Vietnam Textile Market Size, Share, Top Companies, Forecast 2025-2033

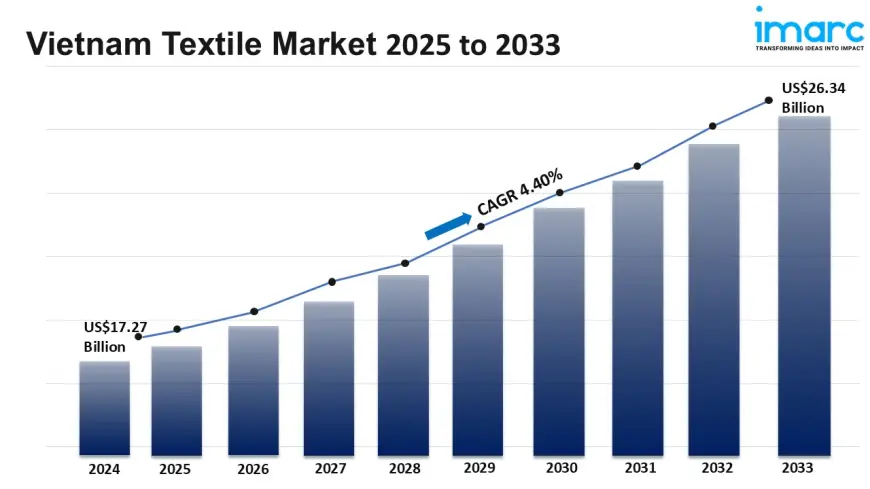

The Vietnam textile market size was valued at USD 17.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 26.34 Billion by 2033, exhibiting a CAGR of 4.40% during 2025-2033.

Vietnam Textile Market Report

Base Year : 2024

Forecast Years:2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 17.27 Billion

Market Forecast in 2033: USD 26.34 Billion

Market Growth Rate (2025-2033): 4.40%

The Vietnam textile market size was valued at USD 17.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 26.34 Billion by 2033, exhibiting a CAGR of 4.40% during 2025-2033. Southern currently dominates the market, holding a significant market share of around 43.2% in 2024. The market is driven by robust export demand, supported by preferential FTAs like the CPTPP and EVFTA, which enhance competitiveness in key markets such as the EU, US, and Japan. Foreign investment is further attracted by cost advantages, including lower labor expenses compared to China. Additionally, supply chain diversification, rising domestic consumption, and sustainability-focused innovations are strengthening production capabilities, further augmenting Vietnam textile market share.

Request Free Sample Report: https://www.imarcgroup.com/vietnam-textile-market/requestsample

Vietnam Textile Market Landscape

Strategic Supply Chain Realignment & Export Diversification Driving Robust Growth

Vietnam's textile industry is experiencing significant expansion, fueled by its strategic positioning within global supply chain realignments. Major international brands are actively diversifying sourcing away from single-country dependencies, leveraging Vietnam's extensive network of Free Trade Agreements (FTAs), particularly the CPTPP and EVFTA, which grant preferential access to key markets like the EU, Japan, Canada, and the UK. This nearshoring/regionalization trend is translating into tangible export growth, with Vietnam consistently ranking among the world's top three apparel exporters. Future demand hinges on Vietnam's ability to capitalize on these agreements – current utilization rates, while improving, still present substantial untapped potential. Investment is pouring into vertically integrated complexes and large-scale factories, especially in technical textiles and high-value segments, aiming to move beyond Cut-Make-Trim (CMT) towards Full Package Production (FPP) to capture greater value. The government's focus on infrastructure development, including deep-sea ports and logistics corridors, is critical to sustaining this momentum and meeting the rising demand for agile, resilient, and tariff-advantaged sourcing. Challenges remain in raw material self-sufficiency (particularly high-quality yarns and fabrics) and navigating complex Rules of Origin (RoO), requiring continued investment in upstream capabilities and streamlined compliance processes to secure long-term competitiveness.

Sustainability Imperative Reshaping Production & Future Market Access

Sustainability is no longer optional but a core market dynamic fundamentally altering Vietnam's textile landscape. Driven by stringent international regulations (e.g., the EU's Corporate Sustainability Due Diligence Directive - CSDDD, Ecodesign for Sustainable Products Regulation - ESPR) and shifting consumer preferences, global brands demand demonstrable environmental and social responsibility. This creates both pressure and opportunity. Vietnamese manufacturers face urgent needs to invest in cleaner production technologies, water treatment systems (Zero Liquid Discharge - ZLD gaining traction), energy efficiency (solar adoption rising), and certified sustainable materials (organic cotton, recycled polyester). Compliance with standards like GRS, Oeko-Tex, and ZDHC is becoming baseline for market access. Future demand will increasingly favor suppliers with robust ESG reporting, traceability systems (blockchain pilots emerging), and circular economy initiatives (textile-to-textile recycling projects scaling). While initial investments are substantial, they offer long-term cost savings, risk mitigation, and premium pricing potential. The government supports this shift through green credit incentives and stricter environmental enforcement. Successfully navigating this dynamic is paramount; failure risks exclusion from major markets, while leadership positions Vietnam as a preferred sustainable sourcing destination, attracting environmentally conscious investment and buyers.

Technological Transformation & Automation as a Response to Labor Constraints

The industry confronts a tightening labor market characterized by rising wages, skilled worker shortages (especially in design, R&D, and technical roles), and evolving workforce expectations. This is accelerating the adoption of Industry 4.0 technologies as a critical growth and competitiveness driver. Automation is moving beyond basic sewing machines to encompass advanced robotics in cutting, sewing, and material handling, automated warehouses, and real-time production monitoring via IoT sensors. Digital printing is rapidly replacing traditional methods, offering speed, customization, and reduced water/chemical usage. Investment in Enterprise Resource Planning (ERP), Product Lifecycle Management (PLM), and AI-powered demand forecasting tools is optimizing supply chains and reducing lead times. Future demand necessitates this digital leap to achieve higher productivity, consistent quality, and the agility required for smaller batch sizes and faster fashion cycles. Manufacturers integrating AI for defect detection, predictive maintenance, and optimized resource allocation will lead. Government initiatives like the National Digital Transformation Program encourage this shift. While automation raises concerns about job displacement, it also creates demand for higher-skilled technicians and data analysts, necessitating significant workforce upskilling and vocational training partnerships to ensure a future-ready workforce and sustain Vietnam's competitive edge in an increasingly tech-driven global market.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=19510&flag=C

Vietnam Textile Market Industry Segmentation:

Analysis by Product:

- Natural Fibers

- Polyesters

- Nylon

- Others

Analysis by Raw Material:

- Cotton

- Chemical

- Wool

- Silk

- Others

Analysis by Application:

- Household

- Technical

- Fashion and Clothing

- Others

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Key highlights of the Report:

- Market Performance

- Market Outlook

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0