Future of Cloud AI Market: Why Every Seller and Researcher Must Act Now on 33.7% CAGR Growth

The cloud AI market is scaling rapidly as advances in machine learning, deep learning, and NLP make AI models more accurate, accessible, and efficient on elastic cloud platforms.

MARKET OVERVIEW

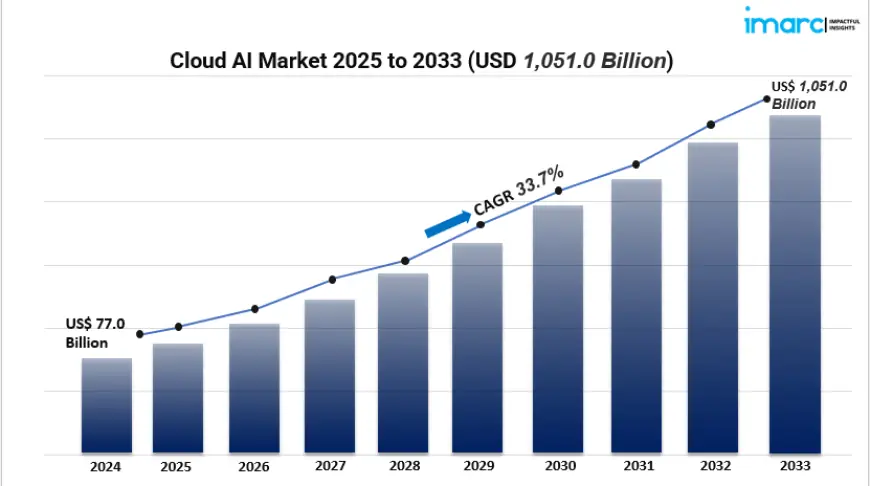

The cloud AI market is scaling rapidly as advances in machine learning, deep learning, and NLP make AI models more accurate, accessible, and efficient on elastic cloud platforms. Generative AI adoption, API-accessible models, and pay-as-you-go pricing are drawing enterprises and SMEs alike. In 2024, the market reached USD 77.0 Billion and is forecast to hit USD 1,051.0 Billion by 2033 at a 33.7% CAGR (2025–2033). North America currently leads, underpinned by strong infrastructure and heavyweight cloud providers.

STUDY ASSUMPTION YEARS

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019–2024

- FORECAST YEAR: 2025–2033

CLOUD AI MARKET KEY TAKEAWAYS

- Market reached USD 77.0B (2024) and is projected to USD 1,051.0B by 2033 (CAGR 33.7%).

- North America holds the largest share, driven by robust tech ecosystems and major cloud hyperscale’s.

- Type: Solution leads over Services, reflecting demand for scalable, configurable AI offerings.

- Technology: Deep Learning is the largest, followed by Machine Learning, NLP, and Others.

- Vertical: IT & Telecommunication is the top adopter; healthcare, retail, BFSI, government, manufacturing, and automotive follow.

- Rising edge/IoT integration and platform scalability are key trends enabling real-time analytics and faster deployments.

MARKET GROWTH FACTORS

1) Breakthroughs in ML/DL & NLP

The rapid evolution of machine learning and deep learning is at the heart of the cloud AI boom, allowing for incredibly precise models that handle everything from images and speech to predictive tasks on a large scale. Thanks to deep learning powered by neural networks, we now have access to nearly limitless cloud computing and storage, which shortens experimentation times and speeds up the journey to value. At the same time, advancements in natural language processing (NLP) are making interactions between humans and computers feel more natural, broadening the range of applications from virtual assistants to smarter contact centers and document analysis. The great thing is that these capabilities are available through APIs and managed services, meaning companies without their own AI experts can still implement advanced models. The combination of improvements in ML/DL and NLP not only boosts performance but also lowers the barriers to entry, creating a positive feedback loop of usage, data generation, and model enhancement—ultimately driving a steady demand for cloud-based AI across various sectors.

2) Elastic Scalability, Integration & Cost Efficiency

Cloud platforms offer flexible computing power that can easily scale up or down based on workload needs, allowing for efficient AI training and inference without hefty upfront costs. This adaptability is perfect for transitioning from pilot projects to full production and can handle seasonal fluctuations or rapid growth without the risk of over-provisioning. The smooth integration with existing IT systems reduces disruptions, while managed MLOps, ready-to-use APIs, and pre-built models speed up the adoption process. For small and medium-sized enterprises (SMEs), service-based pricing opens the door to cutting-edge AI, encouraging experimentation in areas like customer experience, marketing, and operations. The outcome? A lower total cost of ownership, quicker innovation cycles, and wider involvement in AI projects. As businesses increasingly adopt cloud-native architectures, AI services become essential components that can be integrated into various applications, fostering consistent value creation and ongoing market growth.

