The Rise of the Machines: Bank Kiosks Grab Bigger Market Share as Customers Go Digital

The bank kiosk market was valued at USD 491.8 million in 2021 and is expected to reach USD 1463.7 million by 2027 it is anticipated to grow at a CAGR of 19.94% during the forecast period.

Infinium Global Research's new report dives deep into the global bank kiosk market, analyzing various segments and sub-segments across different regions. It goes beyond market size to explore the key factors influencing growth (drivers), potential limitations (restraints), and broader economic trends (macro indicators) that will affect the market's trajectory in both the short and long term. This comprehensive report offers valuable insights into current trends, future forecasts, and the overall financial health of the global bank kiosk market. It even predicts a healthy growth rate of 19.94% CAGR for the market between 2021 and 2027.

Get Sample Pages of Report: https://www.infiniumglobalresearch.com/reports/sample-request/28412

Market Dynamics

Drivers:

· Rising Demand for Self-Service: Customers are increasingly seeking convenient and self-directed banking experiences. Bank kiosks offer 24/7 access to basic banking functions, reducing reliance on traditional branch hours and teller interactions.

· Enhanced Customer Service: Interactive kiosks provide a user-friendly interface for various transactions, potentially improving customer satisfaction compared to long teller queues.

· Increased Adoption in Developing Economies: Developing countries are experiencing rapid growth in financial inclusion, and bank kiosks offer a cost-effective way to expand banking services to geographically dispersed populations.

Restraints:

· Limited Functionality: Compared to human tellers, kiosks may have limitations in handling complex transactions or assisting with financial advice.

· Accessibility Issues: Users with disabilities or limited technological literacy might face challenges when using kiosks. High Initial Investment: Setting up and maintaining bank kiosk infrastructure can be expensive, potentially deterring smaller financial institutions.

Opportunities:

· Advanced Technologies: Integration of AI, biometrics, and voice recognition can enhance user experience and offer more personalized services through kiosks.

· Data Analytics: Utilizing data collected from kiosks can help banks better understand customer behavior and personalize their offerings.Developing user-friendly interfaces and features that cater to diverse user needs can expand the reach of bank kiosks.

Regional Analysis

The Asia-Pacific region is forecast to be the runaway leader in bank kiosk market growth. This surge is fueled by government initiatives across APAC actively promoting the development of the Fintech industry. This push for Fintech adoption aims to revolutionize banking in the region.

· Key Players: Countries like India, China, Japan, South Korea, and Australia are leading the charge in APAC.

· Government Support: Governments across Asia are actively promoting the growth of the fintech industry, encouraging the development and adoption of innovative banking solutions like kiosks.

· Rising Consumer Awareness: Customers in APAC are becoming increasingly comfortable and confident using bank kiosks, thanks to growing awareness of their security and reliability. This shift in consumer behavior is further propelling market growth.

Market segmentation

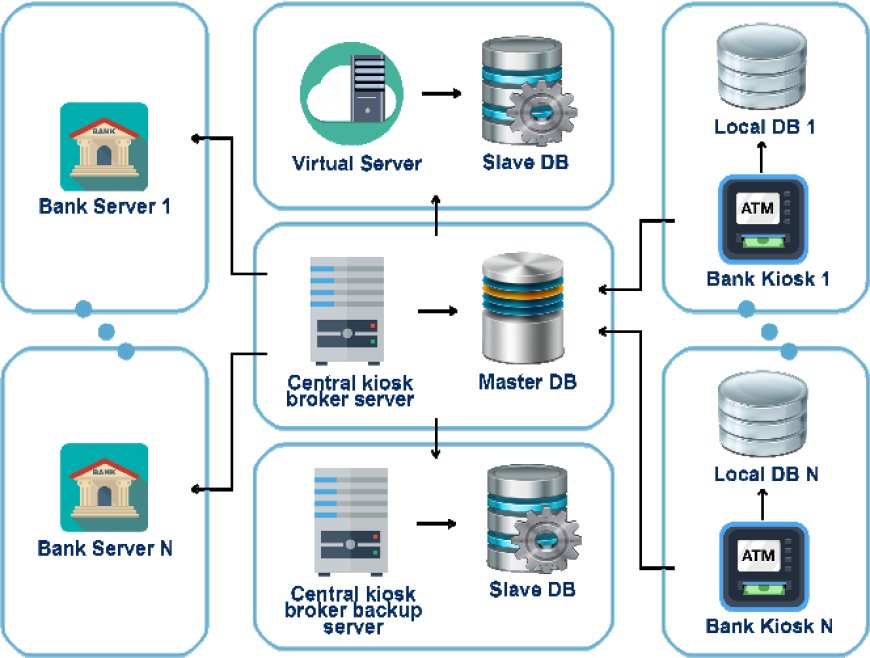

· Type: This explores the different functionalities kiosks offer, including single-function kiosks designed for specific tasks, multi-function kiosks combining various services, and virtual/video teller machines enabling remote teller interaction.

· Offering: This dives into the components that make up a bank kiosk solution, analyzing hardware (physical machines), software (operating systems and applications), and services (installation, maintenance, and support).

· Distribution: This examines where bank kiosks are deployed, considering rural areas, semi-urban centers, urban environments, and metropolitan locations with high population density.

Competitive Landscape

· NCR Corporation

· Glory Limited

· Diebold Nixdorf

· GRGBanking

· OKI Electric Industry Co., Ltd.

· Auriga Spa

· Hitachi-Omron Terminal Solutions

· Cisco Systems, Inc. (Network solutions)

· Star Micronics Co., Ltd. (Hardware solutions)

Report overview: https://www.infiniumglobalresearch.com/reports/global-bank-kiosk-market

Future outlook

This report serves as your crystal ball for the bank kiosk market. It provides insightful forecasts from 2021-2027, allowing you to anticipate future demand. Beyond just numbers, the report explores current market trends and identifies emerging trends that will significantly impact demand in the coming years. This future-focused analysis, coupled with a deep dive into market drivers and challenges, empowers you to make informed decisions and capitalize on lucrative opportunities within the bank kiosk space.

Conclusion

The bank kiosk market is booming, with a projected CAGR of nearly 20% from 2021 to 2027. This growth is driven by factors like rising demand for self-service banking and increasing adoption in developing economies. While limitations like kiosk functionality and accessibility exist, opportunities in advanced technologies and mobile integration offer exciting possibilities. The Asia-Pacific region, fueled by government support and rising consumer awareness, is expected to dominate the market. This informative report provides a comprehensive overview of the market, including segmentation, key players, and a future outlook to help you navigate this dynamic space.

Contact Us:

Infinium Global Research LLP

Mob: +91 9923950043

Email: info@infiniumglobalresearch.com

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0