Market Dynamics: Analyzing Supply and Demand in the Coated Paper Industry

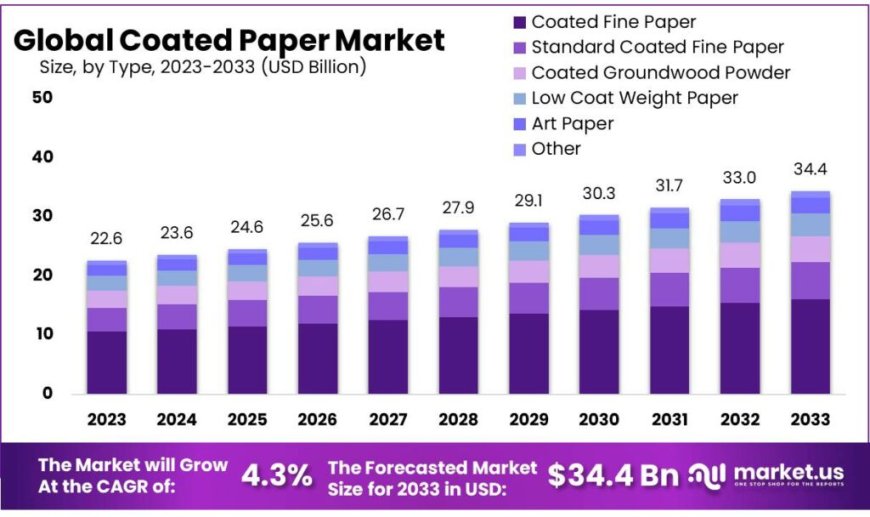

The Coated Paper Market size is expected to be worth around USD 34.4 billion by 2033, from USD 22.6 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The Coated Paper Market size is expected to be worth around USD 34.4 billion by 2033, from USD 22.6 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

Key Market Players:

-

Oji Holdings Corporation

-

Stora Enso Oyj

-

Paradise Packaging Pvt. Ltd

-

Asia Pulp & Paper

-

Sappi Limited

-

UPM-Kymmene Corp

-

Minerals Technologies Inc.

-

Nippon Paper Industries Co. Ltd

-

Shree Krishna Paper Mills & Industries Ltd

-

Emami Group

-

NewPage Corporation

-

Burgo Group SpA

-

JK Paper Ltd

-

Arjowiggins SAS

-

Ballarpur Industries Limited

Click here for request a sample : https://market.us/report/coated-papers-market/request-sample/

By Coating Material:

Ground Calcium Carbonate (GCC) and Precipitated Calcium Carbonate (PCC) are widely used in paper coatings for their brightness and smoothness, enhancing printability and ink receptivity. Kaolin clay, known for its fine particle size, improves paper smoothness and brightness, while wax coatings provide water and grease resistance, essential for packaging materials. Other coating materials, like starch, titanium dioxide, talc, and various polymers, offer specialized properties such as improved strength, gloss, and barrier characteristics. The choice of coating material depends on desired paper properties, market trends, and environmental considerations in the paper industry.

By Type:

In 2023, Coated Fine Paper led the market with a 46.9% share, favored for high-quality printing in magazines, catalogs, and brochures. Standard Coated Fine Paper remained popular for its balance of quality and cost-effectiveness. Coated Groundwood Paper, eco-friendly and affordable, was widely used in publishing and commercial printing. Low Coat Weight Paper, noted for its lightweight durability, suited packaging and labeling. Art Paper, distinguished by its superior quality, was used for premium prints. Other segments included specialty papers for specific needs like barrier coatings and unique finishes, contributing to the coated paper market's diverse landscape.

Application Analysis:

In 2023, Packaging and labeling dominated the coated paper market with a 62.3% share, driven by demand for attractive and functional packaging in industries like food, beverages, cosmetics, and pharmaceuticals. Coated paper's durability and printability made it ideal for packaging solutions. Printing was another major segment, with coated paper preferred for high-quality magazines, brochures, and promotional materials. The "Others" category included specialty uses such as wallpapers, cards, and artistic prints, where coated paper's unique properties were highly valued, showcasing the market's growth and diversity.

Key Market Segments:

By Coating Material

-

Ground Calcium Carbonate (GCC)

-

Precipitated Calcium Carbonate (PCC)

-

Kaolin Clay

-

Wax

-

Others

By Type

-

Coated Fine Paper

-

Standard Coated Fine Paper

-

Coated Groundwood Powder

-

Low Coat Weight Paper

-

Art Paper

-

Other

By Application

-

Packaging & Labeling

-

Printing

-

Others

Drivers:

The demand for high-quality prints drives the coated paper market, with its ability to create sharp, vivid images due to its smoothness and reflective coatings like wax, clay, and titanium oxide. Coated papers, favored for catalogs, magazines, and advertisements, resist dirt and moisture, requiring less ink. Their heavier weight and smooth finish make them ideal for special print finishes. In the food industry, coated papers provide eco-friendly packaging solutions, maintaining food quality and safety. Waxed and resin-coated papers are ideal for wet and greasy foods, while polyethylene-coated papers ensure freshness and hygiene for meats and cheeses.

Restraints:

The shift to digital platforms poses a significant restraint on the coated paper market. As industries increasingly adopt digital solutions for operations and communication, traditional paper mediums are being replaced by e-brochures, online magazines, and digital reports. This transition to online services and advertisements, dominated by websites, television, and social media, has negatively impacted the growth of paper-based media, reducing the demand for coated paper.

Opportunity:

Sustainable practices present a significant opportunity for the coated paper market. Developing eco-friendly coated paper options and promoting recycling and renewable materials can attract environmentally conscious consumers. Exploring niche markets, integrating digital-print technologies like augmented reality, and developing functional coatings with antimicrobial properties or smart packaging features can expand the utility of coated paper. Emerging markets with growing demand for quality printed materials also offer substantial growth potential, while creating unique textures and finishes can help brands differentiate themselves.

Challenges:

The coated paper market faces several challenges, including the widespread shift to digital platforms reducing demand for traditional media. Environmental concerns like deforestation and waste management scrutinize the paper industry, despite sustainable efforts. Competing materials such as plastics and digital displays challenge coated paper's market share. Fluctuating raw material prices and energy costs pressure production costs, while changing consumer preferences towards digital content consumption require adaptation to maintain market relevance.

Files

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0