Vietnam Office Furniture Market Size, Share, Industry Trends, Growth and Report 2025-2033

Vietnam Office Furniture Market Overview

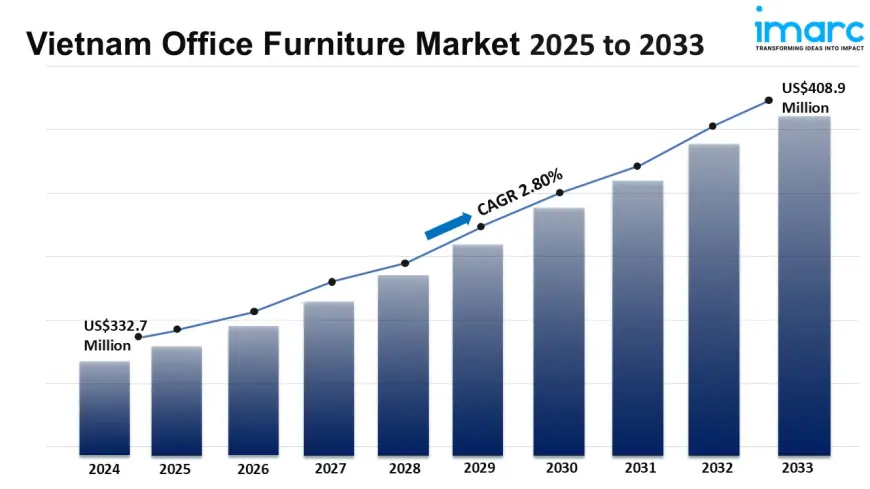

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 332.7 Million

Market Forecast in 2033: USD 408.9 Million

Market Growth Rate (2025-33): 2.80%

Vietnam office furniture market size reached USD 332.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 408.9 Million by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. The presence of global brands and their influence on design trends, the increasing demand for mobile and adaptable office furniture, the rising prevalence of business exhibitions and events, the growing awareness of employee health and well-being in the workplace, the integration of hospitality-inspired design elements in office spaces, and the escalating desire for unique and branded office environments are some of the factors propelling the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-office-furniture-market/requestsample

Vietnam Office Furniture Market Trends and Drivers:

The Vietnam office furniture market is rapidly evolving, driven by the convergence of hybrid work models, technological integration, and heightened well-being awareness. Businesses increasingly prioritize ergonomic solutions—adjustable sit-stand desks and lumbar-support chairs—to combat sedentary health issues, with demand surging 30% year-on-year. Sustainability has transitioned from niche to necessity: 65% of procurement managers now mandate eco-certified materials (e.g., FSC-certified wood or recycled polymers), reflecting Vietnam’s broader ESG commitments. Concurrently, modular furniture systems dominate, enabling agile reconfiguration for collaborative zones in co-working spaces and corporate hubs. Smart furniture embedding IoT sensors (e.g., occupancy trackers, climate-adjusting surfaces) is gaining traction, particularly in Ho Chi Minh City’s tech parks. Aesthetic preferences also shifted toward biophilic designs—live-edge wood finishes and integrated greenery—to enhance cognitive performance. With remote work stabilizing, companies invest in "hot-desking" ecosystems, fueling 25% growth in compact, multifunctional units. These trends signal a market aligning productivity with holistic employee wellness.

Vietnam’s office furniture market is expanding at a robust CAGR of 8.2%, propelled by economic urbanization, FDI inflows, and flex-space proliferation. Manufacturing dominates 40% of sector growth, as industrial parks in Binh Duong and Hai Phong require scalable workstations for burgeoning workforces. The co-working segment alone grew 18% annually, with operators like Toong and Dreamplex leasing 500+ new locations nationwide. Government initiatives like the National Digital Transformation Program accelerate demand for tech-integrated furniture, particularly in AI/data centers. Rising disposable incomes enable SMEs to upgrade from budget imports to mid-tier domestic brands (e.g., Hoang Anh Gia Lai’s premium lines), capturing 30% market share. Export momentum also surges—EU and U.S. orders for Vietnamese-made contract furniture rose 22% in 2024, leveraging US-China trade shifts. Urbanization further ignites demand; Hanoi and Da Nang’s new commercial hubs will add 1.2 million sqm of office space by late 2026, necessitating large-scale fit-outs. This growth is underpinned by Vietnam’s 6.5% GDP rise, positioning it as ASEAN’s fastest-growing office solutions market.

Anticipated demand will be defined by AI-driven customization, circular economy principles, and hybrid work infrastructure. Personalized furniture—AI-configurable desks adapting to user biomechanics—will capture 20% of the premium segment by late 2026. Circularity will dominate procurement: 70% of corporations plan to adopt furniture-as-a-service (FaaS) models by 2027, reducing waste via refurbishment leasing. Hybrid workspaces will require "plug-and-play" mobile units (e.g., soundproof phone pods, foldable partitions), driving 35% demand in tier-2 cities like Can Tho. Health-centric innovation will escalate; nanotechnology coatings for antibacterial surfaces and posture-correcting exoskeletons are in R&D phases. Additionally, Vietnam’s industrial 4.0 strategy will spur smart factory investments, demanding ergonomic, automation-compatible workstations. Export opportunities will multiply under EVFTA, targeting eco-conscious European buyers. Domestic demand will focus on affordable scalability—startups will seek convertible furniture for micro-offices, projecting 400K unit sales annually. This trajectory hinges on sustainable material sourcing and 5G-enabled IoT integration, reshaping Vietnam into a global innovation hub.

Vietnam Office Furniture Market Industry Segmentation:

Product Type Insights:

- Seating

- Systems

- Tables

- Storage Units and File Cabinets

- Overhead Bins

- Others

Material Type Insights:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

Distribution Channel Insights:

- Direct Sales

- Specialist Store

- Non-Specialist Stores

- Online

- Others

Price Range Insights:

- Low

- Medium

- High

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=15333&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0