How Bank Account Ownership Check Works: System Flow, APIs & Validation Logic

In today’s digital-first financial ecosystem, verifying whether a bank account truly belongs to a claimed individual or business is a critical trust layer. From onboarding customers to preventing payment fraud, a Bank Account Ownership Check has become a foundational component of secure workflows. At Meon Technologies, this verification process is engineered with precision—combining real-time APIs, intelligent validation logic, and scalable system architecture.

This article provides a deep technical walkthrough of how a Bank Account Ownership Check works, focusing on system flow, API interactions, and validation mechanisms used in modern enterprise environments.

Why Bank Account Ownership Check Is Critical

A Bank Account Ownership Check ensures that the provided bank details—account number and IFSC—are genuinely linked to the declared account holder. This verification is essential for:

-

Digital KYC and onboarding

-

Loan disbursement and repayments

-

Vendor and merchant payouts

-

Refund processing

-

Fraud prevention and risk mitigation

Without a reliable Bank Account Ownership Check, organizations face risks such as identity fraud, payment failures, and regulatory non-compliance.

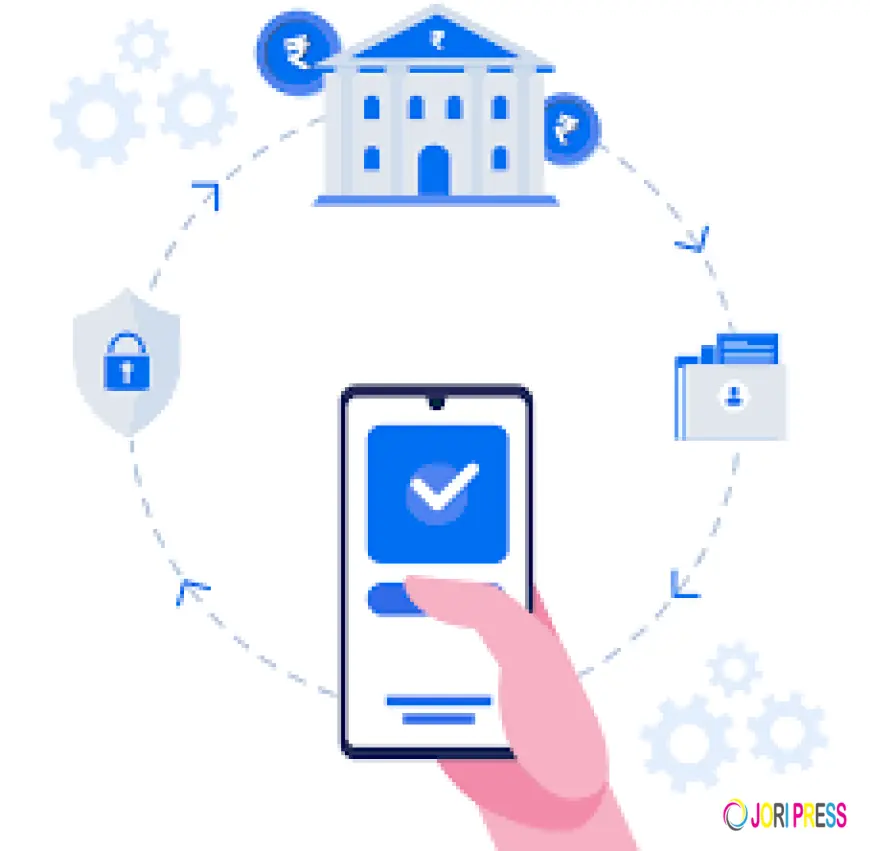

High-Level System Architecture

At Meon Technologies, the Bank Account Ownership Check system is designed as a modular, API-driven workflow that integrates seamlessly into existing platforms.

Core Components:

-

Client Application (Web / Mobile / Backend)

-

Meon Verification Gateway

-

Bank Network & NPCI Rails

-

Validation & Matching Engine

-

Response & Audit Layer

Each component plays a role in ensuring speed, accuracy, and compliance.

