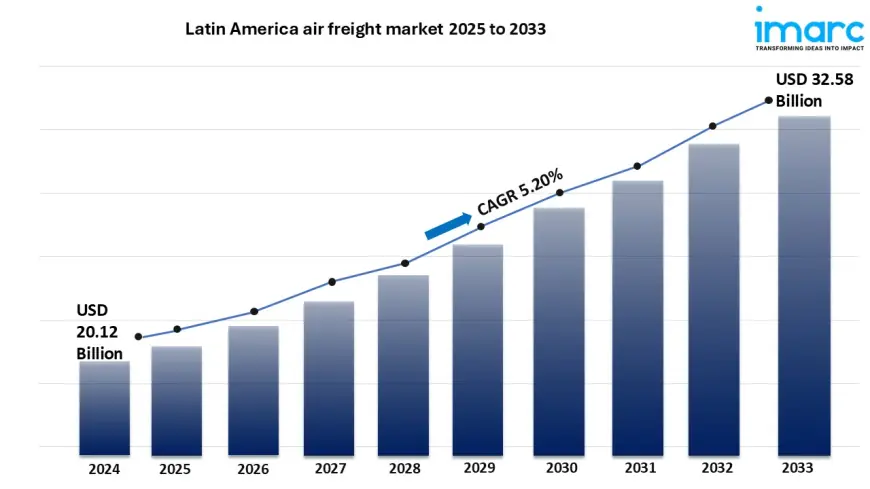

Latin America Air Freight Market to Hit USD 32.58 Billion by 2033

Latin America Air Freight Market Overview

Market Size in 2024: USD 20.12 Billion

Market Forecast in 2033: USD 32.58 Billion

Market Growth Rate (2025-2033): 5.20%

The Latin America air freight market size reached USD 20.12 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 32.58 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033.

Latin America Air Freight Market Trends and Drivers:

The Latin America air freight market is experiencing sturdy momentum as cross-border alternate maintains expanding, pushed via way of means of the region`s deepening integration with international deliver chains. Major logistics companies are actively scaling up operations to satisfy growing call for fueled via way of means of surging e-trade hobby and time-touchy transport requirements. With on line outlets more and more more prioritizing velocity and reliability, air freight is rising as a essential conduit for connecting local dealers with global buyers. As alternate corridors strengthen, exporters and producers are counting on air shipment to hold seamless deliver chain continuity, especially in high-price and perishable segments. Countries like Brazil, Mexico, and Colombia are witnessing an inflow of freight-forwarding investments as operators leverage strategic geographic places and evolving loose alternate agreements to reinforce ability and operational efficiency. Infrastructure improvements at key airports are similarly accelerating cargo handling, lowering transit times, and helping year-spherical transport cycles for different shipment types.

In this evolving landscape, the Latin American air freight marketplace is reaping rewards drastically from local production growth, that's reshaping logistics techniques and reinforcing air shipment as a favored mode for just-in-time transport fashions. Industrial sectors including automotive, pharmaceuticals, and customer electronics are more and more more counting on air freight to mitigate dangers related to manufacturing delays and stock shortages. Advancements in shipment tracking, real-time monitoring, and virtual freight reserving systems are reworking the consumer experience, permitting quicker decision-making and enhancing shipment visibility. The convergence of those technology with superior safety protocols is constructing self-assurance amongst shippers, encouraging broader adoption of air logistics solutions. Moreover, growing intra-local alternate is growing new call for facilities throughout secondary cities, prompting airways to introduce bendy provider fashions and optimize shipment maintain ability to serve different routes extra efficiently. These dynamics are positioning the Latin American air freight marketplace as a high-capability area for sustained funding and innovation.

Within key nations throughout the region, tailor-made guidelines and infrastructure investments are using differentiated growth. In Brazil, government-sponsored airport privatization is facilitating modernization and attracting non-public capital for superior shipment terminals. Mexico is capitalizing on its proximity to North American markets via way of means of improving multimodal connectivity and logistics hubs in crucial and northerly regions. Argentina and Chile are streamlining customs tactics and digitizing alternate documentation to expedite cross-border flows. Across Central America, growing participation in alternate blocs is fostering good regulatory surroundings that encourages logistical agility. These initiatives, mixed with sturdy call for from e-trade and business deliver chains, are reinforcing air freight as a strategic enabler of monetary resilience. As corporations prioritize velocity-to-marketplace and deliver chain adaptability, the air freight marketplace in Latin America is persevering with to adapt as a key pillar helping each home trade and global alternate expansion.

Latin America Air Freight Market News

- December 2024 Air cargo demand in Latin America surged by 12.6% year-on-year, with cargo capacity rising 7.9%. Notably, December witnessed a 10.9% spike, the highest among all global regions.

- January 2025 Latin American carriers recorded 11.2% year-on-year growth in air cargo demand, alongside a 10.6% capacity increase, showcasing the strongest regional performance globally.

- April 2025 Region-wide, air cargo demand leaped 10.1% year-on-year, again leading global regions, with capacity up 8.5%.

- April 2025 Lima Airport (Peru) inaugurated a new air cargo terminal on March 30, featuring a revamped design aimed at improving operational efficiencythough its distance from existing facilities may affect transfer times.

- May 2025 FedEx Latin America emphasized the pivotal role of e-commerce, digitalization, international trade growth, and supply chain diversification in shaping the region’s air cargo market for 2025.

- May 2025 Per Air Cargo News, major carriers are expanding capacity: Avianca is adding two A330 P2F aircraft, and LATAM Cargo is awaiting FAA approval for its Boeing 767 freighter conversions and fire suppression systems. Meanwhile, carriers like Lufthansa and AFKLMP have shifted capacity out of the region, impacting yield dynamics.

- April 2025 Braspress Air Cargo received its Air Operator’s Certificate on April 22, 2025, enabling operations out of Viracopos in Campinas, with initial routes likely to include Manaus.

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/latin-america-air-freight-market/requestsample

Latin America Air Freight Market Industry Segmentation:

Service Insights:

- Freight

- Express

- Others

Destination Insights:

- Domestic

- International

End User Insights:

- Private

- Commercial

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=28825&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0