Freight Forwarding Market Forecast: CAGR and Revenue Insights 2032

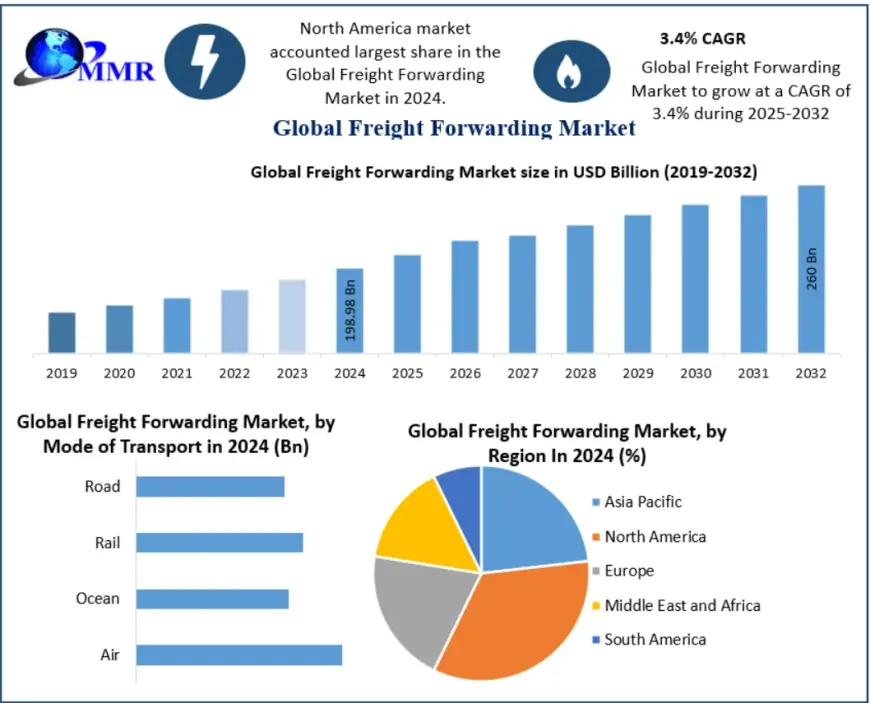

The Freight Forwarding Market size was valued at USD 198.98 Billion in 2024 and the total Freight Forwarding revenue is expected to grow at a CAGR of 3.4% from 2025 to 2032, reaching nearly USD 260 Billion.

Global Freight Forwarding Market to Reach USD 260 Billion by 2032, Driven by Trade Agreements, E-Commerce, and AI Adoption

The Global Freight Forwarding Market, valued at USD 198.98 billion in 2024, is projected to reach nearly USD 260 billion by 2032, expanding at a CAGR of 3.4% during 2025–2032. As globalization, e-commerce, and advanced logistics technologies reshape trade flows, freight forwarding is evolving from a traditional transport service into a digitally enabled, highly strategic pillar of global supply chains.

Market Overview

Freight forwarding is the process of organizing and managing the efficient transport of goods across international and domestic borders via air, ocean, rail, or road. Freight forwarders act on behalf of shippers to ensure smooth delivery through freight consolidation, customs clearance, container tracking, rate negotiation, and documentation services.

With global supply chains becoming increasingly complex, freight forwarders are no longer just intermediaries but strategic partners, ensuring cost-effective, timely, and secure movement of goods across continents.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/148362/

Market Dynamics

Key Growth Drivers

-

Rising Trade Agreements Between Nations

Trade liberalization and new agreements, such as the Regional Comprehensive Economic Partnership (RCEP), are boosting international trade. Covering 15 East Asian and Pacific nations, RCEP eliminates up to 90% of tariffs and is expected to raise intra-regional exports by USD 42 billion, driving demand for freight forwarding services. -

Artificial Intelligence in Logistics

AI-enabled freight forwarding platforms are transforming logistics by offering automation, predictive analytics, and real-time optimization. For instance, Kuehne + Nagel’s eTrucknow.com leverages AI to optimize overland shipments in Asia-Pacific, helping shippers find the most cost-effective routes in minutes. -

Growth in International Air & Ocean Freight

-

Ocean Freight: Expected to grow at 4.5% CAGR, supported by new port infrastructure and rising e-commerce demand.

-

Air Freight: Witnessed 14.9% YoY growth in 2022, projected to grow at 5.4% CAGR, with pharmaceuticals and cross-border e-commerce leading demand.

-

-

Booming E-Commerce Sector

E-commerce now represents 15% of global air freight volume and accounts for 18% of air cargo revenues, expected to rise to 22% by 2025. Online retail sales reached USD 4.28 trillion in 2021, with China alone contributing over half the global share, further fueling freight forwarding needs.

