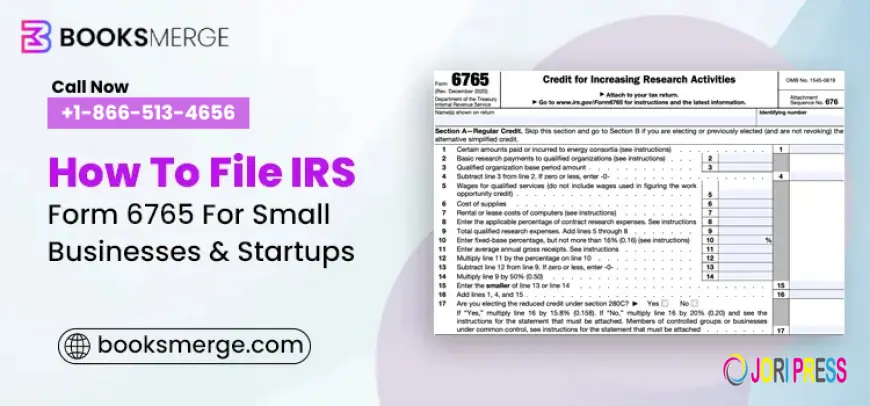

How to File IRS Form 6765 for Small Businesses and Startups in 2025

Discover how to file IRS Form 6765 for small businesses and startups in 2025, including what is IRS Form 6765, the credit for increasing research activities, and how to claim R&D tax credit using Form 6765. Learn who qualifies for R&D tax credit Form 6765 with research credit eligibility and documentation, what are qualified research expenses for Form 6765 (QRE) like wages and supplies, how to calculate alternative simplified credit on Form 6765 (ASC), and electing reduced credit under section 280C election. For startups, see who can claim payroll tax credit on Form 6765 (up to $500K for under $5M sales), what changes to Form 6765 in 2025 like Form 6765 Section G requirements for 2025 and business component reporting in Section G, how to elect reduced credit under section 280C on Form 6765, instructions for filling out IRS Form 6765, how to report qualified research expenses on Form 6765, and group reporting for controlled groups on Form 6765. Boost cash flow with this R&D tax credit for small businesses—avoid pitfalls in tax year 2025.

As a small business owner or startup founder, claiming tax credits can make a big difference in your cash flow. IRS Form 6765, known as the Credit for Increasing Research Activities, lets you get money back for innovation efforts like developing new products or improving processes. This R&D tax credit is especially helpful for startups with limited profits, as it can offset payroll taxes. In 2025, there are new rules making it easier for small businesses to deduct research costs right away, but also stricter reporting to avoid audits.

This guide explains how to file Form 6765 in simple steps. We'll cover what it is, who qualifies, and the latest 2025 changes like mandatory details in Section G. If you're in tech, manufacturing, or any field experimenting with ideas, this could save you thousands. At BooksMerge, we help with bookkeeping and tax prep to make this easy—let's dive in.

What is IRS Form 6765?

Form 6765 is a tax form used to calculate and claim credits for research that boosts your business. It's not just for big companies; small businesses and startups can use it too.

-

Main Purpose: It figures out your R&D tax credit based on expenses like employee wages for testing ideas or buying supplies for experiments.

-

Key Benefits: You can get up to 20% back on extra research costs, or choose a simpler 14% method. For startups, it can cut payroll taxes by up to $500,000 if your sales are under $5 million.

-

New in 2025: The IRS now lets small businesses (sales under $31 million) deduct all U.S.-based research costs immediately, instead of spreading them over years. This is from recent laws like the One Big Beautiful Bill Act, helping cash-strapped founders.

This form attaches to your main tax return, like Form 1040 for sole owners or Form 1120 for corporations.

Who Qualifies for Form 6765?

Not every business can claim this credit—it must meet specific tests. Startups often qualify because they're always trying new things.

-

Eligibility Tests: Your work must be tech-based, fix a problem you don't know how to solve, involve trials like prototypes, and aim to improve a product or process.

-

For Small Businesses: If your average sales are $5 million or less and you've been around less than 5 years, you can apply credits against payroll taxes (FICA) instead of income taxes.

