Contract Lifecycle Management Software Market Report 2025-2033: Trends, Growth, and Forecast Analysis

Contract Lifecycle Management Software Market Overview

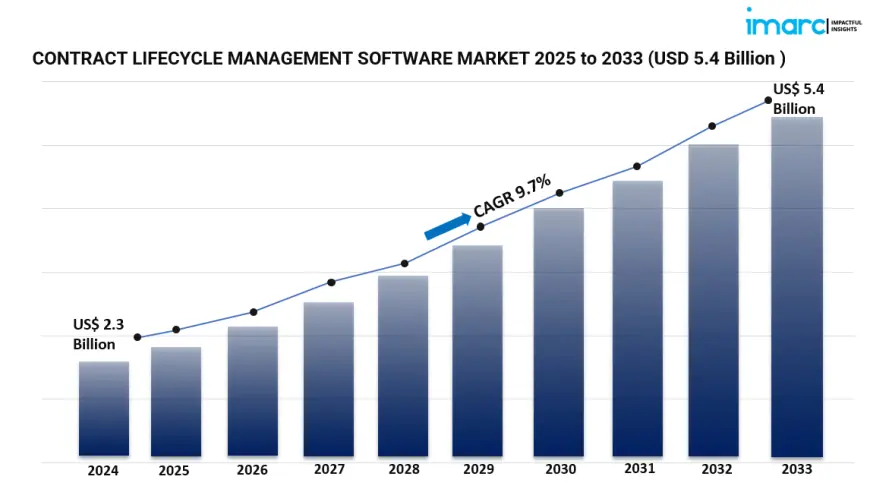

The global contract lifecycle management (CLM) software market is on a strong growth trajectory, reaching a value of USD 2.3 billion in 2024. With increased adoption across industries, the market is projected to escalate to USD 5.4 billion by 2033, registering a CAGR of 9.7% during the forecast period of 2025-2033. This growth is primarily driven by the rising complexity of contractual processes, the need for regulatory compliance, and the rapid integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) to automate and optimize contract workflows.

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Contract Lifecycle Management Software Market Key Takeaways

-

Current and Forecasted Market Size: The market stood at USD 2.3 billion in 2024 and is forecasted to reach USD 5.4 billion by 2033, growing at a CAGR of 9.7% from 2025 to 2033.

-

Deployment Preference: Cloud-based CLM platforms are leading the market due to their agility, scalability, and cost benefits.

-

Solution Type: Licensing and subscription offerings are the most widely adopted, highlighting the shift toward recurring revenue and lower initial costs.

-

Enterprise Usage: Large enterprises represent the dominant user group owing to their complex and high-volume contract management needs.

-

Industry Leaders in Adoption: The manufacturing sector leads in CLM adoption, with significant uptake across automotive, electronics, pharmaceuticals, retail & e-commerce, and BFSI sectors.

-

Regional Leadership: North America remains the largest market, supported by an advanced IT infrastructure and robust regulatory landscape.

To request a sample report, visit: https://www.imarcgroup.com/contract-lifecycle-management-software-market/requestsample

Market Growth Drivers

Advancements in Technology

The development of ML and artificial intelligence is changing the way businesses handle agreements. These tools help to simplify contract lifecycle processes, enable real-time analysis of huge contract data, support predictive insights, and improve decision-making. Intelligent automation helps legal and operational compliance to increase while minimizing human mistakes and operational delays.

Compliance and Risk Mitigation

Businesses are giving systems that enable them to remain compliant top priority amid tightening legal demands. By offering centralized contract databases, guaranteeing compliance monitoring, and lowering the possibility of fines for non-compliance, CLM software helps to manage risk. Efficient governance and risk management are aided by features like audit trails, version control, and renewal notifications.

Efficiency in Operations

Companies are increasingly using CLM systems to remove inefficiencies in approval and contract fulfillment. Automated processes improve openness, shorten turnaround time, and match contracting policies with strategic objectives. Integration with corporate systems and centralized dashboards helps to even more boost output.

Market Segmentation

By Deployment Model:

-

Cloud-Based: Favored for its scalability, remote accessibility, and reduced overhead, cloud-based CLM is ideal for businesses seeking digital transformation.

-

On-Premises: Chosen by firms with heightened data privacy and compliance needs, offering greater control over IT infrastructure.

By CLM Offerings:

-

Licensing and Subscription: Popular for their affordability and scalability, allowing organizations to manage costs through recurring billing.

-

Services: Includes essential implementation, consultation, training, and support for effective deployment and usage.

By Enterprise Size:

-

Large Enterprises: Require comprehensive solutions to manage thousands of contracts across global divisions.

-

Small and Medium Enterprises: Focused on adopting efficient and budget-conscious platforms to streamline contract processes.

By Industry:

-

Automotive: Manages extensive supplier networks and global procurement contracts.

-

Electrical and Electronics: Supports contractual obligations in sourcing and production workflows.

-

Pharmaceutical: Maintains compliance with industry regulations and manages R&D and clinical trial agreements.

-

Retail and E-Commerce: Handles dynamic supplier relationships, pricing arrangements, and customer contracts.

-

Manufacturing: Oversees procurement contracts, quality standards, and vendor agreements.

-

BFSI: Manages a broad spectrum of contracts related to compliance, customer engagement, and service providers.

-

Others: Covers public sector entities, educational institutions, and healthcare providers.

Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Regional Insights

North America leads the global market due to a combination of early technology adoption, regulatory stringency, and high enterprise digital maturity. The U.S. and Canada in particular are prioritizing automation in legal operations, thereby accelerating CLM software adoption. Cloud infrastructure, robust funding environments, and the presence of leading vendors further fuel regional dominance.

Recent Developments & News

The CLM landscape is rapidly shifting, with vendors enhancing AI-powered features that improve contract analysis, negotiation, and lifecycle automation. Subscription-based pricing is gaining traction, catering to demand for scalable and cost-flexible solutions. Cloud-native architecture is now the standard, enabling streamlined deployment and accessibility across user locations.

Key Players

-

Wolters Kluwer N.V.

-

IBM Corporation

-

Icertis, Inc.

-

SAP SE

-

BravoSolution SPA

-

Contracked BV

-

Contract Logix, LLC

-

Coupa Software Inc

-

EASY SOFTWARE AG

-

ESM Solutions Corporation

-

Great Minds Software, Inc.

-

Koch Industries, Inc.

-

Ivalua Inc

-

Optimus BT

-

Oracle Corporation

-

Symfact AG

-

DocuSign, Inc

-

Newgen Software Technologies Limited

-

Zycus Infotech Private Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1177&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0