United States Fast Food and Quick Service Restaurants Market Trends Forecast 2025-2033

United States Fast Food and Quick Service Restaurants Market Trends Forecast 2025-2033

United States Fast Food and Quick Service Restaurants Market Size, Share & Forecast 2025-2033

Market Overview

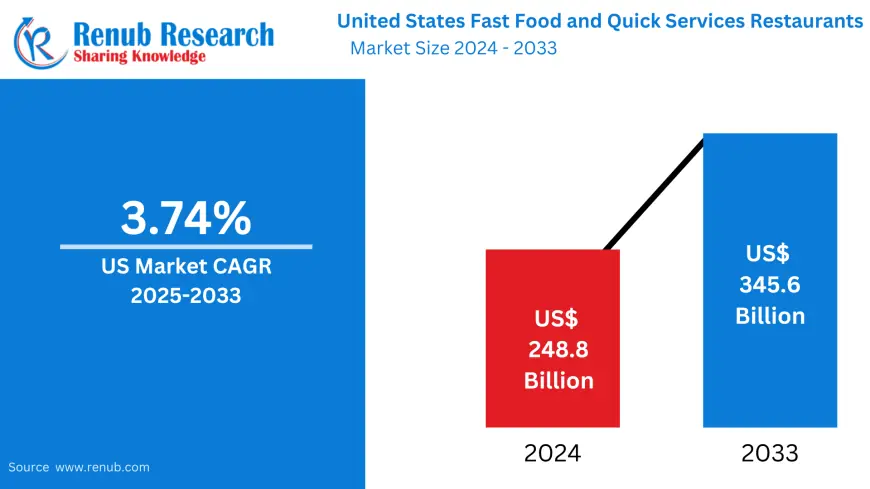

The United States Fast Food & Quick Service Restaurant (QSR) Market was valued at US$ 248.8 Billion in 2024 and is projected to reach US$ 345.6 Billion by 2033, growing at a CAGR of 3.74% during 2025-2033. This growth is primarily fueled by changing consumer preferences, increasing demand for convenience, advancements in digital technology, and the ongoing trend towards healthier food choices.

Fast food and QSRs have become an inseparable part of American culture, driven by the country's fast-paced lifestyle, urbanization, and technological adoption. Consumers are increasingly relying on quick meal solutions that offer affordability, taste, and efficiency—all hallmarks of QSRs.

Market Dynamics

Key Growth Drivers

1. Rising Demand for Convenience and Time-Saving Dining

The American lifestyle has evolved to prioritize efficiency, pushing consumers towards fast food as a practical solution. The rise of drive-thrus, mobile ordering, third-party delivery services (e.g., DoorDash, Uber Eats), and contactless payments has significantly increased consumer reliance on QSRs. Brands like Perkins American Food Co., with its 2024 launch of “Perkins Griddle Go,” are capitalizing on this by creating fast-casual solutions designed for on-the-go consumption.

2. Shift Toward Health-Conscious Menus

A major transformation is visible in the menu strategies of leading QSR brands. Consumers now demand more plant-based, low-calorie, and organic options, prompting giants like McDonald’s, Burger King, and Subway to innovate with grilled items, meat alternatives (Beyond Meat, Impossible Foods), and nutritional transparency. The Healthy Food Financing Initiative (HFFI) and FARE Fund are further accelerating access to healthy fast food across underserved populations.

3. Integration of Smart Technology and Digital Platforms

QSRs are embracing technology to optimize operations and enhance customer engagement. Features such as self-service kiosks, AI-driven ordering systems, and personalized app promotions are boosting loyalty and operational efficiency. Starbucks and Chick-fil-A are leveraging mobile apps and AI-based customer data to personalize the experience. Ghost kitchens and virtual brands are also helping restaurants cater to delivery-first consumers.

Market Challenges

1. Rising Operational Costs

QSRs face challenges from inflation, increasing wages, and supply chain disruptions. Labor shortages and the demand for higher wages have impacted profitability, while restaurants must invest in sustainable packaging and compliance with stringent food safety regulations.

