Vietnam Logistics Market Size, Share, Growth, Trends and Forecast 2025-2033

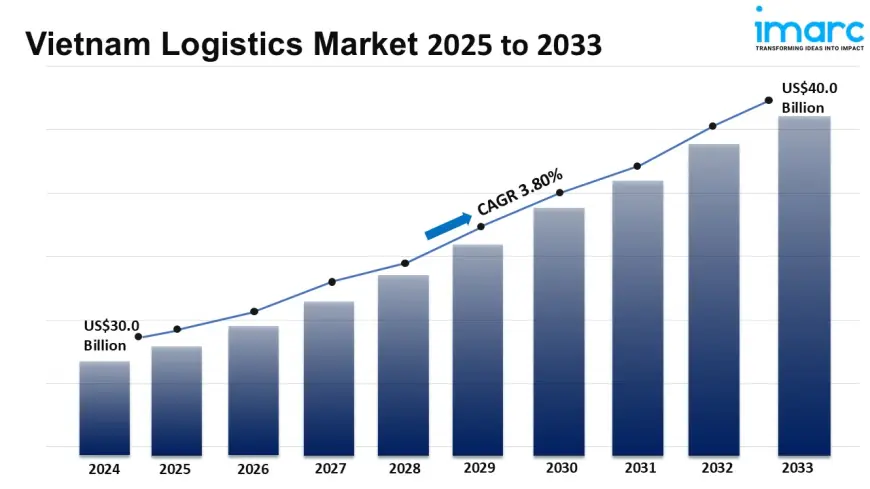

Vietnam logistics market size reached USD 30.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 40.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033.

According to the latest report by IMARC Group, titled “Vietnam Logistics Market Report by Model Type (2 PL, 3 PL, 4 PL), Transportation Mode (Roadways, Seaways, Railways, Airways), End Use (Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, and Others), and Region 2025-2033”, offers a comprehensive analysis of the industry, which comprises insights on the Vietnam Logistics Market. The report also includes competitor and regional analysis, and contemporary advancements in the global market.

Vietnam logistics market size reached USD 30.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 40.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The increasing investments in education and skill development, the shift towards digital documentation and e-logistics platforms, the enhancement of manufacturing capabilities, the rising development and expansion of seaports, the expanding tourism industry, and the establishment of free trade zones are some of the factors propelling the market.

Request Free Sample Report: https://www.imarcgroup.com/vietnam-logistics-market/requestsample

Vietnam Logistics Market Dynamics:

E-commerce Explosion Driving Last-Mile Transformation & Warehousing Innovation

The unprecedented surge in Vietnam's e-commerce sector, fueled by rising internet penetration, a young tech-savvy population, and post-pandemic behavioral shifts, is fundamentally reshaping logistics demand. This necessitates radical innovation in last-mile delivery, pushing logistics providers towards hyper-local fulfillment centers within major urban hubs like Ho Chi Minh City and Hanoi to enable same-day or next-day delivery. Investment in automated sortation centers, advanced warehouse management systems (WMS), and route optimization software is accelerating. Furthermore, the demand for specialized warehousing – particularly temperature-controlled facilities for groceries and pharmaceuticals, along with high-throughput e-commerce fulfillment centers featuring robotics and automated storage and retrieval systems (AS/RS) – is skyrocketing. Providers are also diversifying last-mile solutions, integrating traditional fleets with motorbike networks for dense urban areas and exploring locker systems and pickup points to enhance consumer convenience and reduce failed deliveries. This dynamic creates intense competition but also significant opportunities for players offering integrated, tech-enabled solutions tailored to the unique complexities of Vietnam's urban landscapes and consumer expectations.

