Saudi Arabia Poultry Meat Market Trends Forecast 2025-2033

Saudi Arabia Poultry Meat Market Trends Forecast 2025-2033

Saudi Arabia Poultry Meat Market Size, Share, Growth Trends, and Forecast 2025-2033

Market Overview

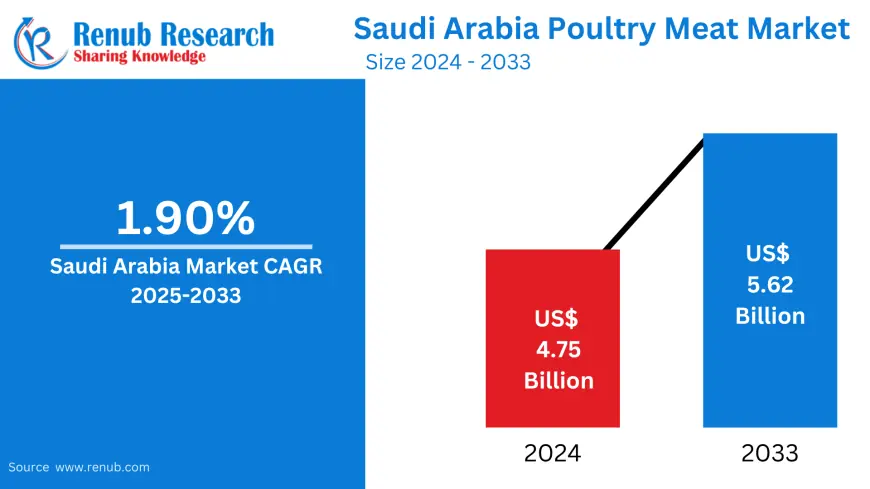

The Saudi Arabia Poultry Meat Market is anticipated to reach US$ 5.62 Billion by 2033, rising from US$ 4.75 Billion in 2024, growing at a CAGR of 1.90% during 2025 to 2033. This growth trajectory is driven by increasing urbanization, a surge in disposable incomes, shifting dietary preferences, enhanced food processing capabilities, and strong government initiatives promoting food security and self-sufficiency.

Driving Forces Behind Market Growth

1. Government Initiatives and Food Security Programs

The Kingdom’s Vision 2030 is at the forefront of its poultry sector transformation. With a focus on reducing import dependency, the government is:

- Providing interest-free loans, equipment subsidies, and infrastructure investments to boost domestic production.

- Targeting 100% domestic poultry production by 2030.

- Offering up to US$ 187 million in incentives annually to producers.

These policies are reshaping the market landscape by attracting foreign investments, improving production efficiency, and reducing mortality rates in poultry farms by around 8% over the past five years.

2. Cultural Significance and Halal Certification

The religious and cultural alignment of poultry production, particularly the emphasis on halal certification, plays a pivotal role. Consumers strongly favor halal-certified meat, making it a non-negotiable quality standard for producers. This alignment enhances both domestic trust and export potential in halal-driven international markets.

3. Robust Retail and Foodservice Sector Expansion

The proliferation of supermarkets, hypermarkets, convenience stores, and the rise of online grocery channels has significantly boosted the availability of poultry products. Meanwhile, the fast-growing foodservice sector, including QSRs (Quick Service Restaurants), is increasing demand for processed and ready-to-eat poultry, such as:

- Marinated cuts

- Nuggets

- Deli meats

- Sausages

This availability across formats is increasing poultry’s penetration in daily diets.

Related Report

Germany Chicken/Poultry Market

Market Challenges

1. Rising Production Costs and Price Sensitivity

Between 2017 and 2022, poultry meat prices rose by 7.84%, reaching US$ 3,426 per ton in 2022. The increase stems from:

- Rising imported feed costs (primarily from France and Brazil)

- A 21% surge in diesel prices

- Supply chain inflation

These factors have led leading producers to raise prices, affecting consumer affordability and profit margins.

2. Intensifying Competition and Market Saturation

As local production scales rapidly, market competition has intensified. More players, both local and international, are entering the Saudi poultry space. This is pushing companies into:

- Price wars

- Margin erosion

- A need for differentiation through innovation and branding

3. Health-Conscious Consumer Behavior

Saudi consumers are increasingly prioritizing nutritional value in their food. There is a gradual shift toward:

- Lean meats

- Organic poultry

- Plant-based protein alternatives

This trend poses a threat to traditional poultry consumption unless producers adapt by offering low-fat, antibiotic-free, and organic options.

Market Segmentation Analysis

By Type

- Chicken (Dominant category)

- Turkey

- Duck

- Others

By Form

- Canned

- Fresh / Chilled

- Frozen

- Processed Poultry:

- Deli Meats

- Marinated / Tenders

- Meatballs

- Nuggets

- Sausages

- Other Processed Forms

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Channels

- Others

Key Statistical Highlights

- In 2022, Saudi Arabia accounted for 71% of the Middle East’s poultry production.

- 68% of poultry meat was domestically produced, up from 45% in 2016.

- Production rose by 73.85% between 2017 and 2022.

- A 1,000g chicken retails for about US$ 4, up from US$ 3.8 in 2021.

Strategic Foreign Investments

- MHP SE (Ukraine) signed a partnership with Tanmiah Food to boost domestic production.

- BRF S.A. (Brazil) established a joint venture in 2023 to meet Saudi Arabia’s halal poultry demand.

- These international partnerships support technology transfer, capacity building, and enhanced quality standards.

Competitive Landscape

Major producers dominate with over 80% market share. Key players include:

|

Company Name |

Notable Highlights |

|

Al-Watania Poultry |

Leading domestic producer with advanced processing facilities |

|

Almarai Food Company |

Diversified operations and extensive retail presence |

|

Tanmiah Food Company |

Partnering with international firms for production expansion |

|

BRF S.A. |

Brazilian giant focusing on halal-compliant operations |

|

Americana Group |

Strong foodservice distribution across the Middle East |

|

Sunbulah Group, Golden Chicken, Savola Group, Almunajem Foods |

Noteworthy contributions in packaged, processed, and frozen poultry |

Future Outlook and Forecast

Saudi Arabia’s poultry industry is on a clear upward trajectory. By 2030, domestic production is expected to double, positioning the Kingdom as a self-reliant poultry producer in the Middle East. However, the sector’s sustainability will depend on:

- Tackling price inflation

- Offering health-conscious options

- Enhancing supply chain efficiencies

- Strengthening public-private partnerships

Report Scope and Details

|

Feature |

Description |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2033 |

|

Market Units |

US$ Billion |

|

Coverage |

Type, Form, Distribution Channel |

|

Company Profiles |

9 Major Companies |

|

Customization |

20% Free Customization |

|

Analyst Support |

1 Year Post-Sale |

|

Formats |

PDF, Excel (Editable PPT/Word on Request) |

Key Questions Answered

- What is the forecast size of the Saudi poultry meat market by 2033?

- What growth rate is expected between 2025 and 2033?

- What are the key growth drivers and restraints?

- Which poultry form and type dominate the market?

- How is the government boosting domestic production?

- What role does halal certification play?

- Which companies are shaping the future of the Saudi poultry industry?

Get Your Customized Report Now

? USA: +1-678-302-0700

? India: +91-120-421-9822

? Email: info@renub.com

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0