Vietnam Construction Market Size, Share, Top Companies, Forecast 2025-2033

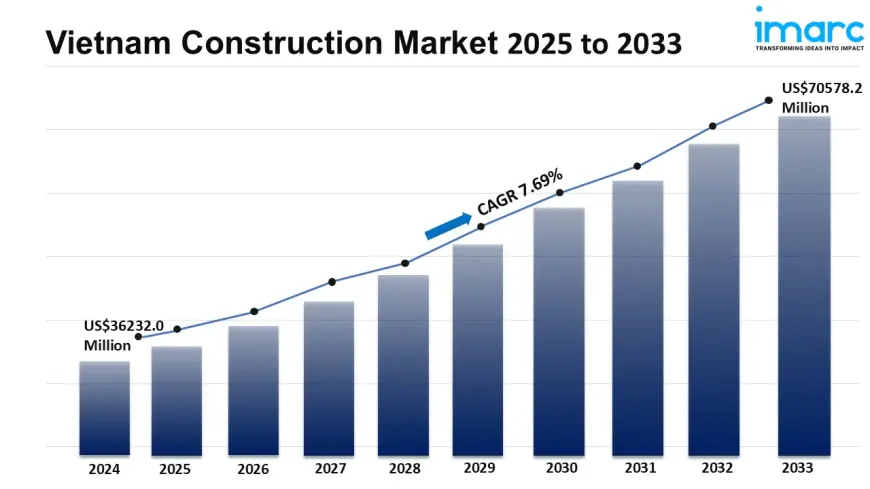

The Vietnam construction market size was valued at USD 36,232.00 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 70,578.22 Million by 2033, exhibiting a CAGR of 7.69% during 2025-2033. Southern Vietnam dominated the market, holding a significant market share of over 35.0% in 2024.

Vietnam Construction Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 36,232.00 Million

Market Forecast in 2033:USD 70,578.22 Million

Market Growth Rate (2025-33): 7.69%

The Vietnam construction market size was valued at USD 36,232.00 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 70,578.22 Million by 2033, exhibiting a CAGR of 7.69% during 2025-2033. Southern Vietnam dominated the market, holding a significant market share of over 35.0% in 2024. The increasing demand for cloud services and big data analytics, rising need for more reliable and scalable data processing and storage facilities, and stringent regulatory compliance represent some of the key factors contributing to the Vietnam construction market share.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-construction-market/requestsample

Vietnam Construction Market Trends and Drivers:

Vietnam’s construction landscape is undergoing a powerful transformation, largely propelled by unwavering government commitment to infrastructure development. Major national plans, particularly the National Master Plan 2021–2030, are not just policy blueprints—they're active frameworks backed by sizable public budgets and increasingly attractive Public-Private Partnership (PPP) models. Flagship projects like the North-South Expressway, Long Thanh International Airport, and deep-sea ports such as Lach Huyen and Cai Mep-Thi Vai represent more than just transport enhancements; they’re critical investments into Vietnam’s long-term economic competitiveness. In parallel, energy infrastructure is seeing its own boom, with LNG terminals, expanded transmission lines, and solar and wind projects forming the foundation for industrial expansion. This infrastructure surge is triggering sustained demand across the entire construction value chain—from materials and machinery to skilled labor—creating a durable and multifaceted growth engine for years to come.

Urbanization is another force reshaping the country’s construction priorities. With over 3.5% annual urban growth and intensifying population pressure on major hubs like Hanoi and Ho Chi Minh City, the need for both high-density housing and satellite townships is urgent. Developers are responding with large-scale mixed-use projects that blend residential, commercial, and public spaces, particularly on city outskirts. At the same time, Vietnam’s position as a top manufacturing destination, bolstered by continued FDI in sectors like electronics and textiles, is driving rapid demand for industrial real estate. The appetite for ready-built factories, logistics parks, and specialized industrial zones remains high, especially in economic hotspots across the north and south. As Vietnam’s supply chain ecosystem matures, construction is no longer just about building infrastructure—it’s about enabling strategic economic shifts, requiring integrated project execution and high operational agility across construction firms.

Sustainability is no longer an option—it’s becoming a requirement. New regulations and updates to energy codes are pushing developers to build smarter, greener, and more responsibly. Green certifications such as LEED, LOTUS, and EDGE are now seen as essential by investors and tenants alike, creating clear competitive advantages. This evolution is changing not just the materials being used—like low-carbon concrete or recycled steel—but also how buildings are designed and executed. Prefabrication and modular construction methods are gaining popularity for their speed, reduced waste, and quality control. There’s also a rising focus on retrofitting older buildings for energy efficiency and converting existing assets through adaptive reuse. All of this demands new skill sets, new technologies, and closer collaboration between developers, consultants, and regulators. In short, Vietnam’s construction industry is becoming more complex, more sophisticated, and more attuned to the long-term balance between growth and environmental responsibility.

Vietnam Construction Market Industry Segmentation:

Analysis by Sector:

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure (Transportation) Construction

- Energy and Utilities Construction

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=15052&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0