Global Network Encryption Market Outlook 2025–2033: Security Trends, Deployment Models & Growth Forecast

Market Overview

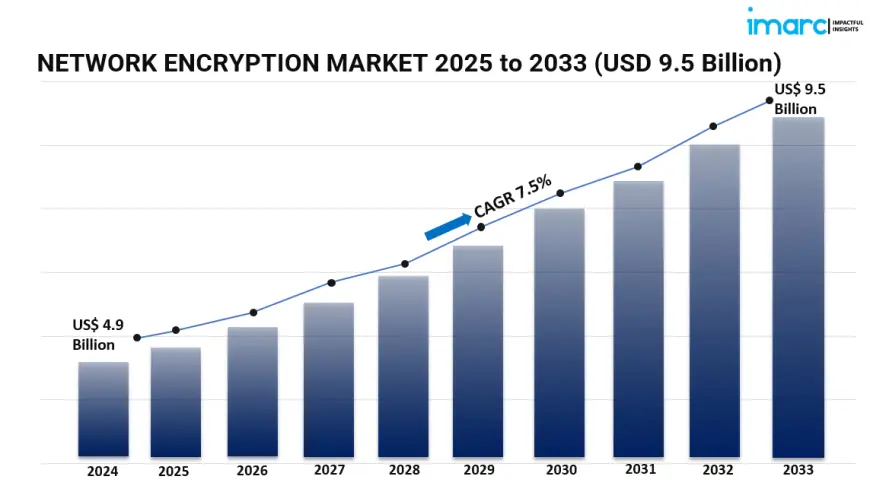

The global network encryption market reached a value of USD 4.9 billion in 2024 and is projected to nearly double to USD 9.5 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 7.5% during 2025–2033. The market is being driven by the rapid deployment of 5G networks, increased cloud adoption, and growing concerns about cybersecurity and data privacy. With digital transformation accelerating across industries, the need for secure data-in-transit has never been greater.

Key Stats

-

Market Value (2025): USD 5.2 Billion

-

Projected Value (2033): USD 9.5 Billion

-

CAGR (2025–2033): 7.5%

-

Leading Segment (2025): BFSI sector

-

Top Region: North America

-

Major Players: Cisco Systems Inc., IBM Corporation, Thales Group, Juniper Networks Inc., Nokia Corporation, and more.

Growth Drivers

1. Technological Innovation & 5G Expansion

Emerging to meet changing cyber threats are next-generation encryption technologies including multi-layer security architectures and quantum-resistant algorithms. A major enabler is the worldwide deployment of 5G infrastructure, which allows for high-speed, low-latency data transfers needing secure transmission across bigger network surfaces.

2. Cybersecurity & Regulatory Compliance

Encryption is becoming a cornerstone of corporate cybersecurity plans as data breaches and ransomware attacks are on the increase. Strict data protection standards are being imposed across industries by regulatory systems including GDPR, HIPAA, and PCI-DSS, which is fueling the spread of sophisticated network encryption products.

3. Cloud Migration & Digital Workflows

The need to protect data across hybrid and multi-cloud systems is growing as businesses move toward cloud-first approaches. Network encryption provides end-to-end data protection, therefore facilitating safe remote access, mobile device usage, and international data interchange without infringing on either privacy or performance.

AI or Technology Impact

Artificial intelligence (AI) and machine learning (ML) are playing an increasing role in the network encryption landscape. These technologies enable adaptive encryption algorithms that dynamically assess risks and automate threat responses. Moreover, AI-driven key management systems enhance encryption efficiency, reduce human error, and ensure secure scalability across enterprise networks.

Segmental Analysis

By Component:

-

Hardware

-

Solutions and Services (dominant in 2025 due to cloud integration and ease of deployment)

By Deployment Mode:

-

Cloud-based (fastest-growing segment due to remote accessibility and scalability)

-

On-premises

By Organization Size:

-

Small and Medium-Sized Enterprises (SMEs)

-

Large Enterprises (leading share in 2025 due to larger attack surfaces and compliance requirements)

By End Use Industry:

-

Telecom and IT

-

BFSI (dominates due to data sensitivity and regulatory demand)

-

Government

-

Media and Entertainment

-

Others

Regional Insights

North America

North America leads the global network encryption market, supported by advanced IT infrastructure, high investments in cybersecurity, and strict regulatory frameworks. The region is home to leading tech firms and a mature BFSI sector, both of which prioritize robust network protection.

Asia Pacific

Asia Pacific is the fastest-growing region, driven by the rapid digital transformation in countries like China, India, Japan, and South Korea. Increasing adoption of mobile banking, cloud computing, and government digitalization initiatives are enhancing demand.

Europe

Europe is experiencing stable growth, backed by GDPR compliance and rising investments in IT security across industries like manufacturing, healthcare, and public services.

Latin America & Middle East and Africa

These regions are emerging as growth markets due to digital infrastructure upgrades and rising awareness of cybersecurity risks. Governments and enterprises are investing in encryption as part of broader digital security strategies.

Market Dynamics

Drivers:

-

Surge in cyber threats and data breaches

-

Expansion of 5G and IoT applications

-

Mandatory compliance with international cybersecurity standards

-

Cloud adoption across all enterprise sizes

Restraints:

-

High costs of deployment in SMEs

-

Complex integration with legacy systems

Key Trends:

-

Rising demand for quantum-safe encryption

-

Growth in software-defined perimeter (SDP) solutions

-

Increasing mergers and acquisitions to strengthen encryption portfolios

-

Integration of zero-trust network architectures

Leading Companies

-

Cisco Systems Inc.

-

International Business Machines Corporation (IBM)

-

Thales Group

-

Juniper Networks Inc.

-

Nokia Corporation

-

Atos SE

-

F5 Networks Inc.

-

Ciena Corporation

-

Raytheon Technologies Corporation

-

Rohde & Schwarz GmbH & Co KG

-

PacketLight Networks Ltd.

-

Colt Technology Services Group Limited

-

Securosys SA

-

Senetas Corporation Limited

-

Viasat Inc.

These players are engaging in strategic partnerships, acquisitions, and product innovations to expand their global footprint and meet rising enterprise demands.

Recent Developments

-

Cisco acquired Isovalent (April 2024) to enhance its multicloud network security capabilities.

-

Thales Group launched a new quantum-safe VPN solution for government and defense sectors in 2023.

-

IBM and Juniper Networks partnered to deliver AI-powered, encrypted hybrid cloud infrastructure.

-

Ciena introduced WaveLogic 6, an encryption-integrated optical transport solution.

-

Governments in North America and Europe are increasing encryption mandates in defense and financial services.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=4969&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0