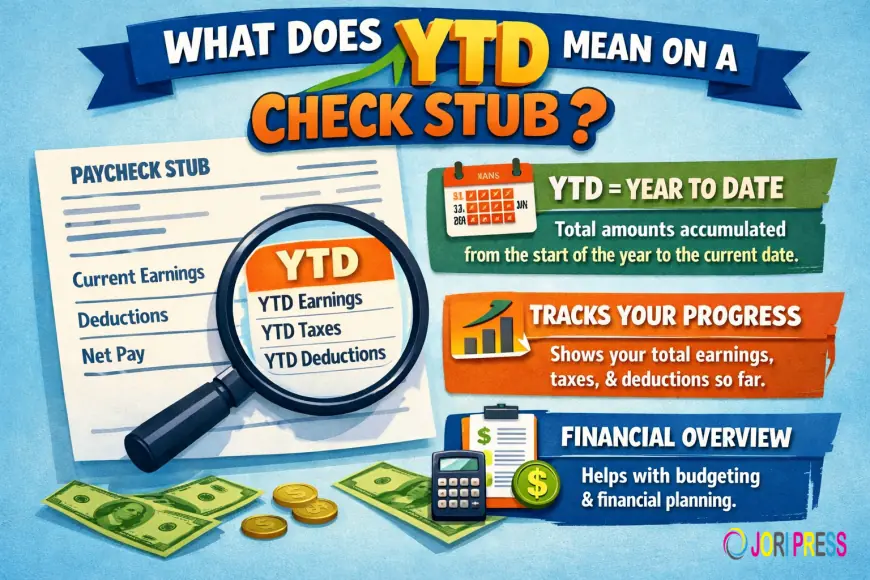

What Does YTD Mean on a Check Stub?

What does YTD mean on a check stub? Learn the simple meaning of Year-to-Date (YTD), how it’s calculated, and why it matters for your earnings, taxes, and deductions.

YTD is an abbreviation for Year to Date. The length of time that the check stub refers to is almost always the YTD period. It measures not only the total money earned by a person but also the total taxes and other withheld amounts up to the current pay period. By using YTD numbers, you can understand how much you earned, how much in taxes you paid, and how much was deducted from your employer for benefits. These YTD numbers allow people to monitor their money without any difficulty. They provide a very convenient way to count their real income without any confusion or mixing up with other numbers.

YTD data is essential if one wants to have correct financial records. The YTD figure is used by employers to limit payroll expenses. On the other hand, employees are engaged with YTD records as a way of checking their earnings. Banks, lenders, and government agents also leverage YTD data to back up income claims. In case the check stub does not have any YTD numbers, it will be difficult to verify pay. This may lead to errors when filing taxes or applying for a loan.

Usually, your pay stub represents YTD information in three different sections. Each section provides you with different kinds of financial data.

YTD Gross Pay

Before any money is taken out of your account, this figure indicates the complete sum of money, which is yours. One thing is for sure; this number has to contain all money-making activities that you did through your employment. First off, it may be either of the two - paid by the hour or fixed salary. Besides, you might be paid with overtime, get a bonus or a commission. In this case, YTD gross pay shows all of the above and converts them into one figure. You should check your present gross pay against your YTD gross pay to make sure that they correspond to your account.

YTD Taxes

It is a numeric representation of the total taxes that were withheld from one single person's or employee's earnings. The tax on wages is deducted by the employer based on the employee's tax form, and the way the latter's pay is structured. Among the most common taxes are federal and state incomes, Social Security, and Medicare taxes. In the end, taxes have to be paid because they are part of government rules that people need to comply with. Looking at YTD tax numbers, you get a clear view of the total tax paid thus far in the year. The figure that one is going to owe or the size of a refund can be figured out in advance based on that data.

YTD Deductions

This number indicates that part of the money from the income of the person has been withdrawn due to requirements, or made voluntary for benefits and other similar needs. These deductions can be of two types: one is compulsory, and the other is voluntary. Some money taken out may be for the following: the cost of health, dental, vision insurance, retirement plans, flexible

spending accounts, or wage garnishments. While at it, you may also find union dues and contributions to other workplace programs. Every deduction removes a certain part of your take-home pay. The YTD deductions allow you to keep tabs on the money invested in benefits over the past year.

You should be familiar with your YTD figures each time a new pay stub is handed to you. This is a much better way of driving your income as compared to when you don't pay attention. The power of the YTD approach is that it enables you to cross-check totals against work hours or salary schedules. It is a common practice for employees to discover errors in a pay stub when

they examine YTD figures. For instance, there might be a case where no overtime is shown, or the benefit deduction is incorrect. By keeping up with YTD numbers, you are able to spot changes instantly and thus inform payroll about them.

Moreover, YTD is a great tool for financial planning. Having a budget that fits your real income is possible by using YTD. You can also track your contribution to the benefits. Besides, you can figure out how much you pay in taxes. The details give you a chance to spend, save, and invest wisely.

In case you need to take out a loan, lenders will mostly require proof of income. A pay stub with YTD figures is the best way to show your earnings to them. They assess your monthly income by comparing it with your average monthly income. Besides, they verify if your income is regular. YTD discloses everything to them. This is a perfect scenario for the approval of your

loan. Besides YTD data is a great help in gathering paperwork quickly during the tax season. You can confirm the exact amount of tax paid by going through your documents. You can also verify the numbers on your W2 with YTD figures. By doing this, you are free from committing errors that interrupt the filing process.

Most of the workers have variable income. Such as freelancers, part-time employees, contractors, and employees working in shifts. YTD numbers give them a clear record of earnings. If your hours change each week, YTD helps you calculate your total income without relying on estimates. This keeps your financial tracking accurate.

In the case of wanting to maintain or start an accurate pay stub for your personal records, you can use an online tool. CheckStubGenerator.com provides simple and clear pay stubs that include YTD information. You are free to create a copy whenever you want. It is a great way to keep yourself organized and ready for financial tasks. The instrument produces neat layouts that make it easy to read your totals.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0