UK Parcel Delivery Industry Rides E-Commerce Wave with 24.13% CAGR

United Kingdom E-Commerce Parcel Delivery Market Overview

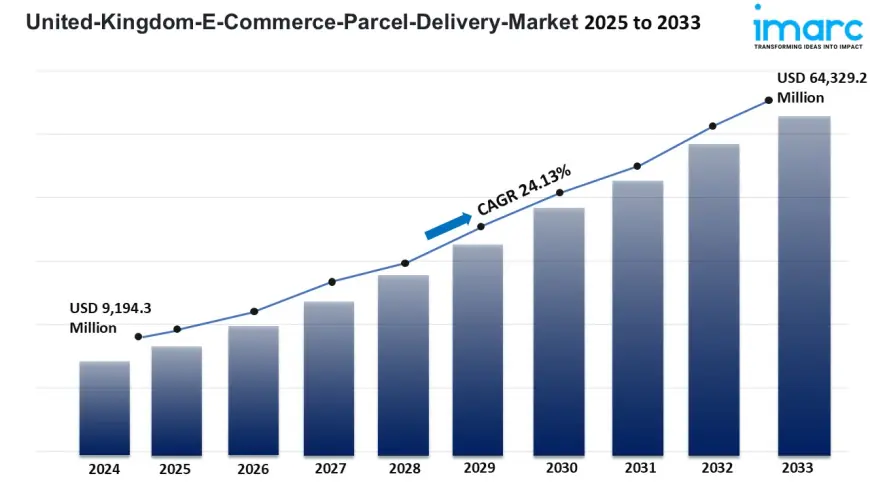

Market Size in 2024: USD 9,194.3 Million

Market Forecast in 2033: USD 64,329.2 Million

Market Growth Rate 2025-2033: 24.13%

The United Kingdom e-commerce parcel delivery market size reached USD 9,194.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 64,329.2 Million by 2033, exhibiting a growth rate (CAGR) of 24.13% during 2025-2033.

United Kingdom E-Commerce Parcel Delivery Market Trends and Drivers:

The United Kingdom e-commerce parcel delivery market is witnessing massive expansion, pushed through an improved shift in customer behaviour closer to on-line shopping. As virtual retail keeps to benefit momentum throughout the nation, the call for for fast, reliable, and client-centric shipping offerings is intensifying. Consumers are an increasing number of prioritising convenience, prompting shops to beautify their last-mile logistics talents and spend money on real-time monitoring and bendy scheduling. This evolution in expectancies is fostering a brand new widespread for shipping performance, encouraging carrier carriers to evolve swiftly. Advanced technology which include automatic sorting systems, direction optimisation algorithms, and AI-pushed logistics control are being followed to streamline operations and decrease shipping times. Additionally, strategic partnerships among e-trade systems and third-celebration logistics companies are strengthening fulfilment networks, allowing organizations to provide top class offerings like same-day or two-day shipping with extra consistency and scale.

Fueling this increase similarly is the dynamic aggressive panorama withinside the UK retail ecosystem, wherein organizations are competing to supply advanced client experiences. As the marketplace turns into an increasing number of saturated with virtual-first manufacturers and omnichannel shops, parcel shipping is rising as a key differentiator. Companies are customising shipping alternatives to house various client needs, inclusive of weekend drop-offs, pickup lockers, and zero-touch handovers. The developing presence of small and medium-sized establishments withinside the e-trade area is likewise amplifying call for for cost-green logistics solutions. These organizations are leveraging scalable shipping infrastructure to attain broader audiences with out incurring the fees of in-residence operations. Moreover, the surge in cross-border e-trade is prompting home logistics carriers to refine global shipping mechanisms, improving transparency, reliability, and speed. In tandem, regulatory assist and infrastructure investments are growing a beneficial surroundings for logistics innovation, reinforcing the general performance and resilience of the shipping ecosystem.

Regionally, metropolitan regions which include London, Manchester, and Birmingham are rising as predominant hubs for e-trade parcel activity, pushed through dense populations, excessive virtual penetration, and robust retail footprints. These areas are showcasing superior adoption of clever logistics, with developing integration of electrical shipping motors and micro-fulfilment centres to boost up last-mile execution. Furthermore, sustainability is turning into a pivotal driver, as agencies introduce green packaging and carbon-impartial shipping alternatives to align with country wide weather desires and customer values. The shift closer to greener operations isn't always simplest improving logo loyalty however additionally attracting funding from environmentally aware stakeholders. As innovation keeps to redefine shipping logistics, the United Kingdom e-trade parcel shipping marketplace is organising itself as a cornerstone of the virtual economy, poised for long-time period increase, operational agility, and client satisfaction.

United Kingdom E-Commerce Parcel Delivery Market News

May 2025: InPost teamed up with ASOS to launch the UK’s next-day out‑of‑home (OOH) delivery service, leveraging its expanded parcel locker network now at 12,800 PUDO locations following its acquisition of Yodel. InPost’s seller base now spans over 700 online retailers, with projected annual volumes of approximately 300 million parcels and an ~8% market share.

April 2025: Polish logistics firm InPost acquired a 95.5% stake in UK parcel firm Yodel (Judge Logistics) via converting ~£106 million in debt into equity. This deal elevated InPost to the position of the third-largest independent parcel delivery operator in the UK (~8% share).

May 2025: DHL agreed to merge its UK e‑commerce delivery operations with Evri (Apollo-owned), aiming to create a parcel giant capable of delivering over 1 billion parcels and letters annually, supported by a fleet of ~30,000 couriers and drivers.

Q1 2024: UK carriers maintained strong performance metrics a transit time of ~1.23 days, on‑time delivery rate of ~98.8%, and first-attempt success around 95%. Royal Mail delivered 94.7% on first attempt; Evri reached 97.6% in Q2.

July 2025: According to Effigy Consulting, parcel volumes in the UK grew by 6.3% in 2024 (B2C up 6.8%). The UK remains Europe’s most mature e‑commerce region with ~1.95% volume growth in 2024. Forecasts expect parcel volume growth of ~5.7% in 2025.

2024: The UK parcel delivery market reached USD 4.91 billion in 2023 and is projected to grow at a 12.2% CAGR through 2032, reaching USD 13.8–15.5 billion by 2032–34.

2024–2025: IMARC reports placed the UK e‑commerce parcel delivery market at USD 9.19 billion in 2024, with expected CAGR of 24.1% from 2025–2033, targeting USD 64.3 billion by 2033.

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/united-kingdom-e-commerce-parcel-delivery-market/requestsample

United Kingdom E-Commerce Parcel Delivery Market Industry Segmentation:

Type Insights:

- Instant Delivery

- Same-Day Delivery

- Two-Day Delivery

Business Size Insights:

- Small

- Medium

- Large

Destination Insights:

- Domestic

- International

Industry Insights:

- Apparel and Accessories

- Consumer Packaged Goods

- Consumer Electronics

- Manufacturing and Construction

- Healthcare

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=23091&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0