Given the Volatility of Real Estate Markets, What is Driving Dubai's Real Estate Boom?

Dubai, a megacity synonymous with towers, luxury, and substance, is passing an extraordinary real estate smash despite

Dubai, a megacity synonymous with towers, luxury, and substance, is passing an extraordinary real estate smash despite the global volatility in real estate requests. While numerous metropolises around the world grapple with shifting property values and profitable query, Dubai's property request is thriving, characterized by rising property prices, high demand, and a swell in new developments. To understand what's driving Dubai's real estate smash, it’s pivotal to explore a convergence of factors ranging from profitable diversification to strategic structure investments and geopolitical stability.

Economic Diversification and Stability

One of the primary motorists of Dubai’s real estate smash is its successful profitable diversification. Traditionally reliant on oil painting earnings, Dubai has transitioned towards a knowledge-grounded frugality, with significant investments in sectors like tourism, finance, and technology. This diversification has handed a stable profitable terrain that appeals to both original and transnational investors.

Dubai's strategic vision, reprised in enterprises like Dubai Plan 2021 and the Dubai 2040 Urban Master Plan, aims to enhance the megacity’s global competitiveness and livability. By fastening on sectors similar to tourism, real estate, and finance, Dubai has managed to produce a flexible frugality that attracts investors looking for stability and growth.

Tax Incentives and Business-Friendly Environment

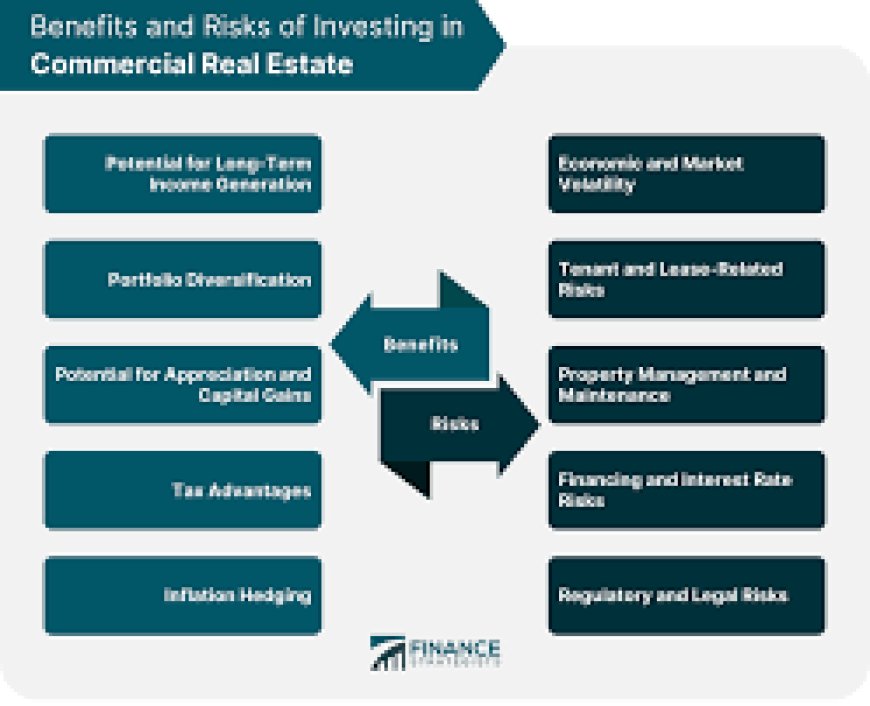

Another crucial factor is Dubai’s business-friendly terrain. The megacity offers a range of duty impulses, including zero income duty and low commercial duty rates. These programs are designed to attract foreign investment and foster a climate of entrepreneurship. also, Dubai's Free Zones, which give 100 foreign powers and full extradition of gains, have been necessary in attracting global businesses.

The real estate sector benefits from these business-friendly programs as companies set up their headquarters or indigenous services in Dubai. This affluence of businesses drives demand for both domestic and marketable parcels, contributing to the real estate smash.

Infrastructure Development and Mega Projects

Dubai’s commitment to structure development is a significant motorist of its real estate request. The megacity is famed for its ambitious mega systems, which include iconic milestones like the Burj Khalifa, Palm Jumeirah, and Dubai Marina. These developments not only enhance the megacity’s global character but also attract high- net- worth individualities and investors.

Ongoing systems similar to the Dubai Creek Tower and the Expo 2020 heritage developments are anticipated to further boost the real estate request. The Expo 2020, in particular, has had a profound impact, with the event attracting millions of callers and leaving behind a heritage of ultramodern structures and installations.

The megacity’s comprehensive transport network, including the Dubai Metro, advanced road systems, and plans for a hyperloop, also plays a pivotal part. Effective transportation links make the colorful corridor of the megacity more accessible, adding the appeal of domestic and marketable parcels across different areas.

Global Geopolitical Stability and Safe Haven Status

Dubai’s geopolitical stability is another crucial factor in its real estate smash. As a haven in a region frequently marked by geopolitical pressures, Dubai offers a sense of security that's seductive to investors. The UAE’s stable political terrain, combined with its strong legal and nonsupervisory frame, makes Dubai a charming destination for those looking to invest in real estate.

The megacity’s character as a secure and stable investment position is further corroborated by its strong legal protections for property possessors. This legal clarity and protection ensure that investors can confidently commit to real estate gambles without the fear of adverse legal or political developments.

Growing Tourism Sector

Dubai’s booming tourism sector significantly impacts its real estate request. As a leading global sightseer destination, the megacity attracts millions of callers annually, numerous of whom seek short-term reimbursement lodgment. This high demand for short-term settlements boosts the profitability of domestic parcels and encourages investors to explore Dubai’s real estate requests.

Events like the Dubai Shopping Festival, transnational conferences, and artistic carnivals contribute to the megacity’s appeal as a sightseer destination. also, the megacity’s luxury hospices, world-class shopping promenades, and entertainment venues produce a vibrant

Expatriate Population and Demand for Housing

Dubai is home to a large aboriginal population, which drives demand for domestic parcels. The megacity’s different and multilateral terrain, combined with its high standard of living, attracts professionals and families from around the world. As further deportees move to Dubai, the demand for quality casing continues to rise.

The real estate request responds to this demand by offering a range of casing options, from luxury estates to affordable apartments. This variety ensures that there are openings for both high-end investors and those looking for further budget-friendly options.

Technological Advancements and Innovation

Dubai’s focus on technological advancements and invention is also a driving force behind its real estate smash. The megacity is using technology to enhance its real estate requests, from smart home features to advanced property operation systems. inventions like blockchain technology are being explored to streamline property deals and increase translucency.

Also, Dubai’s vision to become a global leader in smart megacity technologies is creating new openings in the real estate sector. The integration of technology into civic planning and development ensures that Dubai remains at the van of ultramodern living, attracting tech-smart investors and residents.

This article was originally published on a.land. For more information and opportunities, visit shop.a.land and https://bid.a.lad.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0