Vietnam Road Freight Transport Market Size, Share, Growth, Trends and Forecast 2025-2033

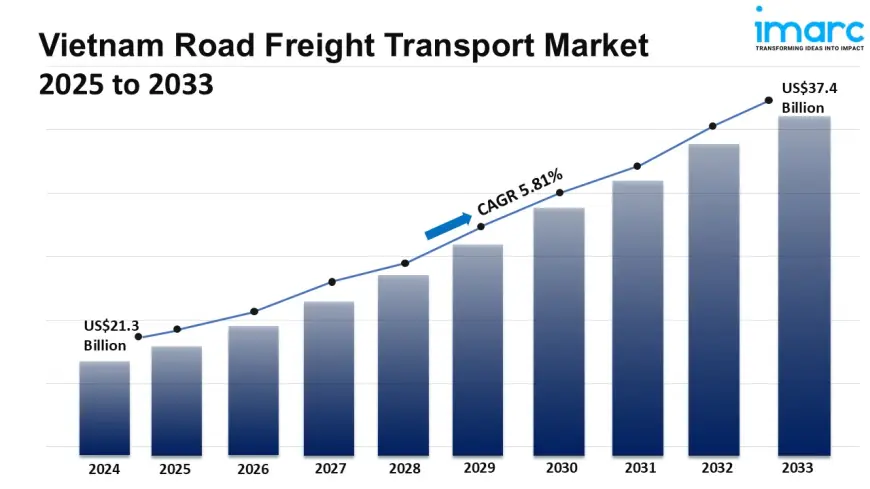

Vietnam road freight transport market size reached USD 21.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 37.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.81% during 2025-2033.

Vietnam Road Freight Transport Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 21.3 Billion

Market Forecast in 2033: USD 37.4 Billion

Market Growth Rate (2025-33): 5.81%

Vietnam road freight transport market size reached USD 21.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 37.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.81% during 2025-2033. Increasing trade volumes, economic development, urbanization, the burgeoning manufacturing sector, the rise of e-commerce and the digital economy, and the need for efficient goods distribution represent some of the key factors driving the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-road-freight-transport-market/requestsample

Vietnam Road Freight Transport Market Trends and Drivers:

Vietnam's road freight sector is undergoing a transformative phase fueled by unprecedented national infrastructure investment. The accelerated completion of critical expressway segments, particularly along the North-South axis like the Trung Lương-Mỹ Thuận and Mai Sơn - National Highway 45 sections, is significantly reducing transit times and logistics costs. This enhanced connectivity is alleviating chronic bottlenecks that historically plagued key industrial corridors around Ho Chi Minh City and Hanoi, boosting average truck speeds by an estimated 15-20% on completed routes. Simultaneously, substantial upgrades to secondary national highways and strategic provincial roads are improving first-and-last mile connectivity to burgeoning industrial zones and deep-sea ports like Lach Huyen and Cai Mep. The government's commitment, evidenced by the disbursement of over $5.8 billion USD for transport infrastructure in the first half of 2023 alone, directly translates to increased network resilience, lower vehicle wear-and-tear, enhanced payload capacities for freight operators, and ultimately, greater market competitiveness. This infrastructure surge is not just facilitating domestic trade but is a crucial enabler for Vietnam to solidify its position within global supply chains, demanding greater operational sophistication from logistics providers.

The meteoric rise of Vietnam's e-commerce sector, consistently growing at over 20% annually and projected to surpass $20 billion USD in GMV soon, is fundamentally reshaping road freight requirements. This surge generates intense demand for faster, more reliable, and technologically integrated express parcel delivery and less-than-truckload (LTL) services nationwide, particularly within dense urban centers. Concurrently, global supply chain diversification efforts, including the "China Plus One" strategy, are driving significant foreign manufacturing investment into Vietnam, especially in electronics, textiles, and high-value components. This influx necessitates robust, high-frequency freight solutions for raw material inbound logistics and finished goods distribution, often demanding temperature-controlled transport and enhanced security protocols. The synergy between e-commerce fulfillment and sophisticated manufacturing logistics is compelling freight companies to invest heavily in warehouse automation near consumption hubs, advanced fleet tracking (GPS/telematics), specialized equipment like reefers and tautliners, and value-added services such as real-time shipment visibility and flexible scheduling to meet the exacting standards of both online retailers and multinational manufacturers.

Sustainability is rapidly transitioning from a niche concern to a core operational and strategic imperative within Vietnam's road freight market. Increasingly stringent environmental regulations, including the national Green Growth Strategy and commitments under COP26, are pushing the industry towards lower emissions. This is manifesting in a noticeable, though nascent, shift towards alternative fuel vehicles, with registrations for electric and CNG/LNG trucks exceeding 1,000 units in 2023 – a significant jump signaling early adoption. Major logistics players and large shippers are actively piloting EV fleets for urban delivery and implementing comprehensive carbon accounting to meet corporate ESG targets and satisfy demands from international partners. Simultaneously, optimization technologies powered by AI and big data are gaining critical mass, enabling dynamic route planning that minimizes empty miles (estimated to reduce fuel consumption by 10-15%) and load consolidation. Government incentives for green investments and rising diesel costs further enhance the economic viability of sustainable practices. This dynamic compels all market participants to innovate, adopt cleaner technologies, and enhance efficiency not just for cost savings, but for regulatory compliance, market access, and long-term viability in an eco-conscious global economy.

Vietnam Road Freight Transport Market Industry Segmentation:

Temperature Control Insights:

- Controlled

- Non-controlled

Product Type Insights:

- Liquid Goods

- Solid Goods

Distance Insights:

- Long Haul

- Short Haul

Containerization Insights:

- Containerized

- Non-containerized

Destination Insights:

- Domestic

- International

End User Insights:

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=13321&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0