Payment Gateways Market | Industry Insights By Growth, Emerging Trends And Forecast By 2032

IMARC Group provides an analysis of the key trends in each segment of the global payment gateways market report, along with forecasts at the global and regional levels from 2024-2032.

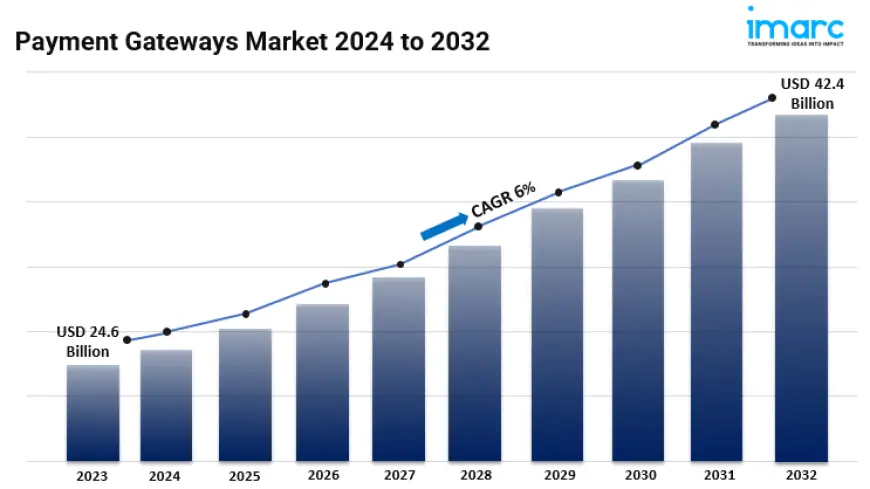

IMARC Group's report titled "Payment Gateways Market Report by Application (Large Enterprises, Micro and Small Enterprises, Mid-Size Enterprises), Mode of Interaction (Hosted Payment Gateways, Pro/Self-Hosted Payment Gateways, API/Non-Hosted Payment Gateways, Local Bank Integrates, Direct Payment Gateways, Platform-Based Payment Gateways), and Region 2024-2032". The global payment gateways market size reached USD 24.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 42.4 Billion by 2032, exhibiting a growth rate (CAGR) of 6% during 2024-2032.

Factors Affecting the Growth of the Payment Gateways Industry:

- E-commerce Growth:

The surge in global e-commerce has created a pressing need for efficient payment processing systems, the growth of the payment gateways market online presence and consumers increasingly turn to digital platforms for shopping, the requirement for secure and hassle-free payment solutions becomes more urgent. Payment gateways play a crucial role in facilitating online transactions, allowing businesses to safely accept a range of payment types, from credit cards to digital wallets and alternative options. By offering advanced security features, such as encryption and fraud protection, payment gateways ensure that online transactions are completed quickly and reliably, fostering customer loyalty and confidence. As e-commerce continues to transform industries worldwide, the demand for reliable payment gateway solutions is expected to rise, driving further market expansion.

- Mobile Commerce (m-commerce) Adoption:

The surge in mobile commerce is fueling the expansion that cater to mobile consumers increasingly rely on their smartphones and tablets for shopping, companies are focusing on streamlining their payment systems to accommodate this shift. By integrating mobile-compatible payment gateways, businesses can provide customers with a hassle-free shopping experience, allowing them to complete transactions effortlessly on their mobile devices. These gateways support a range of mobile payment options and ensure secure, on-the-go transactions. As mobile commerce continues to accelerate, the need for mobile-optimized payment gateways is poised to intensify, propelling growth in the payment processing sector.

- Focus on Payment Security and Fraud Prevention:

The increased emphasis on payment security and preventing fraud is leading to the adoption of payment gateways that come with advanced security features. As online transactions become more common, worries about data breaches, identity theft, and fraudulent activities are on the rise. Payment gateways are essential in protecting sensitive financial details and stopping unauthorized transactions through strong security measures like encryption, tokenization, and fraud detection tools. By adhering to industry standards like PCI DSS and layers of security, paymentways offer comfort to both merchants and customers during online transactions. As security worries grow, companies are giving importance to using secure payment gateway solutions, which is boosting the growth of the payment processing sector.

Leading Companies Operating in the Global Payment Gateways Industry:

- Adyen

- Amazon.com Inc

- Authorize.Net (Visa Inc.)

- BitPay Inc

- JPMorgan Chase & Co.

- PayPal Holdings Inc.

- PayTm (One97 Communications)

- PayU (Naspers Limited)

- Razorpay Software Private Limited

- Stripe, Inc.

- Verifone Inc.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/payment-gateways-market/requestsample

Payment Gateways Market Report Segmentation:

By Application:

- Large Enterprises

- Micro and Small Enterprises

- Mid-Size Enterprises

Large enterprises represent the largest segment as they typically have complex payment processing needs, requiring scalable and customizable payment gateway solutions to manage high transaction volumes and diverse payment methods efficiently.

By Interaction:

- Hosted Payment Gateways

- Pro/Self-Hosted Payment Gateways

- API/Non-Hosted Payment Gateways

- Local Bank Integrates

- Direct Payment Gateways

- Platform-Based Payment Gateways

Hosted payment gateways hold the majority of the market share on account of their ease of integration, simplified setup process, and reduced compliance burden for merchants.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Global Payment Gateways Market Trends:

The surge in global e-commerce has created a pressing need for reliable and efficient payment processing solutions, prompting businesses to invest in secure and user-friendly payment gateways to capitalize on the online shopping boom. The increasing popularity of mobile commerce and widespread smartphone adoption have also boosted demand for payment gateways that provide seamless transactions across multiple devices. Additionally, the escalating importance of payment security and fraud prevention, driven by the rising volume of online transactions, has led to the adoption of advanced payment gateways featuring robust security measures, such as encryption, tokenization, and fraud detection, ultimately propelling market expansion.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0