Vietnam Construction Equipment Market Size, Share, Growth, Trends and Forecast 2025-2033

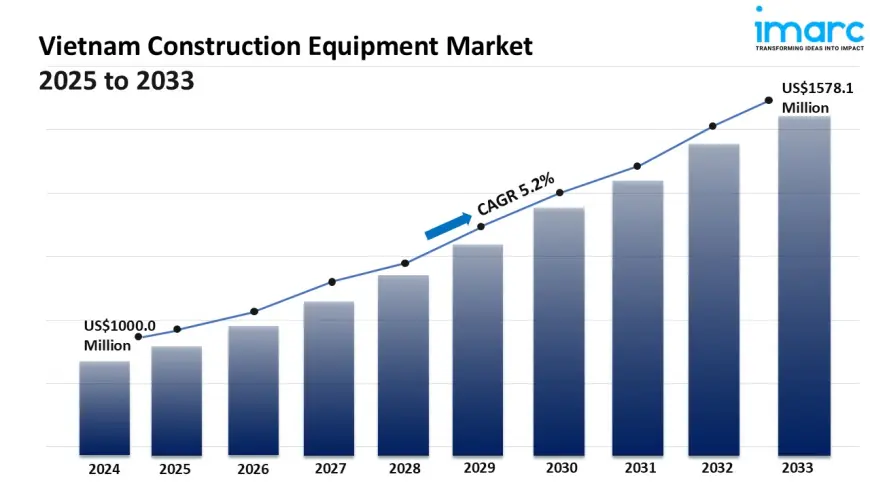

Vietnam construction equipment market size reached USD 1,000.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,578.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033.

Vietnam Construction Equipment Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 1,000.0 Million

Market Forecast in 2033:USD 1,578.1 Million

Market Growth Rate (2025-33): 5.2%

Vietnam construction equipment market size reached USD 1,000.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,578.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The rising number of new infrastructures, along with the upgrade of existing structures to accommodate the expanding population and their needs, is primarily driving the market growth.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-construction-equipment-market/requestsample

Vietnam Construction Equipment Market Trends and Drivers:

Vietnam’s construction equipment market is in the midst of a powerful growth cycle, driven by the country’s massive infrastructure build-out and surging real estate development. Public infrastructure projects are taking center stage, with the government putting serious capital behind strategic priorities outlined in the National Master Plan. Big-ticket investments in the North-South Expressway, metro lines in Hanoi and Ho Chi Minh City, LNG infrastructure, and renewable energy projects are creating consistent demand for heavy machinery across the board. Add to that the private sector’s investment in high-rise buildings, logistics hubs, and industrial zones—especially those tied to foreign manufacturing investment—and you’ve got a market firing on multiple cylinders.

Excavators continue to dominate equipment demand, but growth is strong across mobile cranes, compactors, concrete machinery, and foundation tools. Financing mechanisms such as PPPs and loans from development banks are playing a critical role in keeping this momentum going. Still, challenges persist—land acquisition delays and inconsistent execution remain bottlenecks. These directly affect procurement timelines and fleet utilization, meaning contractors are now paying closer attention to how they time their equipment purchases or rentals, and how efficiently they deploy their fleets on-site.At the same time, the market is starting to move in a more sophisticated direction. There’s a clear shift from simply mechanizing construction to adopting smarter, tech-driven solutions. Telematics is gaining traction, with fleet operators increasingly using data to track performance, cut fuel use, and reduce machine downtime. Interest in electric and hybrid machinery—especially smaller machines suited to urban environments—is starting to take hold as cities push for lower emissions and as companies pursue sustainability goals. Advanced features like GPS machine control on earthmoving equipment are becoming more common on large-scale projects, offering benefits in precision and productivity. These tech trends are forcing a rethink of workforce training, after-sales service, and total lifecycle costs—not just for buyers, but also for rental providers and dealers.

One of the most noticeable trends is the surge in equipment rentals. Contractors of all sizes, particularly small and mid-sized firms, are increasingly choosing to rent rather than buy, allowing them to scale up quickly without locking up capital. Specialized equipment—like tunnel boring machines, tower cranes, and high-capacity concrete pumps—is now more accessible through rental channels. The rental sector itself is evolving fast, with companies expanding their fleets and offering high-tech, connected equipment to meet customer expectations. This is shifting the entire business model—from one focused on product sales to one centered on service, uptime, and flexibility. Dealers and OEMs are responding by building out rental operations, enhancing aftermarket support, and adopting more flexible financing strategies to stay competitive. In short, Vietnam’s construction equipment market is maturing rapidly. The combination of robust infrastructure growth, evolving technology, and a shift toward access-over-ownership is creating a dynamic and highly competitive environment. Companies that adapt to these new realities—whether through smarter fleet management, better service offerings, or more flexible business models—will be the ones best positioned to thrive in this next phase of growth.

Vietnam Construction Equipment Market Industry Segmentation:

Equipment Type Insights:

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Vehicles

- Others

End User Insights:

- Infrastructure

- Construction

- Mining

- Oil and Gas

- Manufacturing

- Others

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=19633&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0