India Precious Metals Market Size, Share, Forecast Analysis and Report 2025-2033

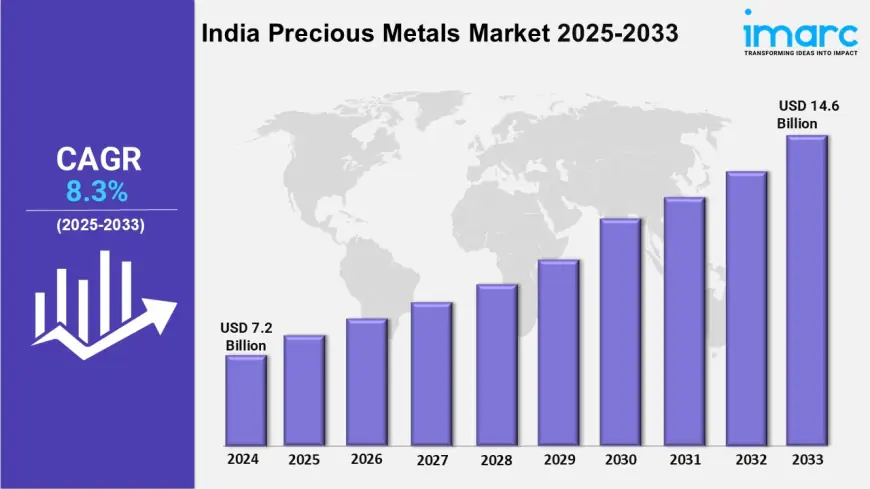

The India precious metals market size was valued at USD 7.2 Billion in 2024 and is expected to reach USD 14.6 Billion by 2033, exhibiting a growth rate (CAGR) of 8.3% during 2025-2033.

India Precious Metals Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 7.2 Billion

Market Forecast in 2033: USD 14.6 Billion

Market Growth Rate: 8.3% (2025-2033)

The India precious metals market size was valued at USD 7.2 Billion in 2024 and is expected to reach USD 14.6 Billion by 2033, exhibiting a growth rate (CAGR) of 8.3% during 2025-2033.

India Precious Metals Market Trends:

The India precious metals market is experiencing dynamic shifts, driven by evolving consumer preferences and economic factors. A key trend is the rising demand for gold and silver as investment assets, particularly during periods of economic uncertainty, as they are perceived as safe-haven assets. Moreover, the growing popularity of jewelry and ornaments continues to fuel demand, with gold and silver being integral to cultural and religious traditions. In addition, the increasing adoption of precious metals in industrial applications, such as electronics, healthcare, and renewable energy, is expanding their market relevance. Furthermore, the emergence of digital platforms and e-commerce is transforming the way consumers purchase precious metals, offering convenience and transparency.

Basically, the rising awareness of sustainable and ethical sourcing is influencing market dynamics, with consumers and manufacturers prioritizing responsibly mined metals. Additionally, the introduction of innovative financial products, such as gold ETFs and sovereign gold bonds, is making precious metals more accessible to a broader audience. These trends collectively highlight a market that is adapting to modern demands while retaining its traditional significance, driven by innovation, cultural values, and economic considerations.

Request for a sample copy of this report: https://www.imarcgroup.com/india-precious-metals-market/requestsample

India Precious Metals Market Scope and Growth Analysis:

The India precious metals market is poised for significant growth, supported by its dual role as a cultural asset and an industrial commodity. Moreover, the untapped potential in rural and semi-urban areas presents substantial opportunities, as rising disposable incomes and financial inclusion drive demand for gold and silver. In addition, the government’s initiatives to promote the gems and jewelry sector are creating a favorable environment for market expansion, with policies aimed at boosting exports and domestic consumption. Furthermore, the increasing use of precious metals in advanced technologies, such as semiconductors and medical devices, is broadening their industrial applications.

Basically, the growing trend of portfolio diversification is encouraging investors to allocate funds to precious metals, enhancing their role in wealth management. The market also benefits from the continuous innovation in product offerings, such as designer jewelry and customized investments, catering to diverse consumer preferences. With the rising integration of technology and sustainability, the scope of the precious metals market is expected to expand further, driven by both traditional and modern applications. Overall, the convergence of cultural significance, industrial demand, and financial innovation underscores the immense potential of India’s precious metals market.

India Precious Metals Industry Segmentation:

The report has segmented the market into the following categories:

Metal Type Insights:

- Gold

- Silver

- Platinum

- Palladium

- Others

Application Insights:

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

Regional Insights:

- South India

- North India

- West and Central India

- East India

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Ask an analyst: https://www.imarcgroup.com/request?type=report&id=9235&flag=C

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0