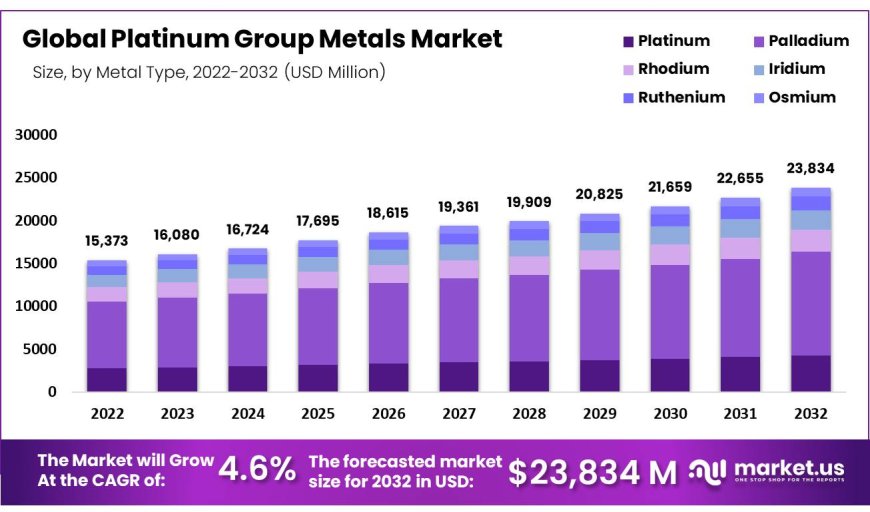

Platinum Group Metals Market 2023 Industry Analysis, Key Players Data, Growth Factors, Share, Opportunities and Forecast to 2032

In 2022, the Platinum Group Metals Market was valued at US$ 15,373 Million and it is projected to reach USD 23,834 Million by 2032 - this represents an annual compounded compound growth rate of 4.6% from 2022-2032.

Market Analysis

The Platinum Group Metals (PGMs) Market is projected to experience steady growth over the coming years due to increasing demand from automotive and electronics industries. PGMs comprise six precious metals - platinum, palladium, rhodium, ruthenium, iridium and osmium - each having unique properties essential for diverse industrial applications.

In 2022, the Platinum Group Metals Market was valued at US$ 15,373 Million and it is projected to reach USD 23,834 Million by 2032 - this represents an annual compounded compound growth rate of 4.6% from 2022-2032.

Get a sample PDF report: https://market.us/report/platinum-group-metals-market/request-sample/

Analysis of Platinum Group Metals Market Analysis:

Drivers:

- Rising Demand for Catalytic Converters: PGMs are widely used as catalytic converters to reduce harmful emissions from vehicles, and as governments tighten emissions regulations around the world, so too should demand for catalytic converters increase.

- Shift towards cleaner vehicles: As more consumers shift towards eco-friendly cars like electric and hybrid vehicles, PGM usage in their catalytic converters increases relative to traditional gasoline-powered vehicles.

- Electronic Industry Growth: PGMs are utilized in numerous electronic devices such as smartphones, computers and televisions; therefore the increased electronics sector growth should lead to an increase in PGM demand in coming years.

- Asia-Pacific's Growing Jewelry Consumption: Asia-Pacific is the highest consumer of jewelry worldwide. Platinum and palladium metals such as platinum are popular choices for making PGM jewelry, which could see demand increase with Asia's expanding middle class.

Restrictions:

- LIMITED SUPPLY: PGMs are relatively rare metals, with production concentrated primarily in certain countries such as South Africa, Russia and Zimbabwe. As a result of such limited supply constraints, PGM markets can become vulnerable to geopolitical events or natural disasters disrupting them.

- Strict Environmental Regulations: Mining and processing PGMs can have serious environmental repercussions. Therefore, governments around the world are adopting ever more stringent environmental regulations for this industry - increasing costs while making new mines difficult to establish.

- Trade Restrictions: Certain countries place trade restrictions on PGMs that could limit their supply in certain markets; Russia recently implemented export bans against these metals following the Ukraine crisis.

- Price Volatility: Prices for PGMs can be highly unpredictable due to many different factors, including changes in supply and demand, economic fluctuations and geopolitical tensions. This volatility makes planning for future business needs difficult as well as discouraging investment into this industry.

Opportunities:

- The increasing adoption of fuel cell technology: PGMs have become essential catalysts in fuel cell technology, which generate electricity using hydrogen as the source. As demand for clean energy solutions continues to surge, more applications of this technology such as automotive, stationary power generation and portable electronics are adopting fuel cell solutions.

- The tightening of emissions regulations: Tighter emissions regulations. PGMs are also utilized in catalytic converters to reduce harmful emissions from vehicles and industrial processes; as regulations tighten around the world, so does demand for PGMs used for these purposes.

- The growing demand for PGMs in industrial applications: PGMs are increasingly sought-after industrially, being utilized in applications as varied as chemical manufacturing, petroleum refining and glassmaking. As these industries expand further they are expected to drive greater PGM demand over time.

- Developing new technologies that use PGMs: Develop new technologies that use PGMs. PGMs are widely utilized across numerous technologies, from fuel cells and catalytic converters to industrial catalysts and more. Exploring innovative ways of using them more efficiently or for new purposes could open up opportunities for both producers and investors of PGMs.

Challenges:

- Concentration: The PGM market is highly consolidated, with South Africa accounting for more than 70% of total production. As a result, supply disruptions such as labor disputes, strikes or power outages could significantly impede production and negatively affect sales volumes.

- Price Volatility: PGM prices can be highly volatile due to various factors, including supply disruptions, demand fluctuations and investor speculation. This makes it challenging for businesses to plan and budget accordingly for PGM purchases.

- Electric Vehicle Demand: Electric vehicles (EVs) present a challenge to the PGM market as they do not use PGMs for catalytic converters; however, PGMs remain used in other components like fuel cells and batteries of these EVs.

- Sustainability concerns: PGM mining and processing can have adverse impacts on the environment, creating increasing concerns among both consumers and businesses alike and possibly leading to greater regulation in this industry.

Key Market Segments

By Metal Type

- Platinum

- Palladium

- Rhodium

- Iridium

- Ruthenium

- Osmium

By Source

- Mined

- Recycled

By Application

- Jewelry

- Medical Devices

- Electronics

- Auto Catalysts

- Glass and Ceramics

- Other Applications

Market Key Players

- BASF SE

- Anglo American Platinum Limited

- Heraeus

- Nornickel

- Sibanye-Stillwater

- Lonmin plc

- Umicore

- Johnson Matthey

- Dowa Holdings

- TANAKA Precious Metals

- Impala Platinum Holdings Limited

- Materion

- Other Key Players

Contact us

Global Business Development Team: Market.us

Market.us (Powered By Prudor Pvt. Ltd.)

Send Email: inquiry@market.us

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351, +91 78878 22626

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0