India Credit Card Payment Market Share, Trends, Size, Growth, Analysis, Outlook 2025-2033

Credit Card Payment Market - India

Market Statistics

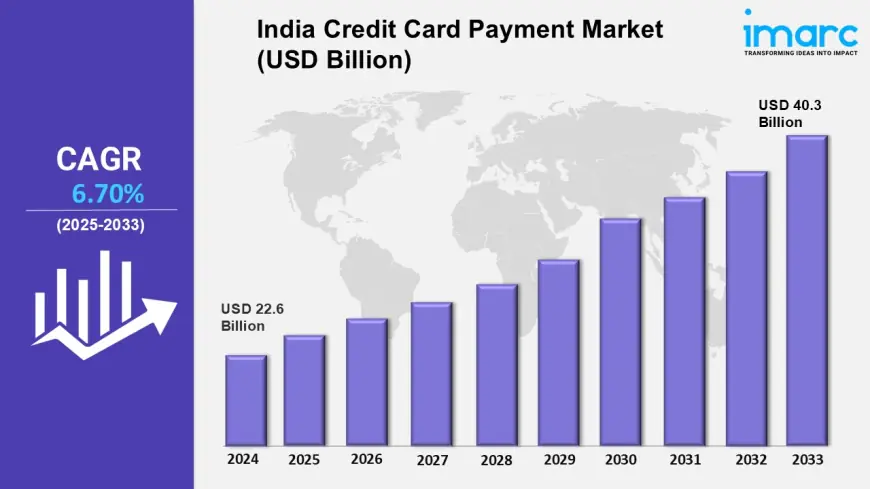

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

- Market Size in 2024: USD 22.6 Billion

- Market Size in 2033: USD 40.3 Billion

- Market Growth Rate (CAGR) 2025-2033: 6.70%

According to IMARC Group's report titled "India Credit Card Payment Market Report and Forecast 2025-2033," the market reached USD 22.6 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 40.3 billion by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033.

Download sample copy of the Report: https://www.imarcgroup.com/india-credit-card-payment-market/requestsample

India Credit Card Payment Market Trends and Drivers:

-

India credit card payment market is growing steadily, fueled by growing urbanization, rising disposable incomes, and a growing consumer preference for cashless payments.

-

Developing digitalization in retail, travel, healthcare, and entertainment industries has made the use of credit cards more popular and viable as a core payment method.

-

Increasing e-commerce penetration, along with aggressive promotional drives by banks and financial institutions offering discounts, cashbacks, and reward points, is driving adoption among young and middle-class consumers.

-

Greater use of smartphones and mobile banking applications has made credit card management, bill payments, and reward redemptions more convenient and user-friendly.

-

Growth in consumer credit awareness, encouraged by financial literacy initiatives and online finance platforms, is building confidence and adoption among first-time credit card users, especially in tier 2 and tier 3 cities.

-

Credit card issuers are increasingly targeting specific user groups such as frequent travelers, premium shoppers, and millennials with co-branded cards, travel rewards, and lifestyle privileges.

-

Reserve Bank of India’s regulatory push in digital payments and guidelines for safer and more transparent credit card issuance are strengthening market confidence and consumer protection.

-

Banks and fintech companies are leveraging artificial intelligence and machine learning to offer personalized credit limits, dynamic rewards, and fraud detection, thereby improving customer retention and engagement.

-

Contactless payment adoption, accelerated by post-pandemic concerns for hygiene and safety, is driving the popularity of tap-and-pay credit card solutions.

-

Seamless EMI conversion, balance transfer features, and instant approval processes are making credit cards more attractive to both salaried and self-employed individuals.

-

Reward programs linked to food delivery, online streaming, and fuel purchases are increasing the frequency of everyday card usage.

-

Integration of credit cards with UPI and QR code payment systems is broadening usage among small merchants and service providers.

-

Rising cross-border spending and international travel are boosting demand for globally accepted cards with multi-currency features.

-

Overall, the mix of regulatory support, digital infrastructure growth, evolving consumer behavior, and innovative product offerings is positioning India credit card payment market as a dynamic and fast-evolving segment within the financial services ecosystem.

India Credit Card Payment Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India credit card payment market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Card Type Insights:

- General Purpose Credit Cards

- Specialty Credit Cards

- Others

Provider Insights:

- Visa

- Mastercard

- Others

Application Insights:

- Food and Groceries

- Health and Pharmacy

- Restaurants and Bars

- Consumer Electronics

- Media and Entertainment

- Travel and Tourism

- Others

Regional Insights:

- North India

- South India

- East India

- West India

Request for customization: https://www.imarcgroup.com/request?type=report&id=32526&flag=C

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0