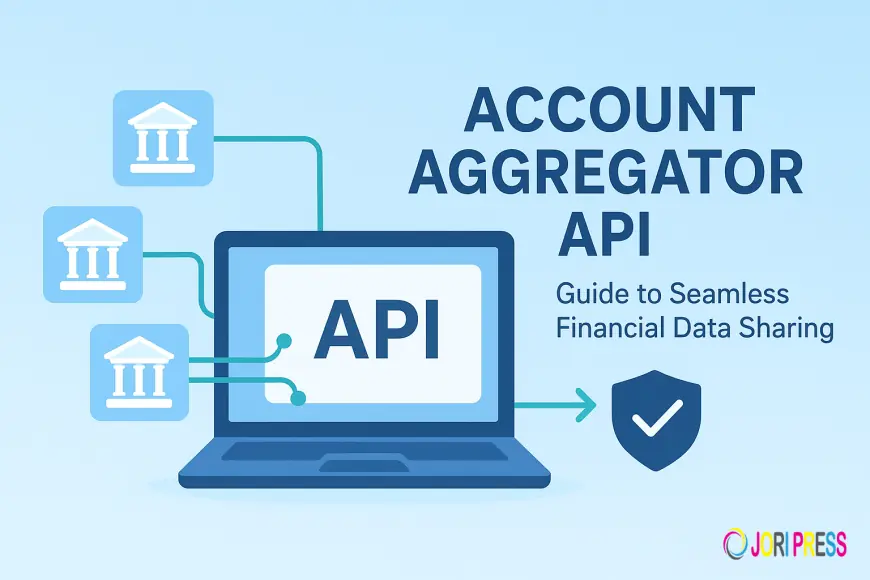

Industries That Benefit the Most from Account Aggregator APIs in India

Account Aggregator APIs in India

As India’s financial ecosystem becomes more data-driven, businesses are increasingly looking for secure and compliant ways to access customer financial information. The Account Aggregator (AA) framework has emerged as a powerful solution, enabling consent-based data sharing while protecting user privacy.

Account Aggregator APIs are not limited to one sector. They are transforming multiple industries by replacing manual document collection with secure, real-time data access. This blog explores which industries benefit the most from Account Aggregator APIs in India and how they use them to improve efficiency, compliance, and customer experience.

Banking and Financial Services

Banks are among the largest adopters of Account Aggregator APIs. Traditional banking processes rely heavily on paperwork, which slows down customer onboarding and credit assessment.

With Account Aggregator APIs, banks can:

-

Access verified financial data instantly

-

Reduce dependency on physical documents

-

Improve compliance and audit readiness

This helps banks deliver faster services while maintaining regulatory standards.

NBFCs and Digital Lenders

NBFCs and fintech lenders operate in highly competitive environments where speed is critical.

Account Aggregator APIs help them:

-

Approve loans faster

-

Reduce fraud risks

-

Improve underwriting accuracy

By using consent-based data, NBFCs can scale lending operations without increasing operational complexity.

Fintech and Payment Platforms

Fintech companies rely on seamless user experiences. Account Aggregator APIs enable them to fetch financial information without forcing users to upload documents.

This leads to:

-

Higher conversion rates

-

Faster onboarding

-

Improved trust

For fintech platforms, Account Aggregator APIs support both growth and compliance.

Insurance Companies

Insurance companies require detailed financial and personal data during policy issuance and claims processing.

Account Aggregator APIs help insurers:

-

Verify financial information efficiently

-

Reduce manual paperwork

-

Speed up policy approvals

This improves both operational efficiency and customer satisfaction.

Wealth Management and Investment Platforms

Investment platforms need accurate financial data to assess risk profiles and recommend suitable products.

Account Aggregator APIs allow them to:

-

Access consolidated financial information

-

Offer personalized investment advice

-

Improve decision-making

This results in better financial planning outcomes for users.

MSMEs and Business Lending Platforms

Small and medium businesses often struggle with documentation during loan applications.

Account Aggregator APIs simplify this by:

-

Providing quick access to business financial data

-

Reducing documentation burden

-

Enabling faster credit decisions

This supports MSME growth and financial inclusion.

HR, Payroll, and Employment Verification Services

Some HR and payroll platforms use Account Aggregator APIs to verify income and employment details with user consent.

This helps:

-

Speed up employee onboarding

-

Improve data accuracy

-

Reduce verification costs

Consent-based access ensures privacy is maintained.

Real Estate and Property Platforms

Real estate platforms require financial verification for rentals, leasing, and purchases.

Account Aggregator APIs assist by:

-

Validating income details

-

Reducing document collection

-

Accelerating approval processes

This makes property transactions smoother and more transparent.

E-Commerce and BNPL Platforms

Buy Now Pay Later services depend on quick financial assessment.

Account Aggregator APIs enable:

-

Instant credit evaluation

-

Reduced fraud risk

-

Faster checkout experiences

This directly impacts conversion rates and customer satisfaction.

Accounting and Financial Management Services

Accounting platforms benefit from Account Aggregator APIs by accessing financial data securely and efficiently.

This allows:

-

Automated data reconciliation

-

Accurate financial reporting

-

Reduced manual intervention

Businesses gain better financial visibility without compromising data security.

Why Account Aggregator APIs Are Industry-Agnostic

The strength of Account Aggregator APIs lies in their flexibility.

They offer:

-

Secure, standardized data access

-

User-controlled consent

-

Regulatory compliance

These features make them suitable across industries that rely on financial data.

Long-Term Impact on India’s Digital Economy

Account Aggregator APIs are building the foundation for:

-

Paperless financial workflows

-

Transparent data sharing

-

Increased trust in digital services

As adoption grows, more industries will integrate with the framework to stay competitive.

Conclusion

Account Aggregator APIs are not limited to banking or lending. They are transforming industries ranging from insurance and wealth management to real estate and e-commerce.

By enabling secure, consent-based access to financial data, Account Aggregator APIs help businesses reduce friction, improve compliance, and deliver faster services. As India’s digital economy continues to expand, industries that adopt Account Aggregator APIs early will be better positioned for long-term growth and innovation.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0