SharkShop Credit Tools: A Smart Investment for Your Credit Score

SharkShop Credit Tools: A Smart Investment for Your Credit Score

SharkShop Credit Tools: A Smart Investment for Your Credit Score

Are you tired of watching your credit score fluctuate like a rollercoaster ride? Do you want to unlock the secret to financial freedom and secure that dream home or shiny new car? Look no further! In today's fast-paced world, having a solid credit score is more than just a number—it's your ticket to better interest rates, higher loan approvals, and peace of mind.

Enter SharkShop.biz Credit Tools: the ultimate game-changer in the realm of personal finance! Whether you're starting from scratch or looking to boost an existing score, these innovative tools are designed for savvy individuals ready to take control of their financial destiny. Join us as we dive deep into how SharkShop can transform your credit journey and pave the way for smart investments in your future!

Introduction to SharkShop Credit Tools

Navigating the world of credit can feel like walking a tightrope. One wrong move, and your score could plummet, impacting everything from loan approvals to interest rates. But what if you had a reliable partner by your side? Enter SharkShop Credit Tools, designed to empower you in mastering your financial health.

Whether you're starting on your credit journey or looking to recover from past mistakes, these tools offer innovative solutions tailored just for you. Say goodbye to confusion and hello to clarity as we explore how SharkShop.biz can transform your credit score into an asset rather than a liability. Let’s dive deeper into this smart investment that promises not just improvements but lasting changes for your financial future!

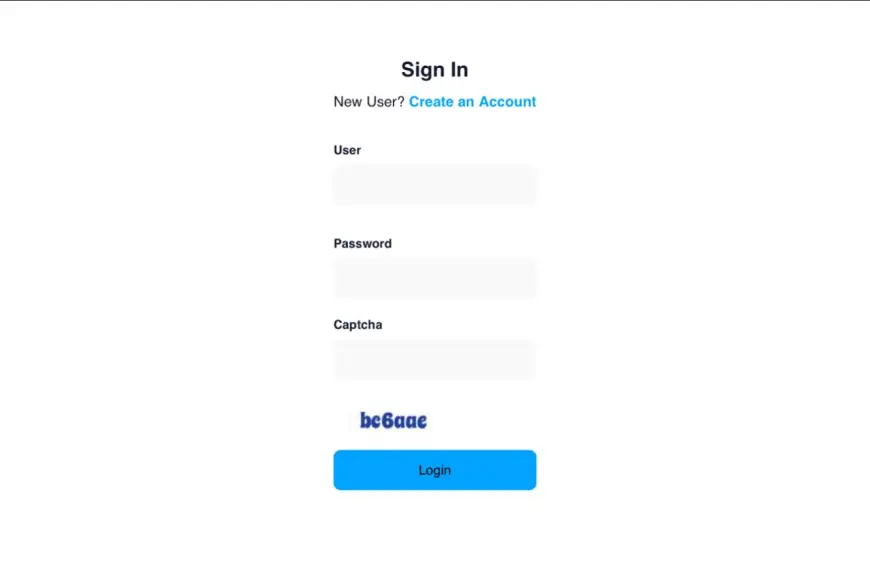

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding Your Credit Score

Your credit score is more than just a number. It’s a key that unlocks financial opportunities, influencing everything from loan approvals to interest rates.

Scores typically range from 300 to 850. The higher your score, the better your chances of securing favorable terms on loans and credit cards.

Several factors contribute to this crucial figure. Payment history holds significant weight, accounting for about 35% of your score. Consistently paying bills on time showcases reliability.

Credit utilization plays another role. This refers to how much of your available credit you’re using. Keeping it below 30% can positively impact your score.

Length of credit history also matters—longer histories indicate stability and trustworthiness in managing debt.

Understanding these fundamentals empowers you to take control of your financial future effectively.

How SharkShop Credit Tools Can Help Improve Your Credit Score

SharkShop Credit Tools present a tailored approach to understanding and enhancing your credit score. By providing personalized insights, these tools guide users through the complexities of credit management.

One standout feature is their intuitive dashboard, which visualizes your credit data. It highlights factors impacting your score while offering actionable recommendations.

Additionally, SharkShop offers educational resources that demystify common pitfalls in credit maintenance. Users can learn about payment history, credit utilization ratio, and account types—key elements influencing their scores.

With real-time alerts for significant changes in your report, you stay informed and proactive. This empowers you to make timely decisions that positively impact your financial health.

Overall, SharkShop's effective combination of education and technology could be the game-changer many need on their journey towards improved creditworthiness.

Features and Benefits of SharkShop Credit Tools

SharkShop Credit Tools come packed with features designed to empower users in their credit journey. One standout feature is the real-time credit monitoring. This allows you to keep tabs on your score and get alerts for any changes.

Another significant benefit is the personalized action plans tailored to your unique financial situation. These plans guide you through steps that can lead to tangible improvements over time.

