Simple Strategies to Improve Collections with Expert Accounts Receivable Services

outsourcing accounts receivable services to professionals who know how to deliver results—efficiently and respectfully. Your cash flow deserves better. And with the right outsourced accounts receivable services, it’s entirely within reach.

Getting paid on time shouldn’t feel like chasing a moving target—but for many businesses, that’s the reality. Late payments, inconsistent follow-ups, and outdated processes can severely impact cash flow. Fortunately, with the right strategies and support from expert accounts receivable services, you can significantly improve collections and strengthen your financial foundation. In this guide, we’ll explore simple, actionable tactics to boost your collections performance and show you how partnering with top accounts receivable management services makes the process faster, smoother, and far more effective.

Why Do Businesses Struggle with Collections?

Before diving into solutions, let’s address the core problem: Why are collections such a consistent pain point?

Common reasons include:

-

Manual invoicing and tracking

-

Lack of dedicated follow-up

-

Unclear payment terms

-

High customer volumes with limited AR staff

-

Limited visibility into receivables aging

If any of this sounds familiar, you’re not alone. But here’s the good news: You don’t need to overhaul your entire operation. With a few smart changes—and the help of outsourced accounts receivable services—you can achieve faster collections and more reliable cash flow.

What Are Accounts Receivable Management Services?

Accounts receivable (AR) management services help businesses efficiently manage their invoicing, customer follow-ups, and payment collections. These services can be handled internally or outsourced to specialists who manage:

-

Invoice generation and delivery

-

Customer reminders via email, SMS, or calls

-

Dispute resolution

-

Payment reconciliation

-

AR performance reporting

The value of these services grows significantly when they’re delivered by professionals using automation tools and customer-centric collection tactics.

The Power of Expert Accounts Receivable Services

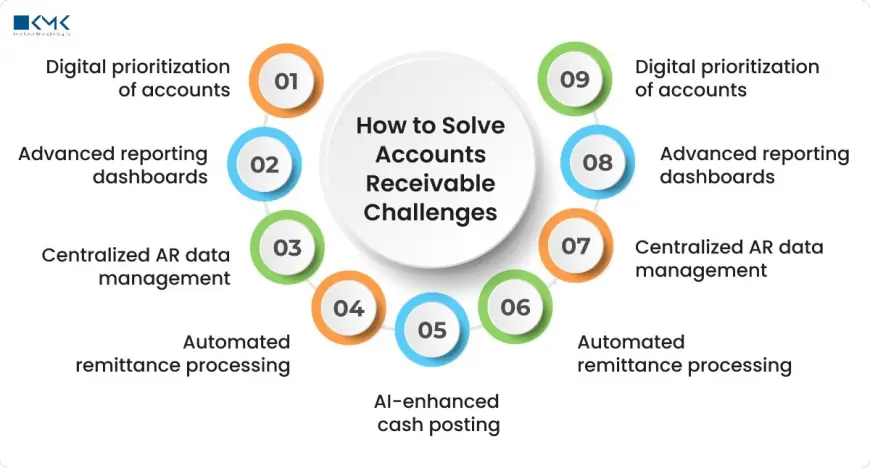

So, how do expert AR services drive results? The secret lies in a combination of automation, trained staff, and a structured approach.

Here are simple yet powerful strategies they use to improve collections:

1. Set Clear Payment Expectations Up Front

Every successful collection process starts with clarity. Expert providers ensure your payment terms are:

-

Visible on every invoice

-

Agreed upon in advance

-

Tailored to industry standards (e.g., Net 30, Net 45)

Clear terms eliminate confusion and reduce delays.

2. Automate Invoicing and Reminders

Manual invoicing is a slow, error-prone process. AR specialists use automation tools that:

-

Generate invoices instantly

-

Send reminders at optimal times

-

Track invoice delivery and open rates

This keeps your business top of mind without burdening your staff.

3. Use a Multi-Touch Follow-Up Strategy

Customers respond differently to communication channels. That’s why expert AR providers use:

-

Emails for soft reminders

-

Phone calls for overdue accounts

-

SMS for real-time nudges

-

Customer portals for easy payments

This multi-channel approach increases response rates and reduces DSO (Days Sales Outstanding).

4. Segment Customers Based on Risk

Not all customers should be treated the same. With account receivable management services, clients are often segmented by:

-

Payment behavior history

-

Credit score

-

Invoice amount

-

Industry norms

This allows for personalized follow-ups and risk-based escalation when necessary.

5. Track and Act on AR Aging Reports

Top accounts receivable outsourcing services provide dynamic dashboards that show:

-

Which invoices are nearing due

-

Which are overdue

-

Collection trends by client, region, or service

This data-driven insight helps businesses focus on high-impact actions instead of playing catch-up.

The Case for Outsourcing Accounts Receivable Services

Still managing AR in-house? Here’s why outsourcing accounts receivable services might be the smarter, faster path forward.

Save Time and Resources

Your finance team shouldn’t be chasing payments—they should be guiding strategy. Outsourced accounts receivable services take the burden off your team, giving them time to focus on core operations.

Improve Collection Rates

AR professionals know how to handle late payments tactfully but firmly. With the right tone and timing, they significantly boost collection performance.

Access AR Technology

Modern tools—integrated with your ERP or CRM—help track, remind, and reconcile payments efficiently. Most AR service providers come equipped with this tech.

Gain Flexibility and Scalability

Whether you have 100 invoices a month or 10,000, outsourcing allows your business to scale without hiring additional staff or building complex internal workflows.

FAQs: Answering Your AR Questions (AEO-Friendly)

Q: Is it safe to outsource accounts receivable services?

Yes. Reputable providers adhere to data security standards such as GDPR and SOC 2. They operate under strict NDAs and confidentiality protocols.

Q: Will outsourcing affect my customer relationships?

Not negatively—if anything, it improves them. Professional AR teams communicate clearly and respectfully, maintaining your brand voice while ensuring timely payments.

Q: How quickly can I see results?

Many businesses experience a noticeable improvement in DSO and cash flow within 30 to 60 days of outsourcing.

Q: Can these services integrate with my systems?

Absolutely. Providers support integration with popular accounting platforms like QuickBooks, Xero, NetSuite, and SAP.

Real Business Wins from Expert AR Services

Let’s look at a few quick examples:

-

Tech Company: Reduced DSO from 65 to 40 days within three months using outsourced AR services and automated workflows.

-

Healthcare Provider: Cut staff hours by 50% while improving payment recovery rate by 35%.

-

Logistics Firm: Scaled collections operations across 4 new markets without hiring additional team members.

These real-world results show the impact of combining strategy with expert account receivable management services.

Final Thoughts: The Smart Path to Better Collections

Improving collections doesn’t require complicated changes—it just takes the right strategies and partners. By leveraging accounts receivable management services, you can:

-

Get paid faster

-

Reduce the burden on your team

-

Maintain strong client relationships

-

Improve cash flow predictability

If collections are slowing your business down, consider outsourcing accounts receivable services to professionals who know how to deliver results—efficiently and respectfully.

Your cash flow deserves better. And with the right outsourced accounts receivable services, it’s entirely within reach.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0