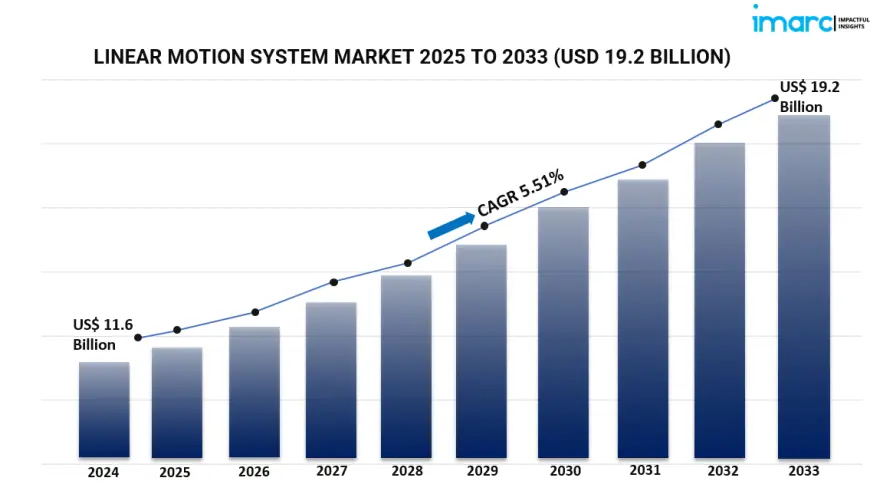

Linear Motion System Market Report 2025–2033: Global Growth Trends, Size & Forecast

The global linear motion system market reached USD 11.6 billion in 2024 and is projected to climb to USD 19.2 billion by 2033, showcasing a robust 5.51% CAGR during 2025–2033.

Market Overview

The global linear motion system market reached USD 11.6 billion in 2024 and is projected to climb to USD 19.2 billion by 2033, showcasing a robust 5.51% CAGR during 2025–2033. This impressive momentum is driven by the escalating deployment of electric vehicles, the rapid proliferation of smart factory infrastructure, and technological breakthroughs in semiconductor and 3D printing applications. Together, these factors are accelerating demand for advanced, high-precision motion control solutions across industries.

Study Assumption Years

-

Base Year: 2024

-

Historical Years: 2019–2024

-

Forecast Years: 2025–2033

Linear Motion System Market Key Takeaways

-

The market size stood at USD 11.6 billion in 2024, and it is forecasted to hit USD 19.2 billion by 2033, growing at a 5.51% CAGR.

-

Asia Pacific dominates the global landscape due to the region's aggressive industrial automation and electronics manufacturing initiatives.

-

Multi-axis systems are witnessing higher adoption over single-axis systems, given their versatility and broader industrial application.

-

The automotive sector continues to lead as the top end-use industry, supported by growth in electric vehicle production and automation-led assembly lines.

-

Diverse component demand includes actuators, guides, tables, controllers, and linear axes, supporting innovation across multiple industries.

-

A noticeable shift from traditional hydraulic systems to electric actuators is improving motion control, efficiency, and sustainability.

? Request for a sample copy of this report: https://www.imarcgroup.com/linear-motion-system-market/requestsample

Market Growth Factors

1. Surge in Electric Vehicle (EV) Adoption

The market for linear motion systems is expanding mostly on account of electric vehicle manufacturing. Global policy frameworks are promoting EV production, therefore boosting demand for high-performance linear motion systems in ADAS calibration, motor installations, and battery assembly. Superior positioning accuracy is needed for the implementation of modular battery designs and fast-charging infrastructure, which linear actuators and axes easily provide. These systems guarantee dependability, therefore driving their integration across electric vehicle manufacturing processes.

2. Industry 4.0 and Smart Factory Evolution

Demand for real-time control and automated operations has grown along with smart factories and Industry 4. 0 adoption. Production settings are integrating IoT, artificial intelligence, and predictive maintenance technologies. These smart operations run on linear motion systems, which allow automated inspection, adaptive machining, and high-precision component handling. Replacing pneumatic/hydraulic systems with electric LMS solutions improves control, efficiency, and environmental compliance even further.

3. Innovations in Semiconductor and 3D Printing

The rising miniaturization in semiconductor production and the rise of additive manufacture (3D printing) call for extremely accurate linear motion possibilities. For semiconductor uses, multi-axis LMS offers the nanometer-level accuracy needed for photolithography, chip packaging, and wafer handling. Meanwhile, in 3D printing, LMS guarantee precise layering for complex patterns and small-batch customized components. Demand for linear tables, modular guides, and intelligent actuators is expected to increase as these industries develop.

Market Segmentation

Breakup by Type:

-

Single‑Axis Linear Motion System

-

Multi‑Axis Linear Motion System

Breakup by Component:

-

Linear Axes

-

Actuators and Motors

-

Linear Tables

-

Linear Guides

-

Linear Modules

-

Controllers

-

Others

Breakup by End Use Industry:

-

Automotive

-

Electronics and Semiconductor

-

Manufacturing

-

Aerospace

-

Healthcare

-

Others

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights

The Asia Pacific region continues to dominate the linear motion system market, driven by its leadership in industrial automation, EV production, and electronics fabrication. Countries like China, Japan, and South Korea are making significant investments in smart factory ecosystems and semiconductor capabilities, propelling LMS integration. The widespread deployment of precision equipment across automotive and manufacturing sectors enhances the region’s role as a global innovation hub for motion control systems.

Recent Developments & News

-

In January 2023, Schaeffler completed the acquisition of Ewellix AB, strengthening its position in the electromechanical motion domain.

-

Thomson Industries, under Altra Industrial Motion, introduced miniature lead screws in 2022, designed for compact actuator systems with high precision.

-

In September 2021, NSK Ltd. launched the world's first 100% bioplastic bearing cage capable of withstanding temperatures up to 120 °C, showcasing a shift towards sustainability in high-performance LMS components.

Key Players

-

Bosch Rexroth AG (Robert Bosch GmbH)

-

Ewellix AB

-

HepcoMotion

-

HIWIN Corporation

-

Lintech Corporation

-

Nippon Bearing Co. Ltd.

-

NSK Ltd.

-

Pacific Bearing Company

-

Rockwell Automation Inc.

-

Schneeberger Group

-

THK Co. Ltd.

-

Thomson Industries Inc. (Altra Industrial Motion)

If you require specific data beyond this report’s scope, our analysts are ready to provide customized insights.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5355&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0