India Two Wheeler Brake System Market 2030F

Despite strong growth prospects, the market faces challenges such as price sensitivity among consumers in the economy segment, which limits the penetration of advanced brake systems.

The India Two-Wheeler Brake System Market has entered an exciting phase of transformation, driven by technological innovation, evolving consumer preferences, and the steady rise of two-wheeler demand across both urban and rural India. According to recent industry insights, the market was valued at USD 1.29 billion in 2024 and is projected to reach USD 2.01 billion by 2030, expanding at a CAGR of 7.62% during the forecast period.

As India cements its position as the world’s largest two-wheeler market, the braking system segment has emerged as a critical area of innovation, safety enhancement, and consumer interest. With motorcycles, scooters, and mopeds forming the backbone of mobility in the country, braking systems are no longer seen as just a functional component but as a defining feature that ensures rider safety, vehicle efficiency, and enhanced driving comfort.

Evolution of Two-Wheeler Brake Systems in India

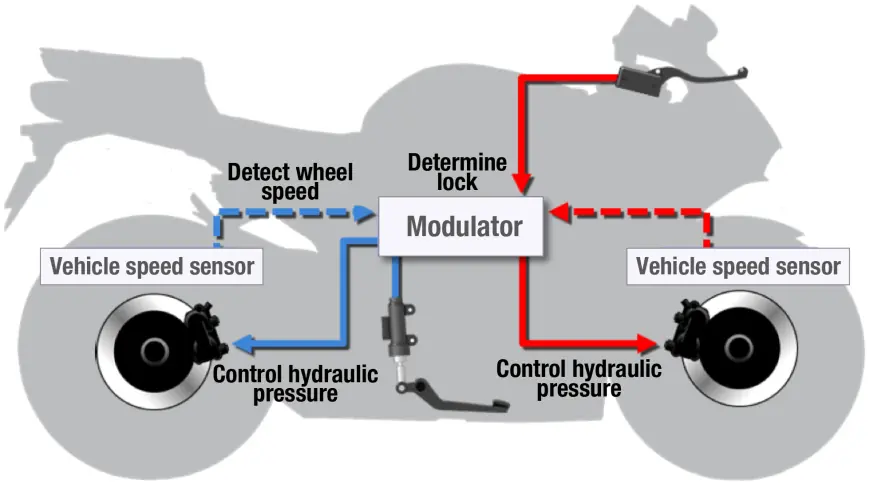

Over the past two decades, the Indian two-wheeler industry has moved from traditional drum brakes to advanced disc brakes, Combined Braking Systems (CBS), and Anti-lock Braking Systems (ABS). These advancements are in response to growing consumer awareness about road safety and stricter government regulations mandating safety features.

Initially, most two-wheelers, especially mopeds and scooters, relied heavily on cost-effective drum brakes. However, with rising performance expectations, increasing traffic congestion, and higher speeds on highways, the market gradually shifted toward disc brake adoption. By the late 2010s, CBS and ABS became standard offerings in mid-range and premium motorcycles, transforming the industry’s safety standards.

The entry of electric two-wheelers has further accelerated changes in braking technologies, with regenerative braking systems gaining popularity. These systems not only ensure rider safety but also recover and store energy, thereby improving overall efficiency.

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=2311

Key Market Drivers

Several factors are shaping the growth of the India Two-Wheeler Brake System Market.

1. Rising Two-Wheeler Ownership

India’s two-wheeler penetration is among the highest in the world, with motorcycles and scooters serving as the primary mode of mobility for millions. Urban households often own scooters for convenience, while rural households prefer motorcycles and mopeds for affordability and rugged performance. As sales volumes rise, so does the demand for reliable and advanced braking systems.

2. Growing Focus on Road Safety

India records one of the highest numbers of road accidents globally, prompting government regulations to enforce stricter safety norms. Mandates for CBS and ABS in different vehicle categories have significantly boosted the demand for modern braking systems. Consumers too are becoming increasingly safety-conscious, creating strong demand for disc brakes and advanced safety systems.

3. Shift Toward Premium and Performance Two-Wheelers

The growing middle class and rising disposable incomes have created a surge in demand for premium motorcycles and scooters. Riders are not only seeking performance but also enhanced safety features, stylish designs, and improved riding experiences. Braking systems, particularly ABS, have become a must-have in this segment.

4. Growth of Electric Two-Wheelers

The electric two-wheeler market is booming in India, driven by affordability, lower running costs, and government incentives. Brake systems for these vehicles need to be designed with regenerative technology to optimize energy recovery. Manufacturers are increasingly innovating in this space to deliver specialized brake solutions tailored to electric mobility.

5. Technological Advancements

Continuous innovation in materials and design, such as lightweight brake components and heat-dissipating disc technologies, are making braking systems more efficient and durable. Smart braking systems that integrate with vehicle telematics are expected to gain traction in the near future.

Segmentation Insights

By Vehicle Type

- Motorcycles: The largest segment, requiring advanced braking solutions due to higher speeds and performance demands. Premium motorcycles extensively use ABS and dual-disc systems.

- Scooters: Popular in urban areas, scooters are increasingly adopting front disc brakes and CBS to handle stop-and-go traffic conditions.

- Mopeds: Budget-oriented and widely used in rural regions, mopeds continue to rely primarily on cost-effective drum brakes, though safety awareness is slowly encouraging upgrades.

