India Mutual Funds Market Size, Analysis, Growth, Share, Trends, Outlook 2025-2033

Mutual Funds Market in India 2025:

How Big is the India Mutual Funds Industry?

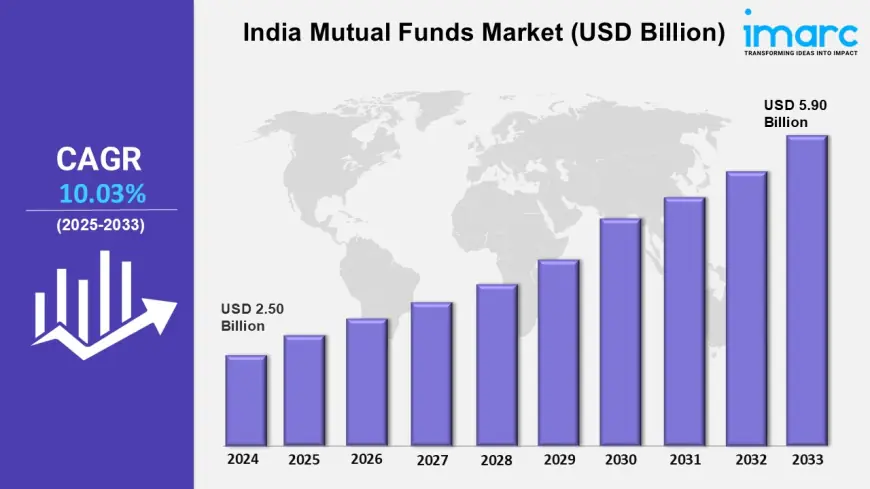

The India mutual funds market size reached USD 2.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.90 Billion by 2033, exhibiting a growth rate (CAGR) of 10.03% during 2025-2033.

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 2.50 Billion

Market Size in 2033: USD 5.90 Billion

Market Growth Rate (CAGR) 2025-2033: 10.03%

India Mutual Funds Market Trends and Drivers:

The Indian mutual fund market is witnessing tremendous growth due to increasing financial consciousness, digital penetration, and an increase in a middle-class citizenry willing to build wealth in the long term. Essentially, the mutual funds have turned out to be a popular investment option since they are easily accessible, professionally managed, and enable risk diversification through small sums of money. A rise in the disposable incomes and a shift in the investment pattern from the traditional assets like property and gold to the market-linked products is also fueling this transition. Other than this, the efforts of the Securities and Exchange Board of India (SEBI) and the mutual fund houses in product simplification and investor awareness through initiatives like "Mutual Funds Sahi Hai" have also improved retail participation significantly. Apart from that, Systematic Investment Plans (SIPs) are becoming very popular, especially among the youth, as they ensure disciplined investment and the power of compounding without requiring high amounts of initial capital. The fintech revolution and entrance of digital platforms have also facilitated easy opening of accounts, becoming KYC compliant, and having transaction processes done at ease, thereby making mutual funds all the more common in urban and rural India.

Apart from this, the performance of equity mutual funds, driven by sound macroeconomic fundamentals and corporate performance, is equally attracting first-timers as well as seasoned investors. Apart from this, increasing demand for tax saving products under plans like ELSS (Equity Linked Savings Scheme) is persuading more salary earners to turn to mutual funds as a twin benefit of investment coupled with tax savings. The shift towards passive investment has also been massive, with investors shifted heavily into index funds and ETFs due to the low expense ratio and high liquidity of the fund. At the same time, there has been increased demand for ESG-based and thematic mutual funds due to the shift to socially responsible and green-focused investors. Apart from this, regulation efforts that encourage transparency, enhanced disclosures, and reduced expense ratios are placing investors in confidence with the mutual fund industry. The availability of goal-based investment plans and robo-advisory services is enabling investors to take informed decisions regarding risk bearing and financial objectives. Finally, though inflationary concerns and rate volatilities continue, mutual funds are being regarded as a fairly stable but rewarding investment avenue. Overall, an amalgam of positive demography, shifting investor mindset, government support, and technology-facilitated access is propelling India's mutual fund industry to a dynamic phase of sustainable and inclusive growth.

Request for a sample copy of this report: https://www.imarcgroup.com/india-mutual-funds-market/requestsample

India Mutual Funds Market Report Segmentation:

The report has segmented the market into the following categories:

Asset Class/Scheme Type Insights:

- Debt-oriented Schemes

- Equity-oriented Schemes

- Money Market

- ETFs and FoFs

Source of Funds Insights:

- Banks

- Insurance Companies

- Retail Investors

- Indian Institutional Investors

- FIIs and FPIs

- Others

Regional Insights:

- North India

- South India

- East India

- West India

Top Players Analysis:

The report provides a detailed analysis of the competitive environment. It covers various aspects such as market structure, positioning of key players, top strategies for success, a competitive dashboard, and a company evaluation quadrant. Furhermore, the report includes comprehensive profiles of all major companies.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=31301&flag=C

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0