Middle East Pro AV (Audio-Visual) Market — Outlook 2024–2032

Executive summary

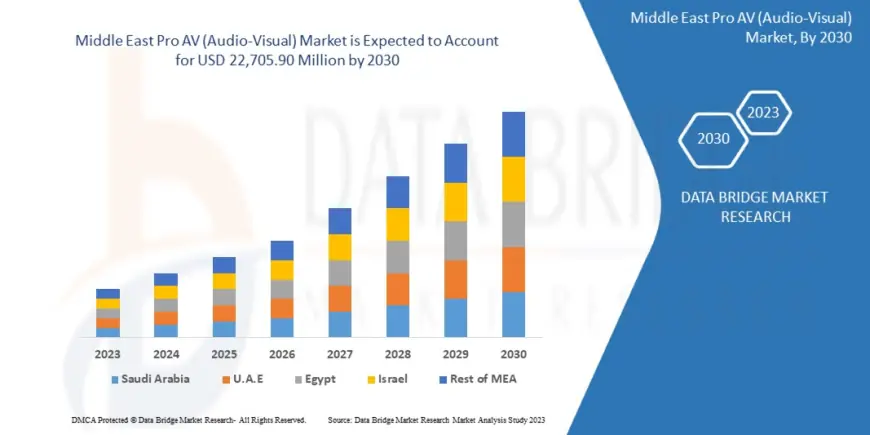

The Middle East Pro AV market is in a multi-year expansion cycle, propelled by giga-projects, hospitality and tourism build-outs, smart-city initiatives, and enterprise hybrid-work investments. Demand spans corporate collaboration, large-venue LED, control rooms, immersive attractions, and retail/DOOH networks.

-

Estimated market size (2024): USD 5.5–6.5 billion (equipment, software, and integration services)

-

Forecast CAGR (2024–2032): 9–11%

-

Projected size (2032): USD 11–12.5 billion

-

Top spenders: Saudi Arabia, United Arab Emirates, Qatar; growing contributions from Kuwait, Oman, Bahrain, Egypt, and Israel

Source - https://www.databridgemarketresearch.com/reports/middle-east-pro-av-audio-visual-market

Growth drivers

-

Giga-projects and public mega-venues

Saudi developments (new cities, cultural districts, stadiums, museums) and UAE mixed-use/entertainment projects require large-format LED, show control, and integrated audio systems. -

Hospitality, retail, and attractions

Tourism-led strategies fuel demand for digital signage, experiential AV, projection mapping, and background/foreground audio. -

Enterprise collaboration & hybrid work

Corporate refresh cycles standardize on UC-native rooms (Teams, Zoom, Google), driving mics, speakers, cameras, DSPs, touch panels, and room scheduling. -

Government, education, and healthcare digitization

Command-and-control centers, auditoriums, lecture capture, and simulation/telemedicine expand across the region. -

Events and live production

Recurring international events sustain rental & staging, line arrays, consoles, intercoms, and high-brightness projection.

Market headwinds

-

Skills and integration complexity: Shortage of experienced AV/IT engineers; long commissioning windows for complex sites.

-

Price erosion in commodity categories: Panel and LED price compression pressures integrator margins.

-

Supply-chain variability: Project timelines sensitive to specialty LED, optics, and control components.

-

Cybersecurity and AV-over-IP risks: Networked AV requires hardened architectures and policy alignment with IT.

-

Harsh environments: Heat, dust, and saline air increase TCO; require ruggedization and maintenance plans.

Segmentation

By solution category

-

Displays & Visualization: dvLED (indoor/outdoor, fine-pitch), LCD walls, projectors (laser, DLP/3LCD), control-room visualization.

-

Audio Systems: line arrays, install speakers, ceiling/wall speakers, amplifiers/DSP, beamforming mics, wireless systems, intercom.

-

Collaboration & UC: PTZ/AI cameras, soundbars, room kits, touch controllers, wireless presentation, scheduling panels.

-

Signal Management & Control: AVoIP encoders/decoders (1/10/25GbE), matrix/switchers, control processors, touch GUIs, KVM.

-

Show & Experience Tech: media servers, show control, projection mapping, XR caves, interactive sensors.

-

Services: design & engineering, installation, programming, managed services/AVaaS, maintenance SLAs, operations outsourcing.

By vertical

-

Corporate & Financial Services

-

Government, Defense, and Public Safety (command centers, courtrooms, briefing rooms)

-

Education (K-12/HE lecture capture, hybrid learning)

-

Hospitality & Retail (digital signage, BGM/PA, experiential)

-

Stadia, Entertainment & Houses of Worship

-

Transport & Smart Cities (airports, metros, control rooms)

-

Healthcare (simulation, telepresence, MDT rooms)

-

Energy & Industrial (control rooms, training)

Country snapshots (high level)

-

Saudi Arabia: Largest growth engine; giga-projects drive premium LED, immersive attractions, and large-venue audio. Strong government/defense control-room demand.

-

United Arab Emirates: Regional reference market with sophisticated enterprise UC standards, hospitality flagships, airports, and retail experiences.