3) Ecosystem Momentum & Industry Adoption

North America is at the forefront of the cloud AI landscape, driven by major players like AWS, Microsoft, Google, IBM, and Oracle. This leadership creates a dynamic cycle of investments, partnerships, and tailored solutions for various industries. Telecommunications companies are leading the charge, using AI for optimizing networks, predicting maintenance needs, and automating customer support. Meanwhile, sectors like healthcare, banking, retail, government, manufacturing, and automotive are rapidly embracing digital transformation through cloud AI. The growing synergy with IoT and edge computing allows for real-time analytics and quick decision-making, opening up new possibilities from smart factories to connected vehicles. With an expanding range of responsible AI tools and compliance frameworks, regulated industries can keep pace with innovation while ensuring they meet governance requirements. This rich ecosystem—comprising hyperscalers, independent software vendors, and service integrators—reduces risk and accelerates deployment, solidifying cloud AI as a key component in modernizing enterprises.

Request for a sample copy of this report: https://www.imarcgroup.com/cloud-ai-market/requestsample

MARKET SEGMENTATION

IMARC categorizes the market by Type, Technology, Vertical, and Region. All segments and sub-segments below are listed exactly as in the source.

Breakup by Type

- Solution — Scalable, flexible AI building blocks that integrate with enterprise stacks, enabling rapid deployment without deep in-house expertise.

- Services — Managed and professional services that help implement, optimize, and operationalize AI models across use cases and industries.

Breakup by Technology

- Deep Learning — Neural networks learning from large datasets to power accurate vision, speech, NLP, and predictive analytics in the cloud.

- Machine Learning — Algorithmic modeling for classification, forecasting, and optimization workloads delivered via cloud platforms.

- Natural Language Processing — Language understanding and generation capabilities exposed through API services for conversational and content tasks.

- Others — Additional AI techniques supported across cloud stacks for specialized or emerging workloads.

Breakup by Vertical

- Healthcare — AI-assisted diagnostics, triage, and workflow automation delivered through secure, compliant cloud services.

- Retail — Personalization, demand forecasting, and omnichannel analytics to elevate CX and inventory decisions.

- BFSI — Risk modeling, fraud detection, and intelligent servicing with auditable, scalable AI pipelines.

- IT and Telecommunication — Network performance, predictive maintenance, and automated support—largest adopting vertical.

- Government — Digital public services and data-driven decisioning supported by secure cloud AI environments.

- Manufacturing — Quality inspection, predictive maintenance, and smart factory analytics on cloud-edge architectures.

- Automotive and Transportation — Connected mobility, logistics optimization, and autonomy-adjacent analytics at scale.

- Others — Additional industry use cases utilizing cloud AI’s scalability and API-first delivery.

Breakup by Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

REGIONAL INSIGHTS

North America is leading the charge in the cloud AI market, bolstered by top hyperscalers, swift AI adoption across various sectors, and robust research and development investments. A supportive regulatory and security landscape, along with widespread applications in healthcare, finance, and retail, further cements its position and speeds up large-scale enterprise deployments.

RECENT DEVELOPMENTS & NEWS

Lately, there's been a big push to speed up enterprise-grade generative AI. For instance, AWS and Capgemini have teamed up for a multi-year project aimed at taking generative AI from pilot programs to full-scale production through AWS Centers of Excellence (January 16, 2024). Meanwhile, Oracle has rolled out OCI Generative AI services to make it easier for businesses to adopt this technology (January 24, 2024). Additionally, Salesforce and Google have broadened their partnership to facilitate content generation across platforms and set up workflow triggers that connect Google Workspace with Salesforce applications (September 12, 2023). All these developments highlight the importance of seamless deployment, security, and tangible boosts in business productivity.

KEY PLAYERS

- Ai H2o Inc.

- Amazon Web Services Inc.

- Cloudminds Technology Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Qlik Technologies Inc.

- Salesforce Inc.

- SoundHound Inc.

- Verint Systems Inc.

- Wipro Limited

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=7926&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (+1-201971-6302)

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0