2. Saturation and Intense Competition

The QSR market is highly saturated with global giants like McDonald’s, Domino’s, and Subway competing with rising fast-casual brands such as Shake Shack and Chipotle. Independent operators and international brands entering the U.S. market further intensify the competition, forcing incumbents to innovate and differentiate continuously.

Related Report

India Online Food Delivery Market

Segmental Analysis

Product Segments

➤ Hamburgers

This category remains a market leader, dominated by McDonald's, Burger King, and Wendy’s. Innovations like custom toppings, plant-based patties, and premium-style burgers from brands like Five Guys and Shake Shack are reshaping consumer preferences. The popularity of Impossible Burgers reflects a clear demand for meat-free alternatives without compromising taste.

➤ Pizza

Domino’s, Pizza Hut, and Papa John’s dominate this space with widespread delivery networks and build-your-own pizza customization options. Health-conscious crust alternatives (cauliflower, gluten-free) and take-home products are attracting more health-aware and home-focused consumers.

➤ Mexican Food

Mexican QSRs, led by Taco Bell, Chipotle, and Qdoba, are booming due to their flavor-rich, fresh, and customizable offerings. The increased Hispanic influence, along with demand for protein-rich and plant-based foods, is helping this segment expand quickly.

➤ Sandwiches and Others

Brands like Subway dominate the sandwich segment, driven by low-cost, fresh, and customizable options. The “Others” category includes rising stars like Asian QSRs and fusion food concepts, which are becoming more popular due to America's diverse cultural base.

Regional Insights

➤ Eastern U.S.

Major cities like New York, Boston, and Washington, D.C., drive strong demand due to dense urban populations and a busy workforce. Digital adoption and a growing preference for healthy options are redefining fast food trends in this region.

➤ Western U.S.

The West is a hub of innovation, both culinary and technological. Home to brands like In-N-Out Burger, the region also leads in eco-conscious and health-focused fast food options. Cities like San Francisco and Los Angeles are at the forefront of mobile ordering and sustainable dining.

➤ Northern U.S.

Consumer preferences in the North are influenced by colder climates and multicultural demographics. Comfort food, hot beverages, and regional QSRs like Culver’s thrive here. Ghost kitchens and delivery options are well-received in metropolitan zones.

➤ Southern U.S.

The South boasts a strong heritage in fast food, especially fried chicken, barbecue, and comfort food. Brands like Chick-fil-A, Popeyes, and Bojangles thrive in this flavor-driven market. Rising urbanization and population growth in Texas and Florida are fueling further expansion.

Competitive Landscape

The report provides comprehensive company analysis across four key dimensions:

- Company Overview

- Key Personnel

- Recent Developments

- Revenue Analysis

Major Players Covered:

- McDonald's Corporation

- Domino’s Pizza, Inc.

- Pizza Hut, LLC

- KFC Corporation

- Taco Bell IP Holder, LLC

- CFA Properties, Inc. (Chick-fil-A)

- Subway IP LLC

- Chipotle Mexican Grill

Report Segmentation

By Product:

- Hamburgers

- Sandwich

- Pizza

- Mexican

- Others

By Region:

- East

- West

- North

- South

Report Specifications

|

Feature |

Details |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2033 |

|

Market Units |

USD Billion |

|

Format |

PDF + Excel (PPT/Word on request) |

|

Post-Sale Support |

1-Year Analyst Access |

|

Customization |

20% Free |

|

Pricing |

Starts at $2,490 |

Key Questions Answered

- What is the current and projected size of the U.S. QSR market?

- What is the CAGR from 2025 to 2033?

- What are the key growth drivers and challenges?

- How is technology influencing QSR operations?

- What product segments are covered?

- What are the trends across different U.S. regions?

- Who are the leading players in the market?

Customization Services Available

We offer tailored customization services, including:

- Segment-wise market size analysis

- Addition of extra company profiles

- Market entry strategies

- Regional dynamics

- Competitive benchmarking

- Trade and supply chain analysis

For more information or to request a customized report, contact:

? USA: +1-678-302-0700 | ? INDIA: +91-120-421-9822

? Email: info@renub.com

? www.renub.com

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0