-

Qatar: Post-tournament legacy facilities, museums, education and healthcare investments sustain steady AV refresh.

-

Kuwait, Oman, Bahrain: Select hospitality, government, and corporate upgrades; opportunity for standardized UC and signage rollouts.

-

Egypt: Price-sensitive growth in education, government, and retail; value-engineered solutions attractive.

-

Israel: Enterprise and defense-tech heavy; collaboration systems, control rooms, and broadcast/production demand.

Technology trends to track (2024–2027)

-

Fine-pitch dvLED mainstreaming: 0.9–1.5 mm for boardrooms and control rooms; COB/MIP packages improving durability and contrast.

-

Laser projection dominance: Maintenance-light projectors (>15K lm) for attractions and rental & staging.

-

AV-over-IP standardization: 1/10/25GbE transports (SDVoE/IPMX/NDI) replace large baseband matrices; synchronized audio/video with PTP.

-

AI in rooms: Auto-framing, voice isolation, noise classification, and meeting analytics embed into cameras/DSPs.

-

Spatial/immersive audio & beamforming: Enhanced intelligibility in reverberant venues and multipurpose halls.

-

Ops & services: AVaaS, proactive monitoring, and SLO-based maintenance become standard in enterprise and public sector.

-

Sustainability: Energy budgets, Eco-modes, and EPDs influence specification; end-of-life and recycling plans included in RFPs.

Indicative budget ranges (guidance only)

-

Executive UC room (8–12 seats): USD 18k–45k (camera, mic/speakers, display/dvLED tile bundle, control, install).

-

Boardroom (16–24 seats, dvLED 1.2–1.5 mm): USD 120k–350k depending on pixel pitch and acoustics.

-

Lecture hall (300 seats, capture + streaming): USD 120k–250k.

-

Control room (12 operators, 24/7 video wall + KVM): USD 400k–1.0m.

-

Retail digital signage (100 screens, CMS, players): USD 250k–600k.

-

Large venue audio (arena/theater line-array): USD 350k–1.5m.

Actuals swing with brand, pixel pitch, acoustics, cabling, rigging, and warranty terms.

Competitive landscape (indicative)

-

Manufacturers: premium global brands across dvLED/LCD, projection, audio (install and live), control, and UC peripherals; regional distribution hubs in UAE and KSA.

-

Systems integrators: multinational SIs and strong regional players; specialization in control rooms, attractions, hospitality, or enterprise UC.

-

Rental & staging: clustered in UAE, KSA, and Qatar, supporting touring and mega-events.

-

Software & platforms: CMS for signage, UC platforms, monitoring/management (SNMP/REST), and analytics.

Differentiators: certified engineering talent, networked-AV expertise, safety/rigging credentials, local stocking and rapid service SLAs.

Go-to-market playbooks

For vendors/manufacturers

-

Develop KSA-centric reference designs (stadia, museums, control rooms) and UAE enterprise room standards.

-

Stock spares and critical tiles/optics regionally; offer advance exchange and on-site SLAs.

-

Provide thermal and dust-mitigation kits and derating guidance for outdoor deployments.

For integrators

-

Standardize UC rooms (good/better/best) by platform; include acoustics and lighting packages.

-

Build a control-room practice (operator ergonomics, KVM over IP, wall processing, incident workflows).

-

Offer AVaaS with remote monitoring, quarterly optimization, and training; tie to measurable business KPIs.

For end-users

-

Use outcome-based RFPs (speech intelligibility, viewing geometry, uptime) rather than brand lists.

-

Mandate network and cybersecurity requirements (segmentation, hardening, logging).

-

Budget for room conditioning (acoustics, lighting, power) and lifecycle (cleaning, recalibration, spares).

Risk & mitigation checklist

-

Supply risk: dual-approve LED vendors/pitches; hold 2–3% spare tiles.

-

Heat/dust: specify IP ratings, protective coatings, filters; schedule preventive maintenance.

-

Cybersecurity: zero-trust design, credential management, firmware policy, and SIEM integration.

-

Skills gap: require manufacturer certifications; include knowledge transfer and admin training.

-

Project execution: phased mock-ups, on-site shoot-outs, FAT/SAT, and clear acceptance criteria.

Forecast scenarios

| Scenario | 2024 Market | CAGR ’24–’32 | 2032 Market | Notes |

|---|---|---|---|---|

| Base case | USD 6.0 bn | 10% | USD 12.9 bn | Balanced giga-project execution and enterprise refresh |

| Upside | USD 6.5 bn | 11% | USD 13.8 bn | Accelerated KSA build-out; dvLED price drops; AVaaS adoption |

| Downside | USD 5.5 bn | 9% | USD 11.0 bn | Delays in large venues; supply constraints; slower public spend |

Conclusion

The Middle East Pro AV market is shifting from isolated flagship installs to repeatable, standards-based deployments across enterprises and public infrastructure—while still delivering iconic experiences in venues and attractions. Winners will blend engineering depth, networked-AV and cybersecurity know-how, regional logistics, and service-led contracts that guarantee outcomes over the full lifecycle.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0