Instant Bank Account Verification and How It Prevents Payment Failures

In today’s digital-first economy, seamless and reliable payments are critical for businesses across banking, fintech, lending, insurance, marketplaces, and enterprise platforms. Even a small percentage of failed transactions can lead to revenue loss, customer dissatisfaction, compliance risks, and operational overhead. This is where Instant Bank Account Verification plays a decisive role in strengthening payment reliability and trust.

At Meon Technologies, payment accuracy and verification intelligence are treated as foundational pillars of digital transaction workflows. By validating bank account details in real time, organizations can drastically reduce payment failures, prevent fraud, and ensure smooth fund movement from the very first transaction.

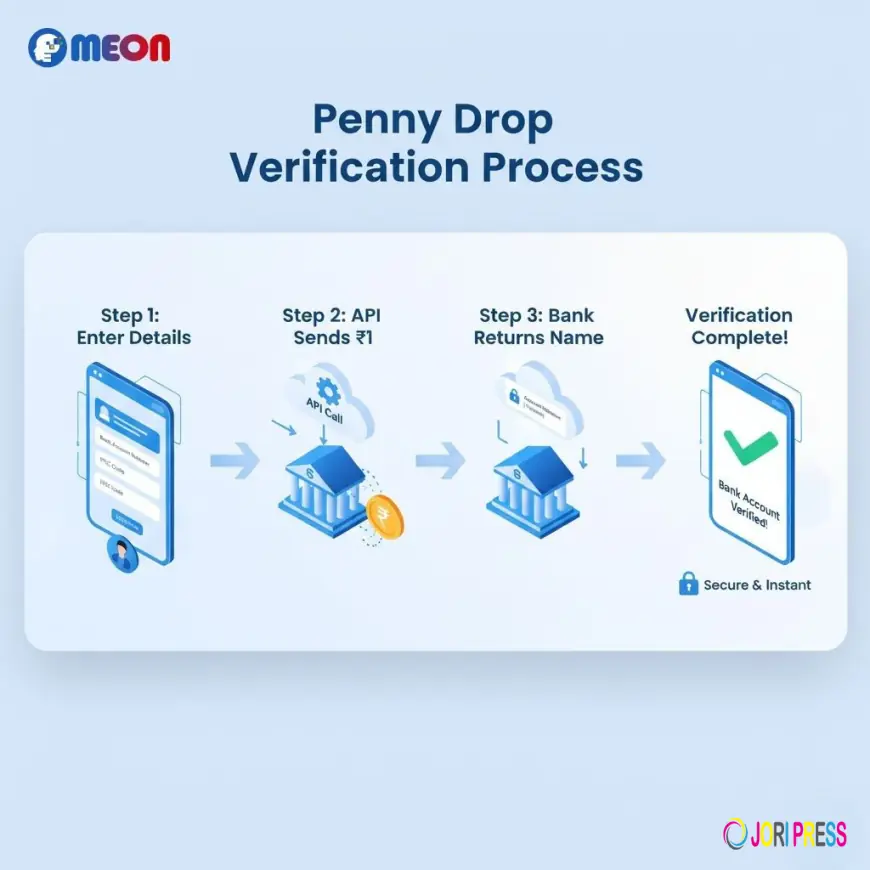

Understanding Instant Bank Account Verification

Instant Bank Account Verification is a real-time process that confirms whether a bank account is valid, active, and capable of receiving or sending funds. Instead of relying on manual checks or delayed confirmations, verification happens instantly through secure automated systems.

This verification typically validates:

-

Account existence and status

-

Bank and branch authenticity

-

Account-holder name matching

-

Transaction readiness

By integrating this capability directly into payment or onboarding flows, businesses eliminate uncertainty before initiating any financial transaction.

