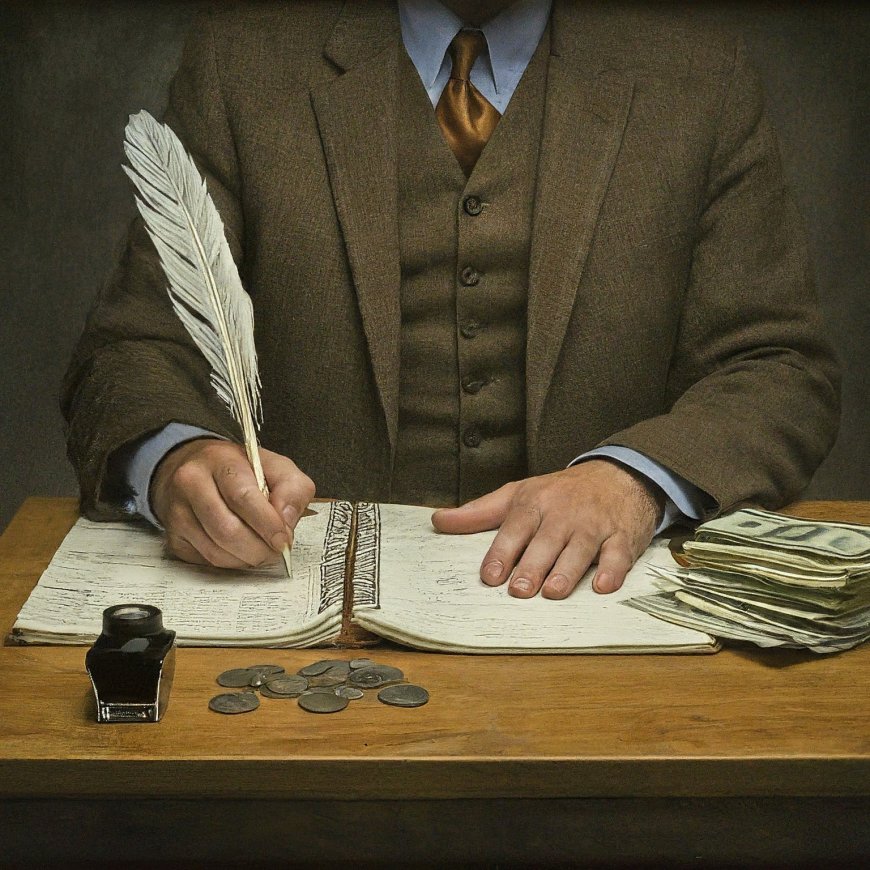

Your Business: The Importance of Bookkeeping Services

In the hustle and bustle of running a business, it's easy to get overwhelmed by the myriad of tasks that demand your attention. One critical aspect that often gets pushed to the backburner is bookkeeping. Yet, meticulous bookkeeping is the backbone of a financially healthy business. In this blog post, we'll explore the importance of bookkeeping services, what they entail, and how they can benefit your business.

What is Bookkeeping?

At its core, bookkeeping involves recording all the financial transactions of a business. This includes sales, purchases, income, and payments. The goal is to keep an accurate record of all financial activities to ensure the business runs smoothly and efficiently.

Key Components of Bookkeeping

- Recording Transactions: Every sale, purchase, and financial transaction must be recorded accurately and promptly.

- Managing Accounts Receivable and Payable: This involves tracking money that is owed to the business (accounts receivable) and money the business owes to others (accounts payable).

- Reconciliation: Regularly comparing internal records against bank statements to ensure consistency and accuracy.

- Financial Reporting: Generating financial statements such as income statements, balance sheets, and cash flow statements.

- Tax Preparation: Ensuring all financial records are in order for accurate and timely tax filing.

Why Bookkeeping is Crucial for Your Business

Financial Health Monitoring

Accurate bookkeeping provides a clear picture of your business’s financial health. By maintaining detailed records, you can easily track profits, expenses, and cash flow. This insight is essential for making informed business decisions, planning for the future, and identifying potential financial issues before they become problematic.

