Rising Disposable Incomes Fuel Demand for Optical Coatings in Consumer Electronics

Optical Coating Market By Product (Anti-Reflective Coatings, High Reflective Coatings, Transparent Conductive Coatings, Filter Coatings, Beam Splitter Coatings, Others), By Technology (Vacuum Deposition, E-beam Evaporation, Sputtering Process, Ion-Assisted Deposition), By End-Use(Consumer Electronics, Solar, Medical, Telecommunication, Architecture, Aerospace & Defense, Automotive, Others) As well as by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2023-2033

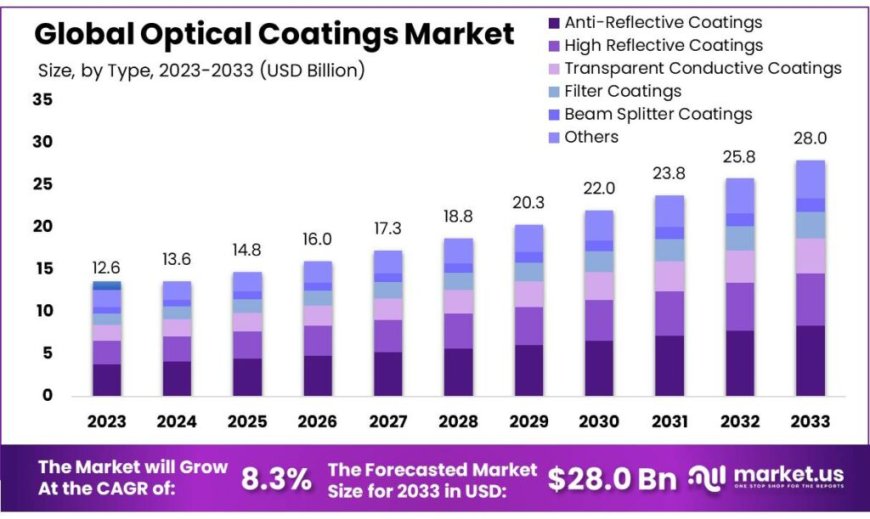

Optical Coatings Market size is expected to be worth around USD 28.0 billion by 2033, from USD 12.6 billion in 2023, growing at a CAGR of 8.3% during the forecast period from 2023 to 2033.

The optical coatings market focuses on the development and application of thin layers of material applied to optical surfaces to enhance their performance. These coatings are designed to improve the functionality of optical devices by manipulating light in various ways, such as reducing glare, increasing reflectivity, or enhancing transmission. With advancements in optical deposition and fabrication technologies, the market is set to expand significantly. The increasing demand for energy-efficient optical devices across different sectors is a major driving force behind this growth.

Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/optical-coatings-market/request-sample/

Optical coatings are used in a wide range of applications. In architecture, they help control light and improve energy efficiency in buildings. In the automotive industry, coatings enhance visibility and durability of vehicle windows and headlights. Consumer electronics, such as solar panels and screens, benefit from coatings that optimize light absorption and reduce reflections.

The telecommunication sector uses coatings to improve signal clarity and data transmission. In medical and military applications, coatings provide essential features like anti-reflective properties and protection for sensitive equipment. Overall, the optical coatings market is expanding due to technological advancements and increasing demand for high-performance optical devices.

Key Market Segments:

By Product

-

Anti-Reflective Coatings

-

High Reflective Coatings

-

Transparent Conductive Coatings

-

Filter Coatings

-

Beam Splitter Coatings

-

Others

By Technology:

-

Vacuum Deposition

-

E-beam Evaporation

-

Sputtering Process

-

Ion-Assisted Deposition

By End-Use:

-

Consumer Electronics

-

Solar

-

Medical

-

Telecommunication

-

Architecture

-

Aerospace & Defense

-

Automotive

-

Others

Product Analysis :

The Anti-Reflective Coatings segment led the market with over 30.1% share in 2023, driven by their use in magnifying lenses, camera lenses, and eyeglasses, and is expected to grow due to increasing demand for solar panels and automotive displays.

Technology :

Vacuum Deposition remains dominant due to its precision and versatility, while E-beam Evaporation is favored for ultra-thin coatings, Sputtering Process is popular for its durability, and Ion-Assisted Deposition excels in enhancing coating adhesion, with Others covering niche methods.

End-Use :

The Consumer Electronics segment led with over 32.0% share in 2023, driven by high demand for smartphones and smart devices, while Automotive applications are expanding due to increased use of optical coatings for displays, gear knobs, and windows.

Key Market Players :

-

Reynard Corporation

-

Sigmakoki Co. Ltd

-

SCHOTT

-

Quantum Coating

-

JENOPTIK

-

PPG Industries Inc.

-

Materion

-

Inrad Optics

-

Newport Corporation

-

ZEISS International

-

DuPont

-

Nippon Sheet Glass Co. Ltd

-

Optimax Systems, Inc.

-

Optical Coatings Technologies

-

Gelest Inc.

Drivers :

The optical coatings market is significantly driven by the rising demand from the electronics and semiconductor industries. Optical coatings enhance the performance of components like printed circuit boards and integrated circuits, supporting high-temperature resistance and rapid thermal processing. Their integration into smartphones for improved display and touch capabilities further accelerates market growth.

Restraints :

Volatility in raw material prices poses a significant challenge for the optical coatings market. Price fluctuations for essential materials like titanium dioxide, indium, gold, and silver can affect manufacturing costs and profitability. This unpredictability can hinder market expansion, though recent trends show a decrease in metal costs.

Opportunities :

The growing adoption of advanced automotive electronics presents a promising opportunity for the optical coatings market. Enhanced demand for driver assistance systems and infotainment features in vehicles drives the need for optical coatings in components like light guides, headlamp lenses, and display windows, creating substantial growth potential.

Challenges :

Stringent government regulations on product safety, environmental sustainability, and performance standards present challenges for the optical coatings market. Compliance requires significant investment in research, development, and process adaptation, impacting operational costs and necessitating a balance between regulatory adherence and cost-effectiveness.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0