Why SMEs Choose Regent Business Strategies for Professional Accounting in London

Regent Business Strategies is your trusted accounting company in London, providing expert accounting services for businesses. Our team of professional accounting experts and qualified accountants near you ensures accurate reporting, compliance, and strategic financial guidance. Looking for a reliable accountant in London? Choose Regent Business Strategies for tailored solutions that drive growth.

In today’s fast-paced business world, staying ahead means trusting your financial management to proven experts. Regent Business Strategies, a London-based consultancy firm, offers tailored and professional accounting services—including tax advisory, payroll processing, and bookkeeping—that make financial compliance and efficiency effortless for businesses in Central London. their team combines expertise and hands-on support to handle your numbers, so you can focus on growth.

Why Choose Expert Accounting Services in Central London?

Deep Knowledge of UK Tax, Payroll & VAT Regulations

From intricate tax planning and filing to VAT registration and returns, Regent Business Strategies brings industry know-how to ensure your financial strategy is compliant and optimized. Their expertise helps businesses stay ahead of evolving UK legislation

Local Focus & Personal Service

Being centrally located, Regent Business Strategies understands the unique challenges and opportunities faced by Central London startups, SMEs, freelancers, and contractors. Their financial services are crafted for local businesses—delivering fast, reliable, and personalized support.

Consultancy Beyond Compliance

More than just bookkeepers or tax advisors, Regent Business Strategies also delivers business consultancy and financial planning. This dual focus on advisory and compliance ensures your financial decisions contribute to long-term growth and stability

Core Services to Simplify Your Business

1. Tax Planning & Advisory

Regent offers comprehensive tax services—from self-assessment and corporation tax returns to strategic tax planning. By anticipating tax obligations and leveraging reliefs and allowances, they help clients minimize liabilities and maximize cash flow.

2. Streamlined Payroll Processing

Accurate payroll is vital. Expect end-to-end payroll management, including Real Time Information (RTI) submissions and auto-enrolment compliance. Regent ensures employees are paid effortlessly while keeping your business aligned with HMRC's ever-evolving requirements.

3. Efficient Bookkeeping Services

Clean books are the foundation of sound accounting. Regent Business Strategies handles invoice tracking, expense logging, bank reconciliations, and VAT-ready bookkeeping—ensuring your accounts are always accurate, audit-ready, and well-organized.

4. VAT Services & Registration

Whether you’re VAT-registered or need to register, Regent provides tailored VAT guidance—registering where necessary, handling filings, and ensuring submissions are accurate and timely to avoid costly penalties

5. Full-Service Accounting Solutions

Looking for comprehensive accounting support? Regent’s full-service offering includes bookkeeping, payroll, tax, VAT, and broader financial planning—alongside tailored consultancy to enhance compliance and drive strategic growth.

How Regent Business Strategies Stands Out

Holistic Approach

Their services blend compliance with consultancy—offering more than routine accounting; they deliver strategic insight to help businesses thrive.

Trusted Local Expertise

Based centrally in London, they know local ventures inside out—offering accessible, responsive, and relevant support.

Tailored, Personal Service

Unlike one-size-fits-all providers, Regent customizes solutions to your unique business needs—regardless of your sector or structure.

Fresh & Dynamic

Founded in late 2024, Regent represents a new breed of agile, modern accounting consultancy driven by results and deeply attuned to SME challenges.

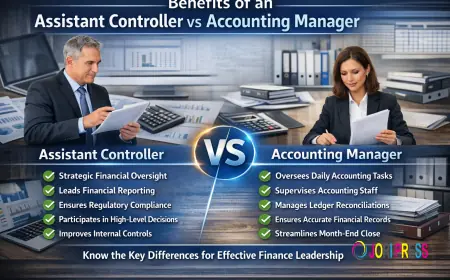

The Importance of Choosing the Right Accounting Company in London

When it comes to financial management, not all accounting firms are created equal. Choosing the right accounting company in London can make the difference between simply staying compliant and actively driving your business forward. In Central London, where competition is high and costs are significant, the support of an experienced accounting partner is invaluable.

A reliable firm does more than file taxes or process payroll. It becomes a strategic advisor, offering guidance on cash flow, growth strategies, and long-term financial planning. Regent Business Strategies stands out because their team takes time to understand your industry, your goals, and the unique challenges of operating in London. Whether you need help with VAT registration, corporate tax planning, or day-to-day bookkeeping, their solutions are tailored to your circumstances.

Another key factor is technology. Modern businesses need accountants who leverage cloud-based bookkeeping software, automated payroll systems, and digital tax filing platforms. This not only saves time but also gives business owners real-time access to financial data—helping them make faster, smarter decisions. Regent integrates these modern tools while providing personal service, ensuring clients benefit from both efficiency and human expertise.

Finally, transparency is critical. Hidden costs and unclear communication are common complaints among businesses that outsource accounting. Regent Business Strategies prides itself on clear pricing, open communication, and reliable support. Clients know exactly what to expect, which builds trust and long-term relationships.

By choosing the right accountants in Central London, business owners gain more than compliance—they gain a partner who actively contributes to their success.

Who Can Benefit?

-

Startups: Get professional guidance on structure, taxes, and cash flow from day one.

-

SMEs: Scale confidently with outsourced bookkeeping and payroll.

-

Freelancers and contractors: Simplify self-assessments and tax returns.

-

Established businesses: Optimize tax strategy, reduce risk, and ensure compliance.

Frequently Asked Questions (FAQs)

1. Do I really need an accountant if I’m a small business in London?

Yes. Even the smallest businesses must comply with HMRC rules. An accountant ensures compliance while helping you plan for growth.

2. Can Regent Business Strategies handle my payroll if I only have a few employees?

Absolutely. Their payroll solutions scale with your business, whether you employ two people or two hundred.

3. How does bookkeeping help my business?

Bookkeeping provides clarity on cash flow, profits, and expenses—giving you the data you need to make smarter decisions.

4. Is outsourcing accounting cost-effective?

Yes. Outsourcing often costs less than hiring in-house staff, while also reducing the risk of errors and penalties.

5. What industries does Regent work with?

They serve a wide range of sectors—from retail and hospitality to tech startups and professional services.

Final Thoughts

In a city where precision, speed, and expertise are non-negotiable, Regent Business Strategies offers an ideal blend of modern, tailored accounting solutions and proactive consultancy. Whether you're a startup navigating your first VAT return or a growing SME seeking seamless payroll integration and tax planning, their offerings make financial management both easy and effective.

Let Regent take care of your books, payroll, and tax strategies—so you can focus on scaling your business with confidence.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0