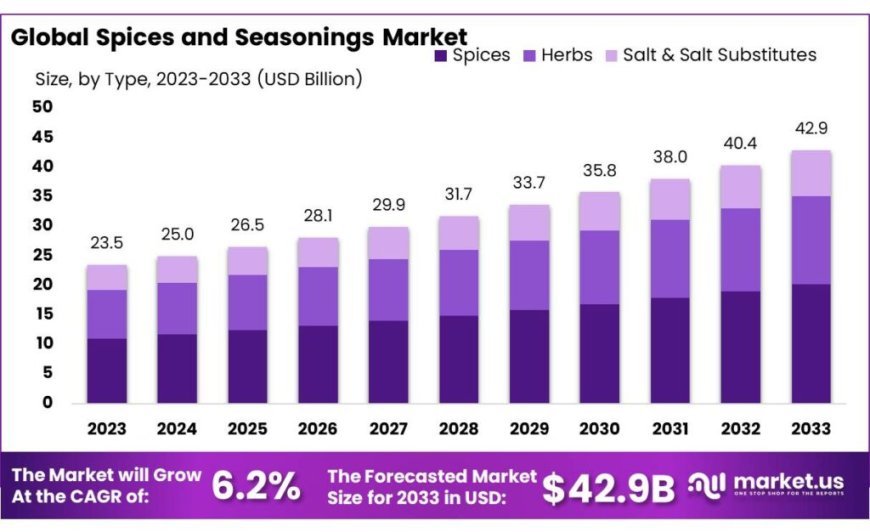

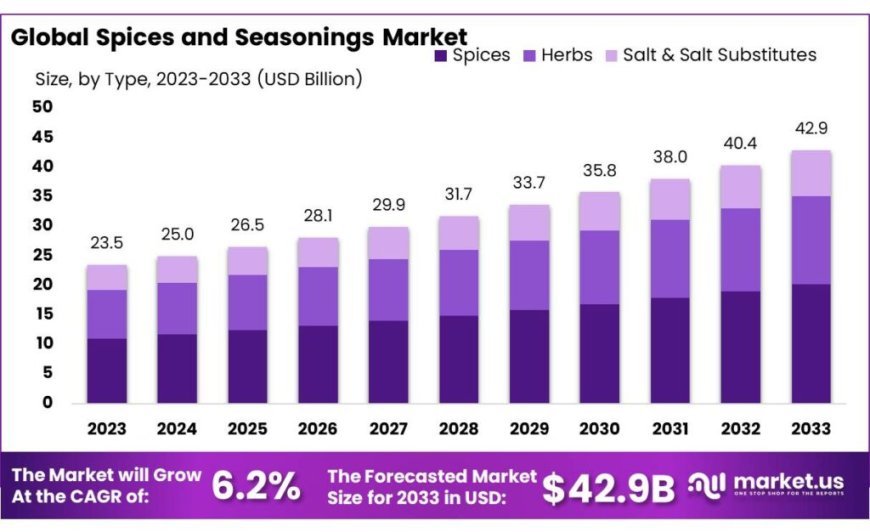

Spices and Seasonings Market size is expected to be worth around USD 42.9 billion by 2033, from USD 23.5 billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2023 to 2033.

The spices and seasonings market refers to the industry that produces and sells various herbs, spices, and seasoning blends used to enhance the flavor, aroma, and color of food. This market includes a wide range of products such as black pepper, cinnamon, turmeric, cumin, oregano, and mixed seasonings, which are integral to culinary practices worldwide. The growing consumer awareness about the medicinal and health benefits of spices, such as their antioxidant, anti-inflammatory, and digestive properties, is significantly driving market growth. Additionally, more people cooking at home, especially post-pandemic, has increased the demand for these products as consumers experiment with new recipes and flavors.

Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/spices-and-seasonings-market/request-sample/

Another key factor fueling the market's expansion is the rising willingness of consumers to pay a premium for ethnic and novel flavors. The globalization of food culture, driven by travel, media, and the internet, has brought international recognition to diverse local cuisines. This trend has led to a surge in demand for exotic spices and seasonings that can replicate authentic culinary experiences at home. Consequently, food manufacturers and retailers are expanding their spice and seasoning offerings to cater to these adventurous palates, further propelling the market's growth.

Кеу Маrkеt Ѕеgmеnts :

By Product Type

-

Spices

-

Pepper

-

Ginger

-

Cinnamon

-

Others

-

Herbs

-

Garlic

-

Oregano

-

Others

-

Salt & Salt Substitutes

By Form

-

Whole

-

Powder

-

Crushed

By Application

-

Meat and Poultry Products

-

Snacks and Convenience Food

-

Soups, Sauces and Dressings

-

Bakery and Confectionery

-

Frozen Products

-

Beverages

-

Others

By Distribution Channel :

-

Foodservice

-

Retail

Product Type Analysis:

In 2023, spices dominated the baking ingredients market, capturing over 47.5% of the share due to their versatility and popularity. Common spices like turmeric, cinnamon, and pepper are in high demand, along with other varieties like cloves, garlic, and ginger.

Form Analysis:

Whole spices, popular in main dishes and snacks, also contributed significantly to the market. Spicy foods' rising popularity has driven the demand for both powdered and whole spices in the food industry.

Application Analysis:

In 2023, meat and poultry products led the spices and seasonings market with over 31% share, followed by snacks and convenience foods at 28%. Soups, sauces, and dressings held 18%, while bakery and confectionery accounted for 15%.

Distribution Channel Analysis:

In 2023, the food service sector accounted for a significant portion of global revenue, driven by cafes, restaurants, and hotels. Despite the pandemic's impact, this sector is recovering as restrictions ease.

Маrkеt Кеу Рlауеrѕ :

-

Ajinomoto Co, Inc.

-

ARIAKE JAPAN CO, LTD.

-

Associated British Foods plc

-

Baria Pepper Co. Ltd.

-

Döhler GmbH

-

DS Group

-

EVEREST Food Products Pvt. Ltd.

-

The Kraft Heinz Company

-

Kerry Group plc

-

McCormick & Company

-

Olam International

-

Sensient Technologies Corporation

-

SHS Group

-

Spice Hunter (Sauer Brands Inc.)

-

Unilever plc

-

Worlée-Chemie GmbH

Driver:

The global trend towards clean-label products is driving the spices and seasonings market. Modern consumers increasingly prefer natural and wholesome ingredients, leading to a higher demand for products with natural flavors and colors. This trend offers food manufacturers opportunities to develop new formulations and products that cater to the growing demand for healthier food options.

Restraint:

Excessive consumption of spices can have adverse health effects, such as heartburn, acid reflux, and acute gastritis. Spicy foods rich in capsaicin can irritate the digestive system, leading to discomfort and potential health issues, thereby limiting the use of spices among certain consumer groups.

Opportunity:

Encapsulation technology in spices has witnessed higher sales growth, offering significant opportunities. Techniques like controlled-release encapsulation enhance the flavor and color of spices, making them easier to handle and more appealing. Companies like TasteTech are leading this innovation, providing improved spice products for the food and beverage industry.

Challenge:

Spices and seasonings are prone to microbial contamination due to their perishable nature. The lack of adequate storage and warehousing facilities, especially in major producing countries like India, exacerbates this issue. Ensuring quality and safety remains a significant challenge for the market.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0