United States Foreign Exchange Market 2025 | Trends, Opportunities, Growth and Forecast by 2033

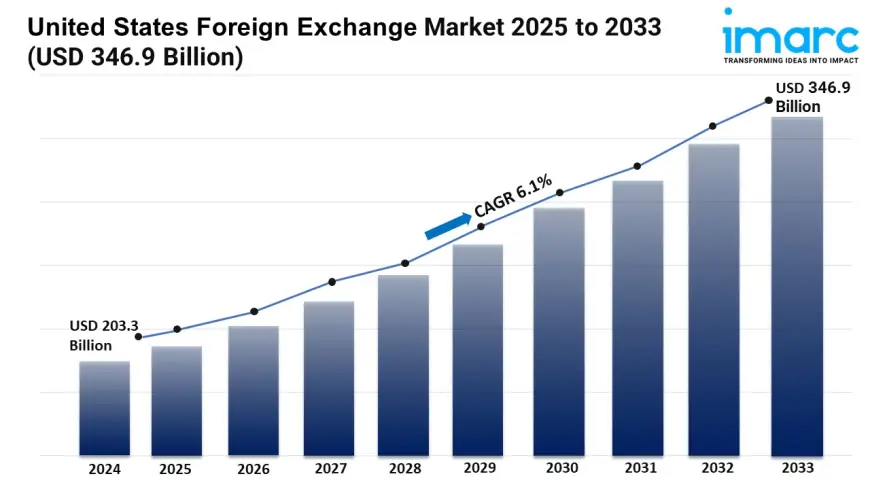

The United States foreign exchange market size was valued at USD 203.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 346.9 Billion by 2033, exhibiting a CAGR of 6.1% from 2025-2033.

United States Foreign Exchange Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 6.1% (2024-2032)

According to the latest report by IMARC Group, The United States foreign exchange market is projected to grow at a CAGR of 6.1% from 2024 to 2032. The market is a dynamic sector driven by global economic factors, monetary policy, and trade relationships. This market is characterized by high liquidity and growing participation from institutional investors.

United States Foreign Exchange Industry Trends and Drivers:

The United States foreign exchange market is driven by a variety of factors that contribute to its growth and dynamism. The country’s status as a global financial hub, coupled with its strong and diverse economy, makes the U.S. dollar one of the most traded currencies in the world. One of the key drivers of the U.S. foreign exchange market is the monetary policy set by the Federal Reserve. Interest rate decisions, quantitative easing measures, and other monetary tools significantly influence currency fluctuations, attracting traders and investors.

Additionally, the United States’ trade relationships with major economies such as China, the European Union, and Canada also play a critical role in currency movements, as trade balances and tariffs impact the demand for foreign exchange. The increasing participation of institutional investors, including hedge funds and pension funds, has further amplified the market’s liquidity, making it one of the most liquid markets globally.

Key trends in the U.S. foreign exchange market include the growing importance of emerging market currencies and the increasing influence of geopolitical events on currency volatility. As global trade continues to expand, the currencies of emerging economies are gaining more prominence in the foreign exchange market, reflecting their growing economic significance. This trend is leading to a broader range of currency pairs being traded, offering new opportunities for market participants.

Moreover, the U.S. foreign exchange market is experiencing a shift towards more transparent and regulated trading environments. The implementation of stricter regulatory frameworks, such as the Dodd-Frank Act, has aimed to enhance transparency and reduce systemic risk in the market. Furthermore, technological advancements are driving the adoption of blockchain and distributed ledger technologies, which are expected to streamline settlement processes and reduce counterparty risk.

The market is also witnessing increased demand for hedging solutions as businesses seek to mitigate the impact of currency fluctuations on their operations. The rise of e-commerce and global supply chains has further intensified the need for effective currency management strategies, positioning the U.S. foreign exchange market as a critical component of global commerce.

Download sample copy of the Report: https://www.imarcgroup.com/united-states-foreign-exchange-market/requestsample

United States Foreign Exchange Industry Segmentation:

The report has segmented the market into the following categories:

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Regional Insights:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=9959&flag=F

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Aarunsingh

Aarunsingh