Challenges

-

Nearshoring and Reshoring Trends: As countries bring manufacturing closer to home, long-haul freight forwarding demand may decline. However, international freight demand continues to outpace regionalized production, cushioning the market from major disruptions.

Market Segmentation

By Mode of Transport

-

Ocean Freight – Largest segment with 43% share in 2024; expected to grow steadily due to cost advantages and expansion of e-commerce shipments.

-

Air Freight – Key for high-value, time-sensitive goods such as pharmaceuticals and electronics.

-

Rail Freight – Expanding in Europe and Asia through investments in cross-border rail networks.

-

Road Freight – Crucial for last-mile and intra-regional trade, enhanced by AI-driven fleet optimization.

By Application

-

Industrial & Manufacturing – Core segment, dominated by machinery and automotive exports.

-

Healthcare & Pharmaceuticals – Growing rapidly post-COVID, driven by high-value medical supply chains.

-

Automobiles – Germany and Japan are leading exporters; cars represent one of the top-traded goods globally.

-

Electronics & Consumer Goods – Expanding alongside e-commerce.

-

Others – Food & beverages, oil & gas, defense logistics.

By Customer Type

-

B2B (Business-to-Business) – Dominant segment with manufacturing and industrial exports.

-

B2C (Business-to-Consumer) – Fastest-growing, fueled by e-commerce penetration.

By Services

-

Transportation & Warehousing

-

Packaging & Documentation

-

Insurance Services

-

Value-Added Services (VMI, just-in-time delivery, supply chain consulting)

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/148362/

Regional Insights

North America (32% Market Share in 2024)

North America leads the market, with the U.S. as the hub of global trade flows. With 30 major trading partners accounting for nearly 90% of its imports and exports, the U.S. maintains strong demand for freight forwarding services. The region also benefits from advanced digital logistics platforms and high-value industries such as aerospace, healthcare, and e-commerce.

Asia-Pacific – Fastest Growing Market

Asia-Pacific is the fastest-expanding region due to the rapid growth of China, India, Japan, and ASEAN nations. Rising e-commerce, strong government support for logistics, and cost-efficient manufacturing strengthen the region’s dominance. Strategic acquisitions, such as Kuehne + Nagel’s USD 1.5 billion purchase of Apex International (China), highlight APAC’s importance as a freight forwarding hotspot.

Europe

Europe is driven by cross-border trade, advanced rail freight infrastructure, and major export economies such as Germany and France. Automotive and industrial exports dominate, with Germany leading global car exports worth USD 122.3 billion in 2021.

Middle East & Africa / South America

Both regions are emerging markets with growing import-export activities, driven by energy exports, rising e-commerce adoption, and trade expansion with Asia and Europe.

Competitive Landscape

The freight forwarding market is highly competitive and fragmented, with global giants, regional specialists, and technology-driven disruptors.

Key Players

-

DHL Global Forwarding

-

Kuehne + Nagel International AG

-

DB Schenker

-

DSV Panalpina A/S

-

Expeditors International

-

Agility Logistics

-

Bolloré Logistics

-

Nippon Express

-

UPS Supply Chain Solutions

-

Hellmann Worldwide Logistics

These players compete on global networks, pricing efficiency, digital platforms, and industry specialization. Many are investing heavily in AI, blockchain, and IoT-enabled freight visibility platforms to gain a competitive edge.

Key Market Trends

-

Digital Transformation of Freight Forwarding: Blockchain, AI, and IoT-enabled platforms are enabling real-time tracking and paperless documentation.

-

Sustainability in Logistics: Increasing adoption of low-emission vehicles, optimized shipping routes, and carbon-neutral freight solutions.

-

E-Commerce Driven Freight Expansion: Cross-border e-commerce is reshaping freight volumes, especially for air freight.

-

Strategic M&A Activity: Major logistics providers are acquiring regional freight forwarders to expand networks in Asia and emerging markets.

Conclusion

The Global Freight Forwarding Market is evolving into a digitally driven, customer-centric industry, bridging the gap between traditional shipping and smart logistics solutions. While challenges like nearshoring may limit growth in some sectors, the rise of e-commerce, AI-driven platforms, and global trade agreements ensures steady market expansion.

By 2032, the freight forwarding industry will be worth USD 260 billion, with Asia-Pacific emerging as the fastest-growing region and North America maintaining its dominance in high-value trade flows. Companies that embrace technology, sustainability, and customer-focused value-added services are positioned to lead in this competitive market.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0