Manufacturing Boom & FDI Influx Driving Demand for Integrated Supply Chain Solutions & Infrastructure Enhancement

Vietnam's strategic position in global supply chains, bolstered by trade agreements (CPTPP, EVFTA, RCEP) and ongoing diversification efforts ("China Plus One"), continues to attract massive Foreign Direct Investment (FDI), particularly in electronics, textiles, footwear, and increasingly high-tech manufacturing. This influx creates substantial demand for sophisticated, end-to-end logistics services beyond basic freight forwarding. Manufacturers require integrated solutions encompassing vendor-managed inventory (VMI), just-in-time (JIT) delivery, bonded warehousing, customs clearance optimization, and robust cross-border transportation networks connecting industrial parks to deep-sea ports and airports. This dynamic exerts immense pressure on Vietnam's infrastructure. While significant investments are underway (e.g., expansions at Lach Huyen, Cai Mep ports, Long Thanh Airport development), bottlenecks persist, driving demand for logistics providers who can navigate these challenges through multimodal transport solutions, digital freight platforms for capacity matching, and strategic warehouse placement near key industrial clusters. The focus is shifting towards reliability, visibility, and cost efficiency across the entire supply chain, elevating the role of 3PLs and 4PLs with strong regional networks and digital capabilities.

Sustainability Imperative Catalyzing Green Logistics Adoption & Regulatory Evolution

Environmental, Social, and Governance (ESG) considerations are rapidly moving from niche concern to core business imperative in Vietnam's logistics sector. Growing regulatory pressure, driven by both domestic environmental goals and international customer requirements (especially from the EU), alongside increasing corporate sustainability commitments, is accelerating the adoption of green logistics practices. Key trends include the electrification of urban delivery fleets, investment in energy-efficient warehousing (LED lighting, solar panels, smart energy management), optimization of transport routes to reduce fuel consumption and emissions, and the exploration of alternative fuels for long-haul trucking. Circular logistics models, focusing on packaging reduction, reuse, and recycling, are gaining traction. This dynamic is also shaping infrastructure development, with modern logistics parks increasingly incorporating green building standards. While upfront costs remain a challenge, the long-term operational savings, regulatory compliance, enhanced brand reputation, and alignment with global supply chain expectations are compelling drivers. Providers proactively investing in sustainability metrics, reporting, and technology (e.g., carbon footprint calculators) are positioning themselves for competitive advantage and future resilience.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Vietnam Logistics Market Trends

The Vietnamese logistics landscape is currently defined by a confluence of powerful trends driving rapid evolution. Technology integration stands paramount, with widespread adoption of Transportation Management Systems (TMS), Warehouse Management Systems (WMS), and digital freight platforms enhancing operational visibility, optimizing route planning, and automating manual processes. Artificial Intelligence (AI) and machine learning are increasingly deployed for predictive analytics, demand forecasting, and dynamic pricing, while Internet of Things (IoT) sensors enable real-time cargo tracking and cold chain monitoring, boosting reliability and reducing spoilage. Concurrently, the push towards operational sustainability intensifies, manifesting in fleet electrification trials, investments in green warehousing standards, and optimization efforts targeting reduced carbon emissions. This is increasingly mandated by both regulatory frameworks and the stringent ESG requirements of multinational clients. Workforce development remains a critical focus, as the sector grapples with a skills gap; significant investment is flowing into training programs for digital literacy, advanced warehousing techniques, and supply chain management to build a future-ready talent pool. Furthermore, supply chain diversification and resilience are top priorities for shippers, driving demand for nearshoring support, multi-modal transport solutions combining road, rail, and coastal shipping to mitigate port congestion, and robust risk management strategies. The cold chain logistics segment is experiencing particularly strong growth, fueled by rising domestic consumption of perishables and expanding agricultural exports requiring stringent temperature control. These converging trends underscore a market in dynamic transition, demanding agility, technological prowess, and a strategic commitment to sustainable and resilient operations from logistics providers aiming for leadership.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=16495&flag=C

Vietnam Infrastructure Market Industry Segmentation:

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Key highlights of the Report:

- Market Performance

- Market Outlook

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0