-

Examples for Startups: A software startup testing new code or a food business experimenting with recipes could qualify. Even if you have no profits, the payroll offset gives real savings.

-

2025 Update: More startups can now claim retroactive relief for 2022-2024 research costs, speeding up deductions over 1-2 years.

If your business spends on qualified research expenses (QRE), like salaries for innovators or contract work, you're likely eligible.

Step-by-Step: How to File Form 6765

Filing is straightforward if you gather docs first. Use IRS software or a tax pro for accuracy. Here's a simple breakdown:

-

Step 1: Gather Your Documents

-

Collect records of QRE: Wages for research staff, supply costs, and contract bills.

-

Track time: Note hours spent on experiments vs. regular work.

-

New in 2025: Prepare details for Section G, like project descriptions and officer wages involved.

-

Step 2: Choose Your Credit Method

-

Regular Credit (Section A): For businesses with history—20% of costs over a base amount from past years.

-

Alternative Simplified Credit (ASC, Section B): Easier for startups—14% of costs above 50% of your 3-year average.

-

Tip: Pick ASC if you're new; it's less math.

-

Step 3: Fill Out the Form Sections

-

Section C: Elect reduced credit under Section 280C to skip extra taxes.

-

Section D: For small businesses, choose payroll tax offset—up to $500,000 against employer FICA.

-

Section G (New Mandatory in 2025): List business components—describe each project, costs, and people involved. This helps IRS verify without audits.

-

Summaries (E/F): Total your credits here.

-

Step 4: Attach and File

-

Add Form 6765 to your main return (e.g., Schedule C for sole props).

-

File by your deadline: April 15 for individuals, March 15 for corporations (extensions possible).

-

E-file for speed; paper mail if needed.

-

Step 5: Track and Amend if Needed

-

Keep records for 3 years in case of IRS questions.

-

2025 Tip: If you missed past years, amend returns for retroactive R&E deductions.

Common mistake: Skipping documentation—always note why costs qualify as research.

2025 Updates and New Info on Form 6765

This year brings good changes for small businesses. The IRS updated instructions in June 2025, making Form 6765 more user-friendly but adding checks.

-

Immediate Deductions: Small firms can now expense all domestic research costs upfront, thanks to new laws—great for startups investing in ideas.

-

Section G Details: Mandatory for most filers—report project specifics to prove claims. This cuts audit risks but needs better bookkeeping.

-

Expanded Payroll Credit: More startups qualify for the $500,000 FICA offset, even if no income tax owed.

-

Retro Relief: Claim faster write-offs for 2022-2024 expenses, helping recover funds quickly.

-

Coming Soon: Watch for IRS webinars in November 2025 on these updates—sign up on IRS.gov for free tips.

These changes aim to support innovation amid economic pressures, but require accurate tracking. At BooksMerge, our services ensure your books capture every qualifying expense.

Filing Form 6765 isn't scary with preparation. It rewards your hard work and frees up cash for growth. If overwhelmed, consult a pro—BooksMerge offers affordable help with tax filing, payroll, and QuickBooks setup. Ready to claim? Contact us today.

FAQs on IRS Form 6765

1.How to claim R&D tax credit using Form 6765 for startups with no profits in 2025?

Startups can elect the payroll tax offset in Section D, applying up to $500,000 against FICA if sales are under $5 million. Gather QRE docs and file with your return.

2.What are qualified research expenses on Form 6765 for small businesses?

QRE include wages for research staff, supplies for tests, and contract costs. They must meet the four tests; track them monthly to simplify filing.

3.How to fill out Form 6765 Section G requirements for 2025 updates?

List each project with descriptions, costs, and involved people. This new mandatory section ensures claims are valid—use spreadsheets for easy reporting.

4.Who qualifies for alternative simplified credit on Form 6765 in tax year 2025?

Any business without strong historical data qualifies for ASC (14% rate). It's simpler for startups; elect it in Section B if regular method is too complex.

What changes to Form 6765 in 2025 affect small businesses claiming payroll tax credits? Immediate R&E deductions and retro relief for past years, plus stricter Section G. These make credits easier to get but require better documentation.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0