Oleochemicals Market Size, Share, Top Companies, Demand and Forecast 2025-2033

IMARC Group provides an analysis of the key trends in each segment of the market, along with the oleochemicals market forecast at the global, regional, and country levels for 2025-2033.

Summary:

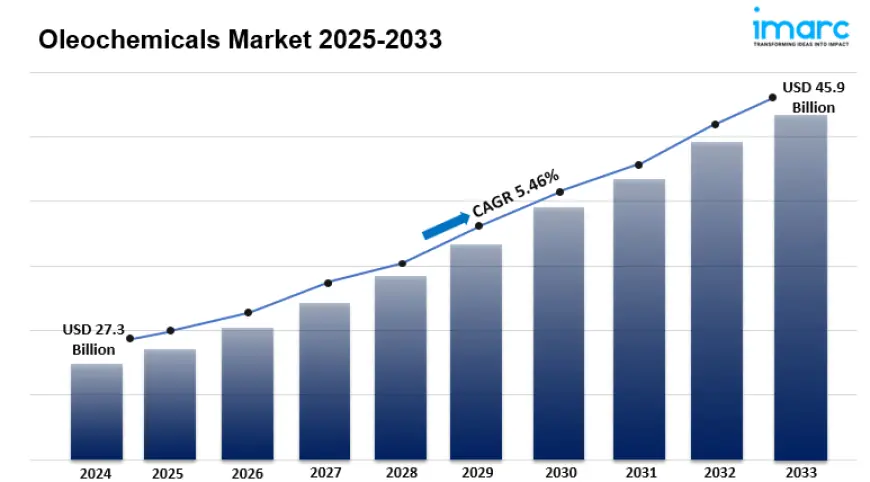

- The global oleochemicals market size reached USD 27.3 Billion in 2024.

- The market is expected to reach USD 45.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.46% during 2025-2033.

- Asia Pacific leads the market, accounting for the largest oleochemicals market share.

- Fatty acids account for the majority of the market share in the type segment due to their emulsifying, moisturizing, and stabilizing properties.

- Liquid form holds the largest share in the oleochemicals industry.

- Soaps and detergents represent the leading application segment.

- Palm remains a dominant segment in the market due to its widespread availability and efficient processing.

- The increase in consumer demand for environmentally friendly products is a primary driver of the oleochemicals market.

- Innovations in production processes are reshaping the oleochemicals market.

Industry Trends and Drivers:

- Rising Demand for Sustainable and Biodegradable Products:

The oleochemicals market is largely influenced by the growing demand from consumers and industries for sustainable and eco-friendly products. Oleochemicals, which are sourced from natural fats and oils like palm, coconut, and soybean oil, offer biodegradable options that are less detrimental to the environment compared to petrochemical products. As public awareness of environmental challenges and the effects of synthetic chemicals increases, there is a significant movement towards the utilization of renewable resources and sustainable materials. This trend is particularly prominent in sectors such as personal care, cosmetics, and household cleaning, where consumers are increasingly mindful of the ingredients in their products. The transition towards green chemistry and sustainability is driving the use of oleochemicals, which provide environmentally friendly alternatives in these markets.

- Widespread Use in Various End-User Industries:

The extensive use of oleochemicals in various sectors is playing a crucial role in the growth of the industry. These compounds are integral to a wide range of products, including soaps, detergents, lubricants, pharmaceuticals, food additives, and biodiesel. For example, in the personal care and cosmetics sector, oleochemicals like fatty acids, fatty alcohols, and glycerin are valued for their moisturizing and emulsifying characteristics, which improve the texture and effectiveness of creams, lotions, and shampoos. In the food sector, oleochemicals serve as emulsifiers, stabilizers, and preservatives, helping to maintain product quality and extend shelf life. Additionally, the rising demand for biodiesel as a sustainable energy alternative is increasing the requirement for oleochemical derivatives, particularly fatty acid methyl esters (FAME), which are vital for biodiesel production.

- Advancements in Production Technologies:

Advancements in production technologies are having a profound impact on the oleochemicals market. Innovations in enzymatic processes, biocatalysis, and green chemistry have significantly improved the efficiency and cost-effectiveness of oleochemical manufacturing. These developments allow producers to create high-quality oleochemicals while minimizing environmental impact, which aligns with the growing focus on sustainability. As a result, companies are progressively integrating greener technologies to maintain the economic viability and environmental responsibility of oleochemical production. Furthermore, technological progress has facilitated the discovery and commercialization of new oleochemical products and derivatives, broadening their application range and generating new market opportunities. For example, certain oleochemical derivatives are being specifically designed for use in high-performance lubricants and biodegradable cosmetics, which are increasingly sought after by consumers looking for sustainable alternatives.

Request Sample For PDF Report: https://www.imarcgroup.com/oleochemicals-market/requestsample

Oleochemicals Market Report Segmentation:

Breakup by Type:

- Fatty Acids

- Fatty Alcohols

- Glycerine

- Others

Breakup by Form:

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

Breakup by Application:

- Soaps and Detergents

- Plastics

- Paper

- Lubricants

- Rubber

- Coatings and Resins

- Personal Care Products

- Others

Breakup by Feedstock:

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Top Oleochemicals Market Leaders:

- Akzo Nobel N.V.

- BASF SE

- Cargill, Incorporated

- Emery Oleochemicals Group

- Evonik Industries AG

- Evyap Oleo

- Godrej & Boyce Mfg. Co. Ltd.

- Kao Corporation

- KLK Oleo

- Myriant Technologies

- Oleon NV

- Procter & Gamble Company

- PTT Global Chemical Public Company Limited

- Corbion N.V.

- Wilmar International Ltd.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0