Compliance with Legal Obligations

Every business must comply with various financial and tax regulations. Proper bookkeeping ensures that your financial records are accurate and up-to-date, making it easier to comply with these regulations and avoid costly fines and penalties.

Enhanced Financial Management

With a detailed and accurate financial record, you can create realistic budgets and forecasts. This helps in setting financial goals and tracking progress towards achieving them. It also enables you to manage your resources more effectively, reducing unnecessary expenses and improving overall profitability.

Simplified Tax Preparation

Come tax season, having well-maintained financial records can significantly simplify the tax filing process. Accurate bookkeeping ensures that you have all the necessary information readily available, reducing the risk of errors and ensuring that you take advantage of all possible deductions.

Better Cash Flow Management

By keeping track of all transactions, bookkeeping helps you manage your cash flow more effectively. You can identify trends in your income and expenses, allowing you to plan ahead and ensure you have enough cash on hand to cover your obligations.

Types of Bookkeeping Services

Bookkeeping services can be provided in various forms, depending on the size and needs of your business. Here are some common types of bookkeeping services:

In-House Bookkeeping

For larger businesses, having an in-house bookkeeper can be beneficial. This individual is a full-time employee who handles all bookkeeping tasks, providing dedicated attention to your financial records.

Outsourced Bookkeeping

Small to medium-sized businesses often find outsourcing their bookkeeping needs to be more cost-effective. Outsourcing allows you to access professional bookkeeping services without the overhead costs associated with hiring a full-time employee.

Online Bookkeeping Services

With the rise of digital technology, many businesses are turning to online bookkeeping services. These services offer cloud-based solutions, allowing you to access your financial records from anywhere, at any time. They often come with additional features such as automated invoicing and expense tracking.

How to Choose the Right Bookkeeping Service

Selecting the right bookkeeping service is crucial for the success of your business. Here are some factors to consider when making your choice:

Experience and Expertise

Ensure the service provider has experience in your industry and is well-versed in the specific financial regulations and requirements that apply to your business.

Technology and Tools

Look for a service that utilizes the latest technology and bookkeeping software. This can enhance accuracy, efficiency, and accessibility of your financial records.

Customization

Every business is unique, so it’s important to choose a bookkeeping service that can tailor their offerings to meet your specific needs. Whether you need basic bookkeeping or more comprehensive financial management, the service should be able to accommodate your requirements.

Cost

Consider your budget when selecting a bookkeeping service. While it’s important to find a service that fits within your financial constraints, remember that investing in quality bookkeeping can save you money in the long run by preventing costly mistakes and improving overall financial management.

Reputation

Check reviews and testimonials from other businesses that have used the service. A reputable bookkeeping service should have positive feedback and a proven track record of reliability and accuracy.

Benefits of Professional Bookkeeping Services

Time Savings

Managing your own bookkeeping can be time-consuming, especially if you’re not familiar with the process. By outsourcing this task to a professional, you can free up valuable time to focus on other aspects of your business.

Reduced Errors

Professional bookkeepers have the knowledge and expertise to ensure that your financial records are accurate and error-free. This reduces the risk of mistakes that could lead to financial discrepancies and legal issues.

Financial Insights

A professional bookkeeping service can provide valuable insights into your financial performance. By analyzing your financial data, they can offer recommendations for improving profitability and managing expenses more effectively.

Scalability

As your business grows, your bookkeeping needs will evolve. A professional bookkeeping service can scale their offerings to match your changing requirements, ensuring you always have the support you need.

Conclusion

Bookkeeping is a vital component of any successful business. It provides the foundation for sound financial management, ensuring that your business remains compliant, profitable, and poised for growth. Whether you choose to manage your bookkeeping in-house, outsource to a professional service, or utilize online tools, the benefits of accurate and efficient bookkeeping cannot be overstated.

Investing in professional bookkeeping services can save you time, reduce errors, and provide valuable financial insights that help drive your business forward. By choosing the right service provider, you can ensure that your financial records are in expert hands, allowing you to focus on what you do best – running and growing your business.

Artado

Artado