How to convert bank statement into Excel?

Learn how to convert a bank statement into Excel easily with step-by-step methods, tools, and expert tips for secure and accurate conversion.

If you’ve ever tried to analyze your bank transactions or prepare financial reports, you know how frustrating it can be to work with PDF bank statements. They are neat for record-keeping but hardly flexible when it comes to sorting, filtering, or running calculations. This is where the need to convert bank statements into Excel arises. The problem is simple: PDFs lock your financial data, while Excel unlocks it. The solution is equally straightforward: by converting your statements into Excel, you can manage, analyze, and even automate your financial planning. In this article, with the help of a bank statement converter, we’ll explore different methods, ranging from quick manual fixes to professional tools, that will help you turn those rigid statements into workable Excel sheets.

Understanding Bank Statements

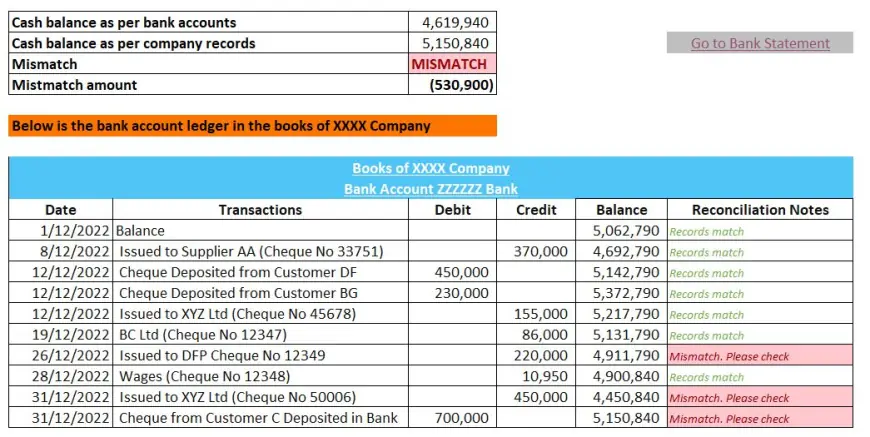

A bank statement is essentially a monthly or periodic snapshot of all transactions made through your bank account. It contains details such as deposits, withdrawals, charges, and balances. Most banks issue these statements in PDF format because it is secure and universally accessible. However, PDFs are static, meaning you cannot directly manipulate or calculate data within them. On the other hand, Excel is dynamic—it allows you to sort transactions by date, categorize expenses, calculate totals, and prepare visual reports. This makes Excel the natural choice for anyone who wants to do more than just look at numbers on a page.

Different Ways to Convert Bank Statement into Excel

There is no single method that works for everyone because bank statements come in different formats, and user needs vary. Some people simply copy-paste data, while others prefer downloading pre-formatted Excel or CSV files directly from their bank’s website. Then there are advanced users who rely on specialized tools or Excel’s built-in data import features. Each method has its own strengths and limitations, so choosing the right one depends on your comfort level with technology and the amount of data you are handling.

Download CSV or Excel Directly from Bank Website

Many banks today make things easier by offering statements not only in PDF format but also in CSV or Excel. CSV stands for “Comma-Separated Values,” which is essentially a raw data format that Excel can open seamlessly. If your bank provides this option, it is the cleanest and most accurate way to get your data into Excel. All you need to do is log into your online banking portal, navigate to statements, and choose the download option in Excel or CSV. Once downloaded, you can open it directly in Excel and start working without worrying about formatting errors.

Using Excel’s “Get Data” Feature

One of the lesser-known but very powerful tools in Excel is the “Get Data” feature. It allows you to import data directly from external sources such as text files, CSVs, and even PDFs in newer versions of Excel. By selecting “Get Data” and pointing Excel to your statement file, you can preview and load structured data into a spreadsheet. This method reduces the chances of formatting errors and makes it easier to clean the data afterward. For users comfortable with Excel, this approach saves time and provides more control over how the data is imported.

Common Issues and How to Fix Them

Converting bank statements is not always smooth. Sometimes you may find garbled text where numbers should be, or you may discover that important columns are missing. This often happens when dealing with scanned PDFs, which are essentially images of documents rather than text-based files. In such cases, Optical Character Recognition (OCR) software can help by recognizing text from scanned images. Another common issue is incorrect date formatting, which can be fixed by adjusting Excel’s date settings to match the original statement format.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0