Why Payment Failures Occur

Payment failures are often not caused by insufficient funds alone. In reality, many failures stem from incorrect or unverified bank details. Common causes include:

-

Incorrect account numbers or IFSC codes

-

Dormant or inactive bank accounts

-

Mismatch between account holder name and records

-

Typographical errors during data entry

-

Fraudulent or synthetic account details

Without upfront verification, these issues surface only after a transaction is attempted—leading to failed settlements, retries, refunds, and manual reconciliation.

How Instant Verification Prevents Payment Failures

1. Validating Account Details Before Transactions

By using Instant Bank Account Verification, businesses ensure that only correct and active bank accounts are used for payments. Invalid accounts are identified immediately, preventing failed transactions at the source.

This proactive validation significantly lowers rejection rates from banks and payment networks.

2. Eliminating Name Mismatch Errors

Name mismatches between bank records and user-provided data are a major contributor to payment failures. Instant verification confirms whether the account holder’s name aligns with official bank records.

This is especially critical for:

-

Vendor payouts

-

Salary disbursements

-

Refund processing

-

Loan disbursals

3. Reducing Retry and Reconciliation Costs

Every failed payment triggers additional operational work—manual checks, customer communication, and repeated attempts. Over time, these hidden costs escalate.

With Instant Bank Account Verification, organizations dramatically reduce retries, allowing finance and operations teams to focus on growth instead of exception handling.

4. Strengthening Fraud Prevention

Fraudsters often use fake or mule bank accounts to exploit payment systems. Real-time verification helps detect such accounts early, adding an essential security layer to payment workflows.

By blocking unverified or suspicious accounts, businesses prevent both payment failures and financial fraud.

Use Cases Where Verification Makes a Critical Difference

Fintech and Digital Payments

For fintech platforms handling high transaction volumes, even a small failure rate can impact user trust. Verification ensures successful first-time transactions.

Lending and Credit Platforms

Loan disbursements depend on accurate bank details. Instant Bank Account Verification ensures funds reach the correct borrower without delays.

Marketplaces and Gig Platforms

Vendor and partner payouts require error-free bank data. Verification prevents failed settlements and disputes.

Enterprises and Payroll Systems

Salary payments and reimbursements rely on precise account information. Eliminating errors ensures employee satisfaction and compliance.

Compliance and Operational Advantages

Beyond preventing payment failures, instant verification supports regulatory and operational requirements:

-

Supports KYC-aligned workflows

-

Improves audit readiness

-

Enhances transaction traceability

-

Builds trust with banks and partners

By embedding verification into digital workflows, organizations achieve both compliance and efficiency without adding friction.

Why Businesses Choose Meon Technologies

Meon Technologies delivers robust verification solutions designed for scale, speed, and accuracy. Our approach to Instant Bank Account Verification focuses on:

-

Real-time validation without manual intervention

-

Secure and compliant data handling

-

Seamless API-driven integration

-

High accuracy across diverse banking networks

By prioritizing reliability and performance, Meon Technologies enables businesses to build payment systems that are resilient against errors and failures.

Improving Customer Experience Through Fewer Failures

Every failed payment impacts customer confidence. Whether it’s a delayed refund, a missed payout, or a rejected transaction, users expect instant resolution.

By preventing issues before they occur, Instant Bank Account Verification ensures:

-

Faster onboarding

-

Higher transaction success rates

-

Reduced customer support queries

-

Stronger brand credibility

This translates directly into better retention and long-term customer trust.

The Future of Payment Reliability

As digital payments continue to scale, prevention will always outperform correction. Businesses that rely on reactive approaches to payment failures will face rising costs and declining user satisfaction.

In contrast, organizations that adopt real-time verification as a standard practice gain a strategic advantage—combining speed, security, and accuracy in every transaction.

Conclusion

Instant Bank Account Verification is no longer optional for modern digital businesses—it is essential. By validating bank details upfront, organizations prevent payment failures, reduce operational friction, enhance fraud protection, and deliver superior customer experiences.

With trusted verification solutions from Meon Technologies, businesses can confidently move money, scale operations, and build payment systems designed for long-term reliability and success.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0