The Impact of Global Market Trends on Cumene Price

Cumene, also known as isopropylbenzene, is an organic compound primarily used as an intermediate in the production of phenol and acetone.

Cumene, also known as isopropylbenzene, is an organic compound primarily used as an intermediate in the production of phenol and acetone. It is a crucial material in various industrial processes, including the manufacture of plastics, resins, and synthetic fibers. Monitoring the price trend of cumene is essential for stakeholders in the chemical industry, as it directly impacts the cost structure of several downstream products. This blog delves into the current and forecasted price trends of cumene, providing a comprehensive market analysis and the latest news affecting its market dynamics.

Cumene Price Trend

The price of cumene is influenced by multiple factors, including crude oil prices, supply and demand dynamics, and production costs. Over the past few years, the cumene market has experienced fluctuations due to varying crude oil prices and changes in industrial demand.

Request For Sample: https://www.procurementresource.com/resource-center/cumene-price-trends/pricerequest

Historical Price Trend

Historically, cumene prices have mirrored the trends in crude oil prices since petroleum derivatives are a significant feedstock for its production. The price of cumene saw a significant drop during the global oil price decline in 2014-2015. However, it rebounded as oil prices stabilized and industrial demand increased.

In 2020, the COVID-19 pandemic caused a significant disruption in the cumene market. With reduced industrial activity and a sharp decline in crude oil prices, cumene prices plummeted. However, as industries began to recover in late 2020 and 2021, the demand for cumene and its derivatives increased, leading to a gradual price recovery.

Recent Price Movements

In recent months, the cumene market has seen a steady increase in prices. This rise can be attributed to the recovery in global industrial activities, coupled with supply chain constraints. Additionally, fluctuations in crude oil prices have continued to influence cumene prices. As of the latest data, the price of cumene is on an upward trend, reflecting the overall recovery in the chemical industry.

Forecast

Short-term Forecast

In the short term, cumene prices are expected to remain on an upward trajectory. The ongoing recovery of the global economy post-pandemic is likely to drive demand for cumene and its derivatives. Additionally, any volatility in crude oil prices will directly impact cumene prices. Supply chain disruptions, particularly in regions heavily impacted by the pandemic, may also contribute to price fluctuations.

Long-term Forecast

Looking at the long-term forecast, the cumene market is anticipated to witness moderate growth. Factors such as the increasing demand for phenol and acetone, which are crucial in manufacturing numerous industrial products, will drive the cumene market. Technological advancements in production processes and the discovery of alternative feedstocks could also influence future price trends.

Environmental regulations and sustainability practices will play a significant role in shaping the cumene market. As industries move towards greener practices, the demand for environmentally friendly production methods may impact the overall cost and, consequently, the price of cumene.

Market Analysis

Demand Dynamics

The demand for cumene is primarily driven by its use in producing phenol and acetone. Phenol is extensively used in the manufacture of plastics, resins, and other industrial chemicals. The growing construction and automotive industries, which rely on phenol-based products, are major consumers of cumene.

Acetone, another derivative of cumene, is widely used as a solvent in various industries, including pharmaceuticals, cosmetics, and paints. The increasing demand for these products is expected to drive the cumene market in the coming years.

Supply Chain Analysis

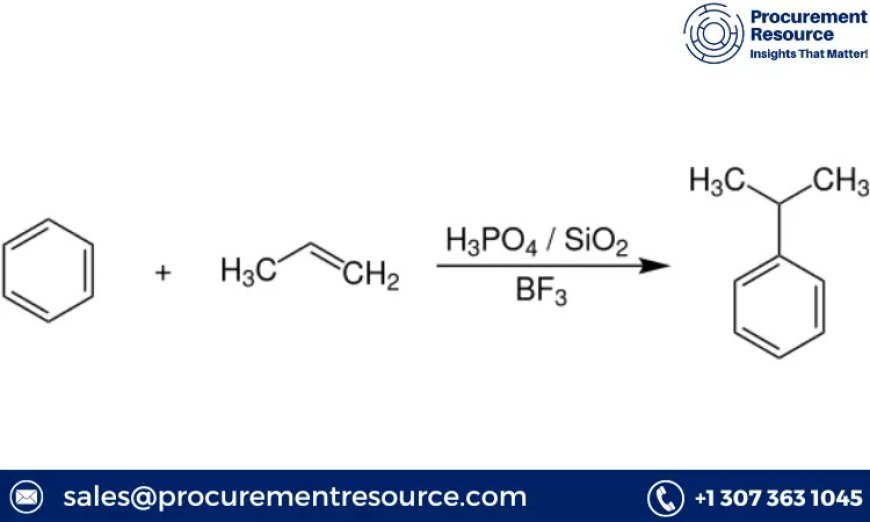

The cumene supply chain is influenced by the availability of raw materials, particularly benzene and propylene. Any disruptions in the supply of these feedstocks can impact cumene production and, consequently, its price. The global supply chain disruptions caused by the COVID-19 pandemic highlighted the vulnerabilities in the cumene market, leading to price volatility.

Regional Analysis

The Asia-Pacific region, particularly China and India, is a significant market for cumene due to the presence of numerous chemical manufacturing industries. The demand for phenol and acetone in these countries drives the cumene market. North America and Europe also hold substantial market shares, with the presence of major chemical manufacturing companies.

Competitive Landscape

The cumene market is highly competitive, with several key players dominating the industry. Companies such as BASF SE, Royal Dutch Shell PLC, ExxonMobil Corporation, and Sumitomo Chemical Co., Ltd. are major producers of cumene. These companies focus on strategic expansions, collaborations, and technological advancements to maintain their market position.

Latest News

Industry Updates

Recent news in the cumene market highlights various strategic initiatives by major companies to enhance their production capacities. For instance, BASF SE recently announced the expansion of its cumene production facility to meet the growing demand for phenol and acetone. Similarly, ExxonMobil has invested in technological advancements to improve the efficiency of cumene production processes.

Regulatory Changes

Environmental regulations continue to shape the cumene market. Governments worldwide are implementing stricter regulations on chemical production to reduce environmental impact. These regulations may drive companies to adopt more sustainable production methods, potentially impacting the cost and price of cumene.

Market Innovations

Innovation in production technologies is another key aspect influencing the cumene market. Companies are investing in research and development to discover alternative feedstocks and improve production efficiencies. These innovations aim to reduce production costs and enhance the sustainability of cumene manufacturing.

Economic Impact

The global economic recovery post-pandemic is a significant factor impacting the cumene market. As industrial activities resume and demand for phenol and acetone increases, cumene prices are expected to rise. However, any economic downturns or disruptions in crude oil supply could lead to price volatility.

Conclusion

Understanding the cumene price trend is crucial for stakeholders in the chemical industry. The market is influenced by various factors, including crude oil prices, supply and demand dynamics, and regulatory changes. By analyzing historical trends and forecasting future movements, companies can make informed decisions to navigate the cumene market effectively.

In summary, the cumene market is poised for growth in the coming years, driven by increasing demand for its derivatives and advancements in production technologies. Staying updated with the latest market trends and news will help businesses capitalize on opportunities and mitigate risks in this dynamic market.

hollandsmith157@gmail.com

hollandsmith157@gmail.com