Vietnam Gasoline Market Size, Share, Top Companies, Forecast 2025-2033

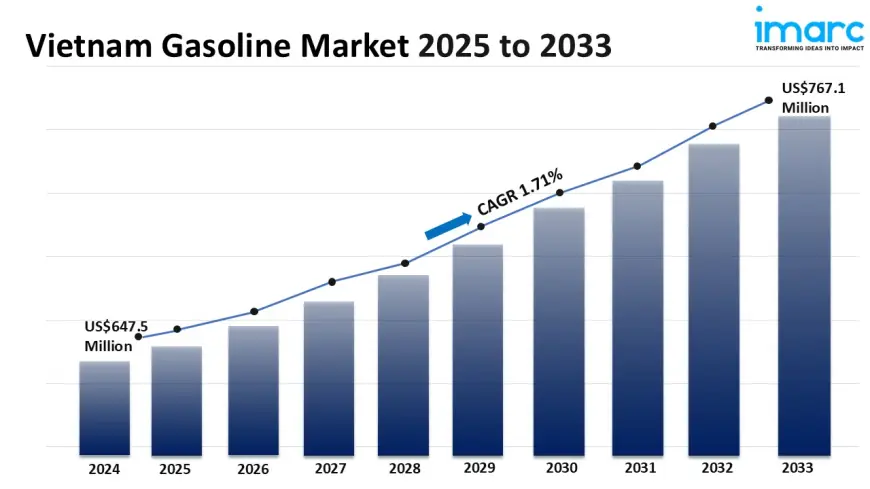

Vietnam gasoline market size reached USD 647.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 767.1 Million by 2033, exhibiting a growth rate (CAGR) of 1.71% during 2025-2033.

Vietnam Gasoline Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 647.5 Million

Market Forecast in 2033:USD 767.1 Million

Market Growth Rate (2025-33): 1.71%

Vietnam gasoline market size reached USD 647.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 767.1 Million by 2033, exhibiting a growth rate (CAGR) of 1.71% during 2025-2033. The increasing advancements in technology that can impact gasoline consumption through improvements in fuel efficiency, the development of alternative fuels, and the adoption of electric or hybrid vehicles, are driving the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-gasoline-market/requestsample

Vietnam Gasoline Market Trends and Drivers:

Vietnam's gasoline market faces a complex dynamic driven by robust demand growth colliding with evolving, yet still constrained, domestic supply capabilities and logistical infrastructure. Consumption continues its upward trajectory, fueled by rapid urbanization, a burgeoning middle class with increasing vehicle ownership – particularly motorcycles and passenger cars – and sustained industrial activity. While domestic refining capacity has significantly increased with the operational stability of Nghi Son Refinery and Petrochemical (NSRP) alongside Dung Quat's consistent output, Vietnam still relies on substantial imports to meet demand, estimated to cover roughly 30-35% of total gasoline needs. Key challenges persist in the midstream and downstream segments. Pipeline networks, while expanding, remain insufficient, leading to continued heavy reliance on coastal shipping and road tankers for distribution. This creates bottlenecks, inefficiencies, and vulnerability to weather disruptions. Storage capacity, particularly strategic reserves, lags behind regional peers and projected demand growth, raising concerns about supply security during global price spikes or unforeseen disruptions. Future growth hinges critically on addressing these infrastructure gaps through accelerated investment in pipelines, expanded storage terminals nationwide, and port upgrades to handle larger vessels, alongside optimizing refinery utilization and product slates.

The regulatory landscape governing Vietnam's gasoline market is undergoing significant evolution, profoundly impacting pricing, competition, and investment. The government maintains a crucial role through the Ministry of Industry and Trade (MOIT) and the Ministry of Finance (MOF), primarily via the managed pricing mechanism. While this mechanism provides a degree of stability, frequent adjustments based on a complex basket of international prices and import parity principles can lead to domestic price volatility, impacting both consumers and retailers' margins. Recent trends indicate a cautious move towards greater market liberalization, with discussions around potentially allowing retailers more pricing flexibility within set bands and refining the formula to better reflect true costs and market conditions. Simultaneously, stringent quality and environmental regulations are tightening, mandating cleaner fuels (like Euro 5 standards implementation) and pushing for enhanced operational compliance, which increases costs for importers and refiners. The state's influence through major players like Petrolimex, PVOIL, and Saigon Petro remains dominant, but the entry and expansion of smaller, agile private retailers is gradually increasing competition, particularly in urban centers. The ongoing refinement of the regulatory framework and pricing mechanism is pivotal for attracting long-term investment, ensuring fair competition, and balancing consumer affordability with market sustainability.

A defining dynamic reshaping Vietnam's gasoline market is the accelerating pressure towards sustainability and the nascent, yet strategically crucial, transition in the broader transportation fuel mix. While gasoline demand remains strong in the near-to-medium term, the government's ambitious commitments under the National Climate Change Strategy and Power Development Plan VIII (PDP8) signal a profound long-term shift. Policies strongly favor electric vehicle (EV) adoption, including tax incentives, charging infrastructure development plans, and proposed bans on internal combustion engine (ICE) vehicle sales by 2040. This creates a critical inflection point for future gasoline demand growth, particularly in the passenger vehicle segment. Concurrently, there is significant governmental push and investment towards biofuels (like E5 RON 92 gasoline) and exploration into synthetic fuels or hydrogen derivatives for harder-to-electrify transport sectors (aviation, shipping, heavy trucking). Refiners are consequently evaluating strategic adaptations, including potential investments in biofuel blending facilities or petrochemical diversification to hedge against declining future liquid fuel demand. Consumer awareness of environmental issues is also rising, influencing purchasing decisions, albeit gradually. This dynamic necessitates that market participants actively plan for diversification, invest in cleaner fuel production capabilities, and closely monitor policy evolution and technological advancements to navigate the inevitable energy transition while managing current gasoline market operations effectively.

Vietnam Gasoline Market Industry Segmentation:

Type Insights:

- Regular Gasoline

- Special Gasoline

Application Insights:

- Motorcycle

- Automobile

- Others

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=20223&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0