Key Developments in Global Tire Mold Market 2030 Explained

As consumers gravitate toward luxury and high-performance vehicles, the need for premium tires with specific tread designs and sidewall aesthetics has increased.

The Global Tire Mold Market is entering a phase of accelerated growth and innovation, propelled by rising automotive production, heightened consumer demand for performance-oriented tires, and ongoing advancements in mold manufacturing technologies. According to recent market assessments, the industry was valued at USD 1.5 billion in 2024 and is projected to reach USD 2.5 billion by 2030, growing at a CAGR of 8.89%. This expansion reflects not only the sheer volume of tire consumption worldwide but also the crucial role that tire molds play in ensuring safety, fuel efficiency, and vehicle performance.

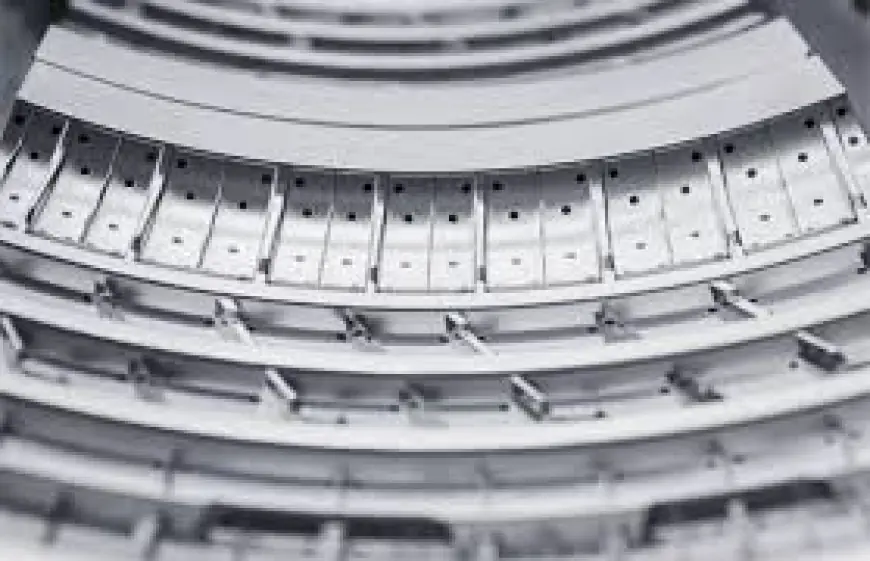

Tire molds are indispensable in the tire manufacturing process, shaping the tread patterns, grooves, and sidewalls that directly impact tire durability, traction, rolling resistance, and overall driving experience. With automakers and tire manufacturers prioritizing sustainability, safety, and fuel economy, the demand for precision-engineered molds is stronger than ever. Both OEM and replacement segments continue to benefit, as new vehicle production rises and consumers frequently replace worn tires.

Industry Key Highlights

- Market Size Growth: USD 1.5 billion in 2024 → USD 2.5 billion by 2030.

- Strong CAGR: Growth rate of 8.89%, underscoring robust demand across passenger and commercial vehicle categories.

- Technological Advancements: Computer-controlled machining, high-grade alloys, and segmental molds are reducing production delays and ensuring higher quality.

- Emergence of EV-Specific Molds: Specialized designs for electric and hybrid vehicles are fueling new opportunities.

- Asia-Pacific Dominance: Countries like China, India, and Southeast Asian nations are leading with rapid automotive production and growing consumer demand.

- Sustainability Pressures: Manufacturers are increasingly focusing on eco-friendly processes and energy-efficient mold production.

- Dual Segmentation: Passenger cars emphasize comfort and efficiency, while commercial vehicles prioritize durability and heavy-duty performance.

- High Production Costs: Remain a significant challenge, with technical complexities adding to operational expenses.

- Customization Demand: Unique tread and sidewall requirements are driving precision design capabilities.

- Competitive Ecosystem: A blend of global tire giants and regional mold specialists fosters innovation and competition.

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=28691

Emerging Trends in the Global Tire Mold Market

1. Rise of Smart Manufacturing in Mold Production

Industry 4.0 technologies are transforming tire mold manufacturing. CNC machining, 3D modeling, and digital twin technologies enable manufacturers to design and simulate tire molds with greater accuracy before production. This reduces errors, shortens development cycles, and enhances mold efficiency.

2. Customization for Electric Vehicles

Electric vehicles (EVs) require unique tire specifications—low rolling resistance, noise reduction, and high load-bearing capacity. As a result, mold makers are developing specialized tread patterns tailored for EVs. These designs are increasingly being integrated into segmental molds, which allow flexibility and precision.

3. Sustainability as a Core Strategy

With rising global concerns over carbon emissions, tire mold manufacturers are shifting toward eco-friendly materials, energy-efficient processes, and recyclable alloys. Many are also exploring additive manufacturing (3D printing) to minimize waste and reduce environmental impact.

4. Increased Focus on Durability and Longevity

Consumers are demanding tires that last longer without compromising performance. This is pushing manufacturers to innovate high-performance molds that enable advanced tread compounds and designs optimized for durability.

5. Collaborations and Partnerships

A growing number of tire mold producers are entering strategic alliances with tire manufacturers to co-develop next-generation molds. Such partnerships are accelerating innovation while ensuring molds align with evolving vehicle technologies.

Market Drivers

1. Growth in Global Automotive Production

The consistent rise in automotive manufacturing, particularly in emerging economies, is directly fueling demand for tire molds. Passenger vehicles, SUVs, trucks, and buses all require uniquely designed molds to meet performance and regulatory requirements.