By Brake Type

- Disc Brakes: Preferred for high performance, offering better heat dissipation and stopping power. Growing adoption across mid-range and premium two-wheelers.

- Drum Brakes: Cost-effective and reliable, still dominant in entry-level motorcycles, mopeds, and budget scooters.

- ABS & CBS: Witnessing rapid adoption due to regulatory mandates and consumer awareness.

By Region

- South India: Fastest-growing market with a high concentration of two-wheeler manufacturing hubs and urbanized consumer bases. Cities like Bengaluru, Chennai, and Hyderabad show strong adoption of premium bikes and scooters with ABS and CBS.

- North India: Driven by large rural populations, motorcycles and mopeds dominate. Safety awareness is rising, leading to gradual adoption of disc brakes.

- West India: Maharashtra and Gujarat represent growing hubs for both premium motorcycles and commuter scooters.

- East India: Comparatively smaller market but poised for growth as infrastructure and income levels improve.

Emerging Trends

1. Regenerative Braking in EVs

Electric scooters and motorcycles are increasingly adopting regenerative braking to extend battery life and efficiency. This trend will reshape braking system designs over the coming years.

2. Smart and Connected Brake Systems

With the rise of connected vehicles, brake systems are becoming integrated with IoT-based platforms for predictive maintenance and real-time safety alerts.

3. Lightweight Brake Components

To enhance performance and fuel efficiency, manufacturers are focusing on aluminum-based and composite materials that reduce overall vehicle weight.

4. Dual-Channel ABS Adoption

Earlier limited to premium motorcycles, dual-channel ABS is now expanding into mid-segment motorcycles and scooters, ensuring balanced braking and greater safety.

5. Urban Mobility Innovations

Compact scooters and e-scooters designed for urban traffic are now featuring CBS and advanced front-rear disc combinations, responding to city mobility challenges.

Industry Key Highlights

- Market size: USD 1.29 billion (2024) projected to reach USD 2.01 billion (2030).

- CAGR: 7.62% over 2024–2030.

- Motorcycles remain the dominant segment, but scooters are catching up with advanced braking features.

- South India leads growth due to rapid urbanization and strong demand for premium bikes.

- Rising adoption of ABS and CBS across mid-range motorcycles and scooters.

- Electric two-wheelers driving regenerative braking innovations.

- Government regulations remain a crucial enabler for safety feature adoption.

Competitive Analysis

The India Two-Wheeler Brake System Market is highly competitive, with both domestic and global players vying for market share.

Key Players:

- Brembo N.V. – Leading supplier of premium disc brakes and ABS solutions.

- UNO Minda Limited – Strong domestic presence, focusing on cost-effective yet efficient systems.

- TVS Srichakra Limited – Offering integrated braking technologies for scooters and motorcycles.

- Robert Bosch GmbH – Global leader in ABS and CBS technologies, supporting premium and electric two-wheeler segments.

- Rane Holdings Limited – Specialist in steering and braking components with strong OEM partnerships.

- Sundaram Clayton Limited – Focuses on lightweight, durable braking solutions.

- ZF Friedrichshafen AG – Known for advanced engineering and integration in performance two-wheelers.

- Endurance Technologies Limited – Key supplier for affordable and mass-market braking systems.

- JJUAN, SAU – Growing presence in disc brake systems.

- Akebono Brake Corporation – Global player with expertise in high-performance braking solutions.

Competition is intensifying as players focus on localization strategies, cost optimization, and technological innovations to cater to both mass-market and premium segments.

Future Outlook

The India Two-Wheeler Brake System Market is expected to sustain robust growth through 2030, fueled by:

- Rising safety regulations enforcing ABS and CBS adoption across all vehicle categories.

- Boom in electric two-wheelers, driving demand for regenerative and energy-efficient braking systems.

- Premiumization trend, with consumers willing to pay more for high-performance braking technologies.

- Urban traffic challenges, necessitating quicker, more reliable braking systems in scooters and e-scooters.

- Technological integration, leading to smart and connected braking solutions that align with global standards.

By 2030, the braking system segment in India will not just be about functionality—it will represent innovation, safety, and efficiency at the core of two-wheeler mobility.

10 Benefits of the Research Report

- Provides in-depth market size and growth projections up to 2030.

- Identifies key drivers shaping the India Two-Wheeler Brake System Market.

- Offers insights into vehicle-type-specific braking system demand.

- Highlights emerging technologies like ABS, CBS, and regenerative braking.

- Analyzes regional market dynamics across India.

- Profiles leading domestic and global market players.

- Examines regulatory influences on braking system adoption.

- Explores consumer trends shaping future product development.

- Offers competitive intelligence to support strategic decisions.

- Helps investors and businesses identify growth opportunities and risks.

Conclusion

The India Two-Wheeler Brake System Market is evolving at a rapid pace, reflecting the broader transformation of India’s mobility landscape. With increasing demand for safety, performance, and innovation, braking systems have moved beyond their traditional role, becoming a cornerstone of consumer choice and regulatory focus.

As India moves toward electrification and premiumization of two-wheelers, the demand for advanced, smart, and energy-efficient braking systems will only intensify. Companies that invest in R&D, localization, and safety-focused innovation are set to thrive in this competitive and fast-growing market.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Website: www.techsciresearch.com

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0