Step-by-Step System Flow

1. Data Input & Pre-Validation

The process begins when the client submits:

-

Bank account number

-

IFSC code

-

Claimed account holder name

Before initiating the Bank Account Ownership Check, Meon Technologies performs format-level validations:

-

Account number length and structure

-

IFSC format verification

-

Mandatory field checks

This reduces unnecessary API calls and improves success rates.

2. API Request Initiation

Once validated, the client system sends a secure API request to Meon Technologies’ verification endpoint.

Key API characteristics:

-

REST-based architecture

-

JSON request/response format

-

Token-based authentication

-

TLS encryption

This API layer is the backbone of the Bank Account Ownership Check workflow.

3. Bank Network Invocation

Meon Technologies routes the request through regulated banking channels to perform a live verification. The system triggers a real-time check using bank-supported verification mechanisms.

This step confirms:

-

Account existence

-

Account status (active/inactive)

-

Ownership association

The Bank Account Ownership Check is performed without exposing sensitive customer data.

4. Name Fetch & Matching Logic

One of the most critical stages is name validation. The bank responds with the registered account holder name or a masked reference.

Meon Technologies applies intelligent matching logic:

-

Exact match scoring

-

Fuzzy name comparison

-

Initial and abbreviation handling

-

Threshold-based acceptance rules

This ensures high accuracy even with minor spelling variations during the Bank Account Ownership Check.

5. Validation Engine Decisioning

The validation engine evaluates multiple signals:

-

Bank response status

-

Name match score

-

Account activity indicators

Based on configurable rules, the system returns a final verdict:

-

Verified

-

Partially Matched

-

Failed

This structured decisioning is what makes Meon Technologies’ Bank Account Ownership Check enterprise-ready.

6. Response & Callback Handling

The final response is sent back to the client application in real time.

Typical response payload includes:

-

Verification status

-

Match confidence score

-

Reference ID

-

Timestamp

For asynchronous workflows, webhook callbacks are also supported, making the Bank Account Ownership Check adaptable to different system designs.

API Design Principles at Meon Technologies

The Bank Account Ownership Check API is built with developer-first principles:

-

Low latency responses

-

Idempotent request handling

-

Clear error codes and messages

-

High throughput scalability

These design choices ensure smooth integration across fintech, banking, and enterprise platforms.

Validation Logic Explained

Validation is not just about “yes” or “no.” Meon Technologies uses layered logic:

-

Structural Validation – Input correctness

-

Network Validation – Bank confirmation

-

Identity Validation – Name matching

-

Risk Validation – Anomaly detection

This multi-layered approach makes the Bank Account Ownership Check resilient against fraud and data inconsistencies.

Security & Compliance Considerations

Security is embedded into every Bank Account Ownership Check workflow:

-

Encrypted data in transit and at rest

-

No storage of raw bank credentials

-

Role-based API access

-

Full audit logs and traceability

Meon Technologies ensures that verification processes align with regulatory and industry best practices.

Scalability & Performance

A production-grade Bank Account Ownership Check must handle spikes during onboarding campaigns or payout cycles. Meon Technologies’ infrastructure supports:

-

Horizontal scaling

-

Auto-failover mechanisms

-

High availability architecture

This guarantees consistent performance even at large transaction volumes.

Common Use Cases

Organizations use Bank Account Ownership Check APIs from Meon Technologies for:

-

Instant customer onboarding

-

Secure loan disbursements

-

Marketplace seller verification

-

Subscription refunds

-

Corporate vendor validation

Each use case benefits from real-time verification and reliable decisioning.

Final Thoughts

A Bank Account Ownership Check is no longer optional—it is a core trust primitive in digital finance. By combining robust system flow, intelligent APIs, and advanced validation logic, Meon Technologies delivers a verification solution that is fast, accurate, and scalable.

For organizations building secure financial workflows, implementing a well-architected Bank Account Ownership Check is a decisive step toward reducing risk and improving operational efficiency.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0