France Logistics Market Size, Share, Top Companies, Forecast 2025-2033

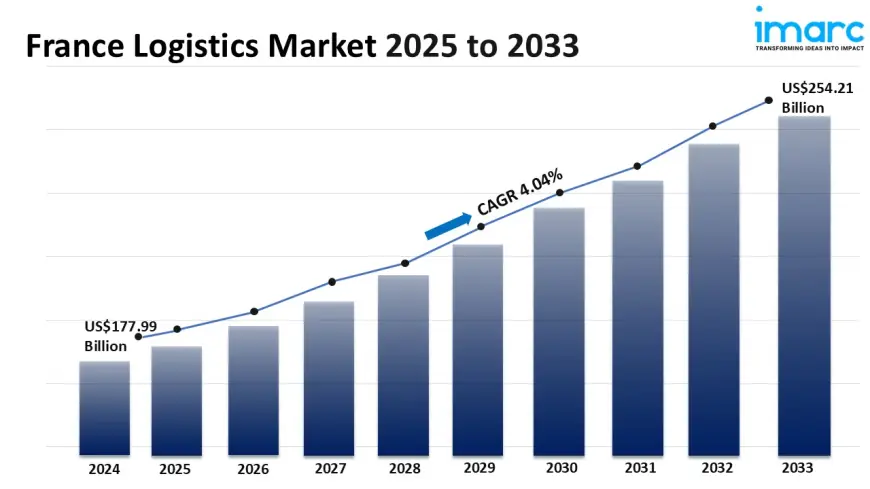

The France logistics market size reached USD 177.99 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 254.21 Billion by 2033, exhibiting a growth rate (CAGR) of 4.04% during 2025-2033.

France Logistics Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 177.99 Billion

Market Forecast in 2033: USD 254.21 Billion

Market Growth Rate (2025-33): 4.04%

The France logistics market size reached USD 177.99 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 254.21 Billion by 2033, exhibiting a growth rate (CAGR) of 4.04% during 2025-2033. There is a rise in the emphasis placed on sustainability in French freight operations as companies are being pushed to minimize their impact on the environment. Moreover, the expansion of e-commerce sites is propelling the market growth in France. Additionally, the advancements in enhancing supply chain efficiency are expanding the France logistics market share.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/france-logistics-market/requestsample

France Logistics Market Trends and Drivers:

The French logistics industry is experiencing a significant transformation, where being environmentally responsible has shifted from being just a side project to a core part of business strategy. This change is largely driven by a tough regulatory environment, including the increasingly strict Loi Mobilités (Mobility Law) and the expectation of broader carbon border adjustments. Companies are now under pressure to carefully track and reduce their Scope 3 emissions. As a result, we’re seeing a remarkable surge in the adoption of green technologies and practices. Top logistics providers are rolling out fleets of electric and bio-CNG (Compressed Natural Gas) vehicles, not just for last-mile deliveries in urban areas but also for substantial parts of middle-mile operations, all backed by an expanding network of high-capacity charging stations. Additionally, the way warehouses are designed and operated is being completely rethought; new facilities are being built to meet high environmental standards (like BREEAM or HQE), featuring solar panel canopies, rainwater harvesting systems, and advanced energy management systems that significantly cut down on energy use. The benefits are clear: beyond just meeting regulations and boosting brand image, these initiatives help companies avoid the ups and downs of fossil fuel prices and future carbon taxes, turning sustainability into real, long-term savings and a strong competitive edge. This shift positions green logistics not as a burden, but as the new backbone of resilient and profitable supply chain operations in France.

The rapid rise of e-commerce has completely changed what consumers expect in terms of delivery speed and flexibility, and now it’s driving a more intricate and detailed overhaul of our national logistics systems. The old model, which relied on huge distribution centers located on the outskirts of cities, is quickly being replaced by a more layered, hyper-local setup that’s all about agility. To keep up with the demand for same-day and even two-hour deliveries in bustling cities like Paris, Lyon, and Marseille, companies are creating a tight network of urban fulfillment centers (UFCs) and micro-fulfillment centers (MFCs) right in the heart of these cities. This shift not only shortens the distance and time for last-mile deliveries but also depends heavily on cutting-edge predictive analytics and artificial intelligence to smartly manage inventory placement. As a result, vacancy rates for warehouses in city centers and suburban areas have dropped to record lows, leading to a surge in investments aimed at upgrading and vertically expanding existing properties. The logistics landscape is transforming from just moving bulk goods to smart inventory management, where the key to success lies in having the right product just a few kilometers away from the customer before they even hit the order button, all while efficiently handling the complexities of returns.

Facing a constant shortage of skilled warehouse workers and rising labor costs, the French logistics sector is turning to automation—not just for efficiency, but as a crucial strategy for keeping businesses running smoothly. The emphasis has clearly shifted away from large, fixed conveyor systems that demand hefty investments and rigid layouts, moving instead towards more flexible, scalable robotic solutions that can seamlessly fit into existing operations with little disruption. We're seeing a surge in the use of autonomous mobile robots (AMRs) for picking orders, which can boost pick rates by over 100% while easing the physical demands on workers. Likewise, robotic sortation systems and automated guided vehicles (AGVs) for moving pallets are becoming the norm in new facilities. This wave of technology isn't about replacing humans; it's about fostering collaboration between humans and robots. Automated systems take on the repetitive, physically taxing tasks, allowing human workers to step into more skilled roles in managing robots, overseeing systems, and handling exceptions. This shift not only strengthens operational resilience by lessening reliance on a fluctuating labor force but also ensures more consistent and accurate order fulfillment. Plus, it provides the data transparency necessary for predictive analytics, helping to optimize the entire supply chain and ultimately safeguard operations against demographic changes and increasing market competition.

France Logistics Market Industry Segmentation:

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=37692&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0