Trade Surveillance System Market Size, Share, Demand, Key players Analysis and Forecast 2025-2033

IMARC Group provides an analysis of the key trends in each sub-segment of the global trade surveillance system market report, along with forecasts at the global, regional and country level from 2025-2033.

Market Overview:

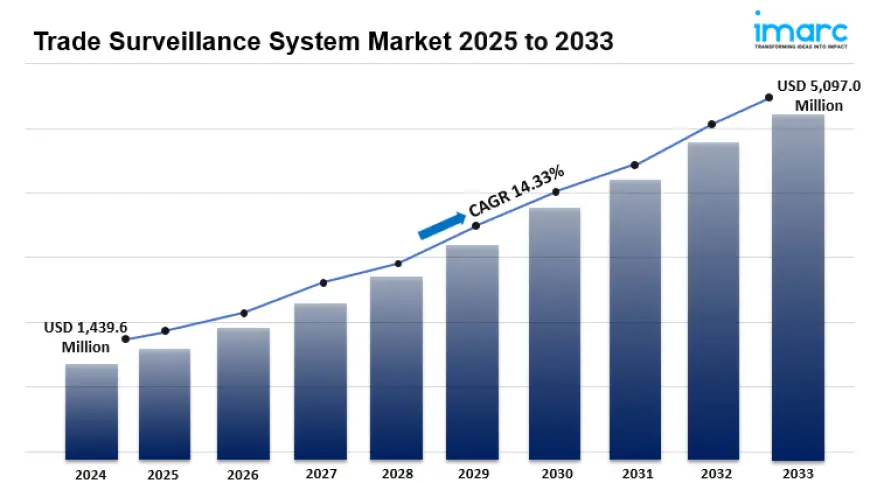

The global trade surveillance system market, valued at USD 1,439.6 million in 2024, is expected to expand significantly, reaching USD 5,097.0 million by 2033. With a strong CAGR of 14.33% from 2025 to 2033, this growth is driven by rising instances of market manipulation and fraud, as well as the growing demand for regulatory compliance. The increasing adoption of automated trading technologies and advancements in AI and machine learning are further bolstering market expansion.

STUDY ASSUMPTION YEARS:

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019-2024

- FORECAST YEAR: 2025-2033

TRADE SURVEILLANCE SYSTEM MARKET KEY TAKEAWAYS:

- The trade surveillance market is projected to grow from USD 1,439.6 million in 2024 to USD 5,097.0 million by 2033, at a CAGR of 14.33%.

- Growing concerns over market manipulation, fraud, and financial crime are major growth drivers.

- The increasing reliance on algorithmic trading is pushing the need for enhanced surveillance systems.

- AI, machine learning, and NLP innovations are significantly enhancing surveillance capabilities.

- The market is expanding due to stronger regulatory frameworks and mandatory compliance requirements.

- Demand is increasing across diverse sectors such as banking, institutional brokers, and market centers.

- North America remains the dominant region, with significant investments in surveillance technology.

MARKET GROWTH FACTORS:

Technological Advancement:

These systems are immensely repulsing for ongoing usage from the instant AI, machine learning, and natural language processing (NLP) development. These innovations will help the system to detect risk while in operation, secure funding from more frauds, and ensure compliance with regulatory requirements instantaneously. With the advancement of algorithm-based trading, financial personnel have recognized the importance and value of these high-tech mechanisms that will be able to identify risks instantly and take actions on them efficiently. Transitioning further to the cloud-based structures has given design new dimensions in terms of ease of access and scalability to make a significant difference in the growth of the market.

Regulatory Impact of These Developments:

Besides, the following forces are accessing regulatory compliance by investing heavily in automated trade surveillance systems. Global regulatory regimes, however, are essentially having stricter regulations in terms of illicit trade detection such as insider trading, money laundering, and forgery due to increasing voices raised at every end. To some extent, the pressure that is emerging from increased regulatory scrutiny forms the strongest market driver since it makes companies use more sophisticated tools to monitor trading activities and keep their heads above the waters in terms of compliance.

Increasing Demand for Pre- and Post-Trade Monitoring:

The rising level of complexity in financial markets brings increased transactions, which demand better pre-trade and post-trade monitoring. Recently, there has been a huge shift within major financial institutions to now rely on surveillance systems both before and after trades are carried out for suspicious activity. More recently, this phenomenon has intensified with the advent of online trading and more digital asset exchanges. It becomes all the more imperative to have robust monitoring systems as many platforms manage to gather members and experience a sudden upsurge in activity.

Request Sample For PDF Report: https://www.imarcgroup.com/trade-surveillance-system-market/requestsample

Market Segmentation:

Breakup by Component:

- Solutions

- Services

Breakup by Deployment Mode:

- On-premises

- Cloud-based

Breakup by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Breakup by End User:

- Banks

- Institutional Brokers

- Retail Brokers

- Market Centers and Regulators

- Others

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

REGIONAL INSIGHTS:

North America holds the largest market share, with the United States leading in both adoption and innovation. The region’s dominance can be attributed to a combination of strong regulatory environments and the increasing sophistication of financial markets. Investments in AI-driven surveillance systems, along with the growing need for real-time monitoring, are significant drivers in this region.

RECENT DEVELOPMENTS & NEWS:

Recent advancements in trade surveillance systems highlight a strong trend towards incorporating AI, NLP, and machine learning into market monitoring. This shift aims to enhance detection capabilities for financial crimes such as fraud and market manipulation. Companies are investing heavily in cloud-based solutions, which offer scalability and flexibility for businesses. These innovations align with increasing regulatory pressures and the need for more accurate and efficient trading surveillance solutions.

Key Players:

- ACA Group

- Accenture plc

- Aquis Exchange PLC

- b-next, Cognizant

- CRISIL Limited (S&P Global Inc.)

- FIS

- International Business Machines Corporation

- Nasdaq Inc

- NICE Ltd.

- OneMarketData LLC

- SIA S.p.A.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.