2. Replacement Tire Demand

Frequent replacement cycles, influenced by consumer safety awareness and road conditions, contribute significantly to tire demand. As new tires are produced, so too is the requirement for molds, especially in aftermarket segments.

3. Technological Advancements in Mold Making

The adoption of high-grade alloys, precision machining, and digital tools has improved the ability to manufacture complex and consistent tire patterns. These innovations have enhanced product quality while lowering defects.

4. Government Policies and Regulations

Stricter safety and environmental regulations worldwide are compelling tire makers to innovate. Molds play a critical role in enabling manufacturers to meet fuel economy standards, wet-grip requirements, and rolling resistance regulations.

5. Surge in Electric and Hybrid Vehicles

As EV adoption grows, tire mold designs must adapt. EV tires require unique features, such as low rolling resistance and noise-optimized treads, creating a fresh wave of demand for specialized molds.

Market Segmentation Overview

By Vehicle Type

- Passenger Cars: Focused on comfort, fuel efficiency, and tread balance for everyday road use.

- Commercial Vehicles: Engineered for durability, traction, and heavy-duty performance under intense driving conditions.

By Mold Type

- Segmental Molds: Allow flexible and quicker production with reduced downtime.

- Two-Piece and Multi-Piece Molds: Still widely used but gradually being replaced in high-volume manufacturing by segmental options.

By Material

- Cast Steel and Forged Iron/Steel: Remain dominant due to durability, though newer eco-friendly alloys are gaining traction.

Regional Insights

Asia-Pacific: The Growth Engine

Asia-Pacific is the fastest-growing and largest regional market, driven by surging automotive production, expanding middle-class populations, and government support for local manufacturing. Countries like China and India are investing heavily in tire production infrastructure, strengthening demand for molds. Additionally, the region is a hotbed for EV production, requiring advanced mold designs.

North America & Europe: Mature but Innovative

Both regions exhibit steady demand, characterized by stringent environmental regulations and a strong shift toward sustainable manufacturing. Tire mold producers in these regions are focusing on lightweight materials, 3D mold printing, and advanced alloys to maintain competitiveness.

Middle East, Africa & Latin America

These regions are emerging markets with rising automotive adoption, creating opportunities for tire manufacturers to localize production. Strategic investments in tire factories are fueling incremental mold demand.

Challenges in the Tire Mold Market

- High Production and Maintenance Costs

Mold development is expensive, particularly for advanced designs, and ongoing maintenance adds operational strain. - Technical Complexity

Developing molds for next-generation tires with complex treads is technically demanding and requires skilled expertise. - Sustainability Challenges

Eco-friendly manufacturing demands higher investments in materials and production methods. - Competitive Pricing Pressures

Price competition in emerging markets challenges mold producers to balance cost efficiency with high quality.

Competitive Analysis

The market features a blend of global players and regional specialists, each competing on innovation, precision, and cost-efficiency.

Key Players

- Hoffmann SE – A leader in precision mold solutions.

- Kurtz Holding GmbH & Co. Beteiligungs KG – Known for durable mold materials.

- Kobelco (Kobe Steel Ltd.) – Specializes in high-performance alloys for mold making.

- Jiangsu Tianyi Mould Co., Ltd. – A strong Asian player with growing global reach.

- Marangoni S.p.A. – Innovation-driven with eco-friendly mold approaches.

- Techno Molds – Focused on customized mold solutions.

- Harburg-Freudenberger Maschinenbau GmbH – Advanced European manufacturing capabilities.

- Oerlikon Balzers – Expertise in surface coatings and wear resistance.

- Michelin – Integrates mold innovation into its premium tire production.

- Continental AG – Focuses on sustainable and high-performance tire molds.

These companies are actively investing in R&D, collaborations, and technological innovation to maintain their competitive edge.

Future Outlook

The Global Tire Mold Market is poised for sustained growth as vehicle demand continues to rise worldwide. By 2030, molds will play an even greater role in enabling EV adoption, safety enhancements, and sustainability goals.

- Short-Term Outlook (2024–2026): Continued growth in Asia-Pacific, with technological upgrades improving mold precision.

- Medium-Term Outlook (2026–2028): Strong EV-driven demand for specialized molds, particularly in developed economies.

- Long-Term Outlook (2028–2030F): Market consolidation, with eco-friendly manufacturing becoming a defining industry standard.

The future will see a balance of efficiency, innovation, and environmental responsibility shaping mold design and production.

10 Benefits of the Research Report

- Provides comprehensive market size and forecast data through 2030.

- Highlights emerging trends influencing mold production.

- Offers detailed insights into drivers, challenges, and opportunities.

- Explores segmentation by material, type, vehicle, and region.

- Identifies fastest-growing regional markets with growth strategies.

- Analyzes the competitive landscape with key player strategies.

- Guides investors with long-term growth outlooks.

- Covers technological advancements reshaping mold design.

- Assists manufacturers in aligning with sustainability standards.

- Provides actionable intelligence for business expansion and partnerships.

Conclusion

The Global Tire Mold Market is more than just a supporting segment of the tire industry—it is a vital enabler of automotive safety, efficiency, and sustainability. As automakers shift toward greener mobility and consumers demand performance-oriented tires, the precision and quality of molds will remain central to tire innovation. With steady growth projected through 2030, industry stakeholders—ranging from mold producers to tire manufacturers—must embrace technological innovation, sustainability, and strategic collaboration to capture the immense opportunities this market offers.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Website: www.techsciresearch.com

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0