Business Structure Comparison: Which One Is Right for You? – MyCorporation’s Expert Guide

Explore various business structures—Sole Proprietorship, Partnership, LLC, Corporation—to determine the best fit for your entrepreneurial journey.

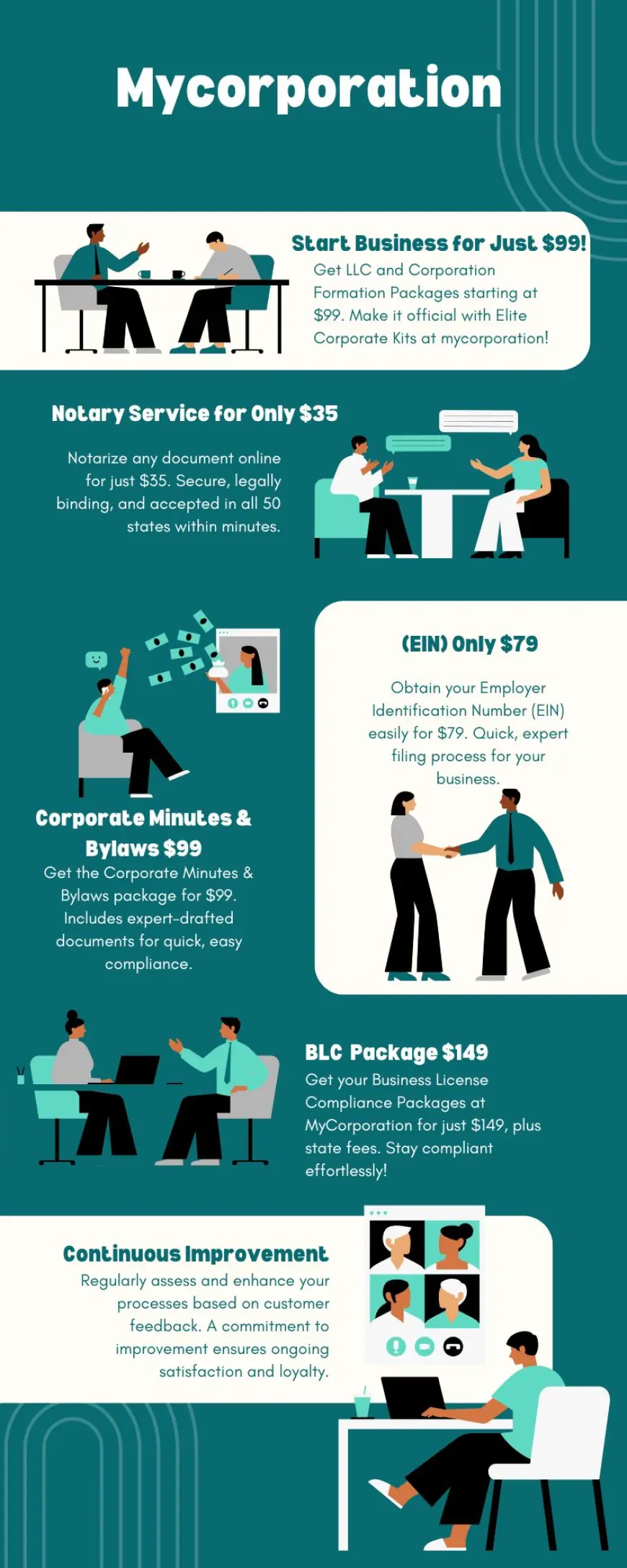

Starting a business requires making crucial decisions, and one of the most important is selecting the right business structure. The choice affects taxation, legal liability, and operational flexibility. This guide provides a detailed comparison of different business structures to help entrepreneurs make informed decisions. Save big on business incorporation services with mycorporation coupon codes. Get the best deals on LLC, EIN, and more!

Understanding Business Structures

Sole Proprietorship

A Sole Proprietorship is the simplest form of business ownership, where a single individual owns and operates the business. While easy to establish, it does not provide liability protection, meaning the owner is personally responsible for debts and legal issues.

Pros:

-

Simple and inexpensive to set up

-

Complete control over business operations

-

Minimal regulatory compliance

Cons:

-

Unlimited personal liability for debts

-

Difficult to raise capital

-

Business lifespan is tied to the owner

Partnership

A Partnership involves two or more individuals who agree to share ownership. There are two main types:

-

General Partnership: All partners share equal responsibility for management and debts.

-

Limited Partnership: One or more partners have limited liability and restricted management roles.

Pros:

-

Shared financial resources and responsibilities

-

Simple structure with flexible management

Cons:

-

Unlimited liability for general partners

-

Potential conflicts between partners

Limited Liability Company (LLC)

An LLC is a hybrid structure that combines the liability protection of a corporation with the tax benefits of a partnership.

Pros:

-

Limited liability protection

-

Flexible tax options

-

Fewer compliance requirements than corporations

Cons:

-

Requires registration and ongoing paperwork

-

Self-employment taxes for members

Corporation (C Corp & S Corp)

Corporations are separate legal entities that offer the highest level of liability protection but involve more regulatory requirements.

C Corporation

-

Separate taxation at corporate and shareholder levels

-

No limits on shareholders

S Corporation

-

Avoids double taxation through pass-through taxation

-

Limited to 100 shareholders, who must be U.S. citizens or residents

Pros:

-

Strongest liability protection

-

Easier access to capital

Cons:

-

More regulatory and compliance requirements

-

Costly to establish and maintain

Key Factors in Choosing a Business Structure

Liability Protection

Business owners should assess their risk exposure. Sole Proprietorships and General Partnerships provide no liability protection, whereas LLCs and Corporations protect personal assets from business debts.

Taxation

-

Sole Proprietorships & Partnerships: Income is taxed on personal tax returns.

-

LLCs: Offer pass-through taxation, avoiding corporate taxes.

-

C Corporations: Subject to double taxation.

-

S Corporations: Avoid double taxation but must meet IRS requirements.

Compliance Requirements

-

Sole Proprietorships & Partnerships: Minimal paperwork.

-

LLCs: Require Articles of Organization and an Operating Agreement.

-

Corporations: Must file Articles of Incorporation, hold meetings, and maintain records.

LLC Tax Benefits

LLCs offer flexibility in taxation. By default, they are taxed as pass-through entities, avoiding corporate taxes. Members can also choose to be taxed as S Corporations, potentially reducing self-employment tax burdens.

Single-Member LLC Formation

A Single-Member LLC (SMLLC) is an LLC owned by one person, providing liability protection without the complexity of a corporation. The IRS treats SMLLCs as disregarded entities, simplifying tax filing.

Small Business Registration and EIN Application

To legally operate, businesses must register with the state and obtain an Employer Identification Number (EIN). The IRS provides an Online EIN Application, making it easy to get an EIN quickly.

Legal Requirements for LLC Formation

-

Choose a business name that complies with state regulations.

-

File Articles of Organization with the state.

-

Create an Operating Agreement outlining management structure.

-

Obtain an EIN for tax purposes.

Conclusion

Choosing the right business structure is crucial for long-term success. Sole Proprietorships and Partnerships are simple but lack liability protection. LLCs offer a balance of flexibility and protection, while Corporations provide the strongest protection but come with complex regulations. Entrepreneurs should evaluate their needs to select the best structure.

Shipping and Return Policy

For businesses involved in selling goods, establishing a clear shipping and return policy is essential. A well-defined policy ensures transparency, enhances customer trust, and minimizes disputes. Policies should include estimated shipping times, return conditions, and refund processing timelines. Keeping customers informed about order tracking and return procedures enhances their experience and boosts brand reputation.