The user-friendly interface makes it easy for anyone, regardless of technical expertise, to navigate the tools effectively. Whether you're looking at debt management or understanding credit utilization, everything is just a click away.

Additionally, SharkShop offers educational resources that explain complex concepts in simple language. This ensures you not only improve your score but also gain valuable knowledge about maintaining good credit health long-term.

Real Life Success Stories with SharkShop Credit Tools

Many users have transformed their financial lives using SharkShop Credit Tools. Take Sarah, for instance. After struggling with a low credit score due to unpaid bills, she sought help through the platform. With personalized guidance and actionable insights, her score jumped by over 100 points within six months.

Then there’s Mike, who was on the verge of being denied a mortgage. He turned to SharkShop and discovered errors in his report that were dragging him down. The tools helped him dispute those inaccuracies effectively, paving the way for homeownership.

These stories highlight how real people are experiencing significant improvements thanks to targeted strategies provided by SharkShop login. Each success is unique but shares a common thread: empowerment through knowledge and effective resources tailored for individual needs.

Comparing SharkShop Credit Tools to Other Credit Repair Services

When looking at credit repair options, SharkShop stands out in several key areas. Unlike many traditional services, which often rely on generic solutions, SharkShop offers personalized tools tailored to your unique financial situation.

Many companies promise quick fixes but can leave clients feeling frustrated. SharkShop emphasizes education and empowerment instead. Users gain insights into their credit scores and learn strategies for long-term improvement.

Another differentiator is transparency. While some services charge hidden fees or make vague promises, SharkShop provides clear pricing with no surprises. This commitment builds trust and fosters a more positive user experience.

Additionally, the integration of technology within SharkShop's platform allows users to track progress in real-time. Many competitors lack this feature, leaving clients guessing about their status.

Ultimately, choosing a credit repair service requires careful consideration of features that align with personal goals—and SharkShop certainly delivers on that front.

Tips for Using SharkShop Credit Tools Effectively

To maximize your experience with SharkShop, start by setting clear goals. Understand what you want to achieve—whether that's boosting your score for a mortgage or simply improving overall credit health.

Regularly monitor your progress through the tools provided. This will keep you informed and motivated. Utilize features like personalized insights to understand where improvements can be made.

Don’t hesitate to take advantage of educational resources available on the platform. Knowledge is power when it comes to managing credit effectively.

Engage with community forums if available; sharing experiences can yield helpful tips and alternative perspectives.

Lastly, consistency is key. Regularly check in on your account and update any necessary financial information promptly. The more proactive you are, the better results you'll see from using SharkShop cc comprehensive suite of tools.

Common Misconceptions About Improving Your Credit Score

Many people believe that checking their credit score will negatively impact it. This is a common myth. In reality, checking your own credit report is considered a soft inquiry and does not affect your score.

Another misconception is that debt elimination guarantees an improved score. While reducing debt helps, factors like payment history and credit utilization also play significant roles in determining your overall score.

Some think closing old accounts boosts their rating. However, keeping older accounts open can enhance the length of your credit history—a vital aspect of scoring models.

Lastly, many assume they can quickly fix their scores overnight with quick fixes or shady services. Improving a credit score takes time and dedication, often requiring consistent financial habits rather than instant solutions.

The Importance of Investing in Your Credit Health

Investing in your credit health is crucial for financial freedom. A solid credit score opens doors to better loan terms, lower interest rates, and even rental opportunities.

Many underestimate the long-term benefits of maintaining good credit. It’s not just about borrowing money; it impacts insurance premiums and potentially job prospects too.

Think of your credit as a reflection of your financial responsibility. By investing time and resources into understanding and improving it, you’re setting yourself up for stability.

The effort you put forth today can save hundreds or thousands in future expenses. Small steps like monitoring reports regularly or using tools designed for improvement can yield significant results.

In a world where financial decisions matter more than ever, prioritizing your credit health is an intelligent move that pays dividends down the line.

Conclusion: Why SharkShop Credit Tools is a Smart Investment for Your Future

Investing in your credit health is a decision that can significantly impact your financial future. SharkShop.biz Credit Tools provide you with the resources and support needed to navigate the complexities of credit management effectively. With its user-friendly interface, comprehensive features, and proven success stories from real users, it stands out as a reliable option for anyone looking to improve their credit score.

By utilizing SharkShop’s tools, you not only gain insights into your current standing but also learn actionable strategies tailored for long-term improvement. This investment in yourself pays dividends over time—whether you're aiming for better loan rates, securing housing, or simply wanting peace of mind regarding your finances.

As you contemplate ways to strengthen your credit profile, remember that partnering with an established service like SharkShop can make all the difference. Your journey towards better credit begins with informed choices and effective tools designed specifically for success. Embrace this opportunity; it's more than just numbers on a report—it’s about building a brighter financial future.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0