Vietnam Office Furniture Market Size, Share, Industry Trends, Growth and Report 2025-2033

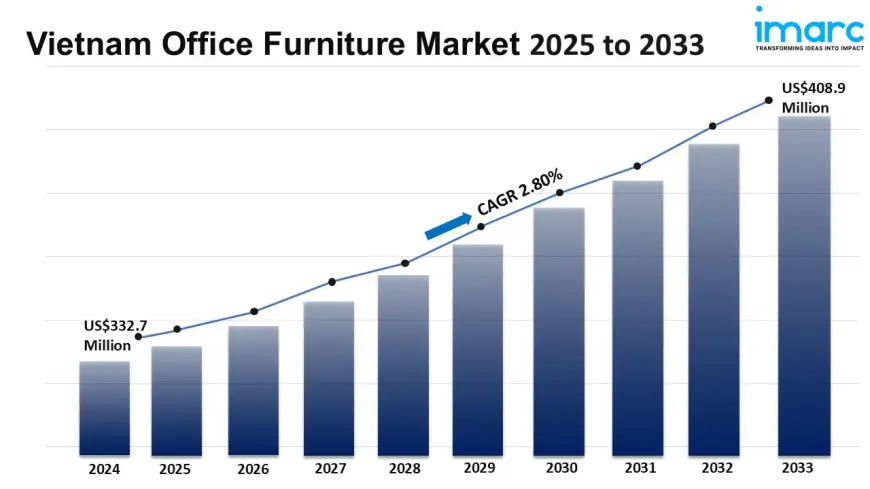

Vietnam office furniture market size reached USD 332.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 408.9 Million by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033.

Vietnam Office Furniture Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 332.7 Million

Market Forecast in 2033: USD 408.9 Million

Market Growth Rate (2025-33): 2.80%

Vietnam office furniture market size reached USD 332.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 408.9 Million by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. The presence of global brands and their influence on design trends, the increasing demand for mobile and adaptable office furniture, the rising prevalence of business exhibitions and events, the growing awareness of employee health and well-being in the workplace, the integration of hospitality-inspired design elements in office spaces, and the escalating desire for unique and branded office environments are some of the factors propelling the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-office-furniture-market/requestsample

Vietnam Office Furniture Market Trends and Drivers:

The Vietnamese office furniture market is currently undergoing a major transformation, driven by a permanent shift towards hybrid work models. This isn’t just a temporary fix; it’s a complete rethinking of how corporate spaces are designed. We’re moving away from cramped, cost-focused layouts and embracing flexible, human-centered environments that prioritize employee well-being. As a result, there’s been a noticeable increase in demand for modular furniture that can be easily rearranged for collaboration, focused tasks, or social interactions—all within the same space. Manufacturers are stepping up with creative solutions like sound-absorbing acoustic pods, mobile whiteboards, and lightweight, ergonomic seating that can effortlessly transition from a formal desk setup to a relaxed breakout area. The driving force behind this change is the understanding that offices need to provide an experience that makes the commute worthwhile—something that competes with the comfort of working from home. As a result, furniture that integrates technology, such as built-in power management for easy device charging and connectivity options for video calls, has shifted from being a luxury to a standard expectation. This trend is reshaping the value of office furniture, moving beyond just functionality to enhance productivity, collaboration, and employee retention, with adaptability becoming the key focus for corporate purchasing strategies.

Sustainability has really evolved from just a trendy marketing term to a fundamental part of how businesses in Vietnam operate and make purchasing decisions, especially in the office furniture sector. This shift is fueled by a mix of multinational companies pushing for ESG (Environmental, Social, and Governance) standards, a rising awareness of environmental issues among younger workers, and a strategic focus on building resilient supply chains. We're seeing a clear move away from cheap, imported furniture towards high-quality, long-lasting items made from certified sustainable materials like FSC-certified wood and recycled metals and plastics. Another important trend is the strategic nearshoring or onshoring of production. More and more companies are teaming up with skilled local Vietnamese manufacturers who can provide quicker turnaround times, lower carbon emissions from shipping, and more flexibility in customization, all while meeting international quality and sustainability benchmarks. This local sourcing approach not only helps reduce the risks and expenses tied to unpredictable global logistics but also supports the national "Make in Vietnam" initiative, creating a strong link between corporate responsibility and economic pride. The most innovative manufacturers are now embracing full circular economy practices, offering take-back programs and designing products that can be easily disassembled for material recovery at the end of their life.

The blend of furniture design with smart technology and advanced ergonomics is truly at the forefront of market innovation. It’s creating a fresh premium segment that emphasizes holistic employee wellness and data-driven space optimization. This goes way beyond just adjustable chairs and desks; it’s about a whole ecosystem of smart products that actively promote a healthier and more efficient workplace. We’re witnessing a swift rise in the use of IoT-enabled sit-stand desks that can be tailored to individual preferences and even remind employees to switch up their postures, directly connecting furniture use to health metrics. Plus, ambient intelligence is being woven into furniture with built-in sensors that keep an eye on environmental quality—adjusting lighting, tracking occupancy to optimize cleaning and energy use, and giving management crucial insights into how spaces are utilized. This information empowers facilities managers to make informed decisions about real estate needs, moving past mere anecdotal observations. This trend is driven by employers’ heightened focus on attracting top talent and cutting down healthcare costs linked to sedentary work habits. Investing in this smart, health-oriented furniture is increasingly seen not as a cost, but as a direct investment in human capital, productivity, and corporate innovation, helping progressive employers stand out in a competitive market.

Vietnam Office Furniture Market Industry Segmentation:

Product Type Insights:

- Seating

- Systems

- Tables

- Storage Units and File Cabinets

- Overhead Bins

- Others

Material Type Insights:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

Distribution Channel Insights:

- Direct Sales

- Specialist Store

- Non-Specialist Stores

- Online

- Others

Price Range Insights:

- Low

- Medium

- High

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=15333&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0