Global Drones Market Report 2025-2033: Industry Trends, Share, Size, and Forecast

Global Drones Market Outlook: 2025–2033

Market Overview

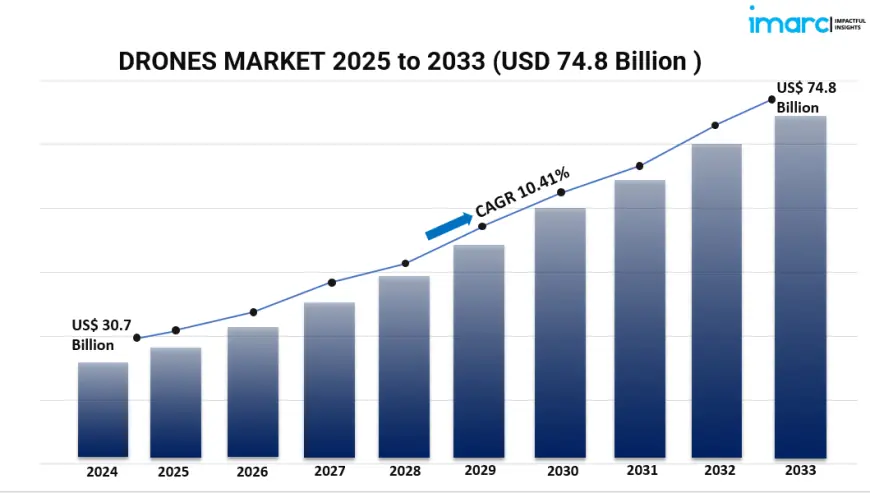

The global drones market is poised for significant expansion, fueled by rapid technological innovations, a surge in diverse applications, and supportive regulatory developments. In 2024, the market size reached USD 30.7 billion and is projected to escalate to USD 74.8 billion by 2033, marking a CAGR of 10.41% between 2025 and 2033. Notable growth contributors include the integration of 5G networks, IoT solutions, and AR capabilities, along with growing consumer interest in drone-based recreational activities such as aerial photography and drone racing.

Study Assumption Years

Base Year: 2024

Historical Years: 2019–2024

Forecast Years: 2025–2033

Drones Market Key Takeaways

- Market Size & Growth: The drones market was valued at USD 30.7 billion in 2024 and is anticipated to grow to USD 74.8 billion by 2033, progressing at a CAGR of 10.41% over the forecast period.

- Regional Performance: North America led the global market in 2024 with over 48.4% share, bolstered by technological prowess and strong institutional support.

- Leading Type Segment: Fixed-wing drones accounted for the highest market share among types due to their superior flight endurance and coverage capacity.

- Component Insights: The hardware segment held the largest share, driven by demand for durable, lightweight, and high-performance materials.

- Payload Dominance: Drones under 25 kilograms were the top choice, offering flexibility for applications such as aerial imaging and small package delivery.

- Point of Sale: Original Equipment Manufacturers (OEMs) emerged as the largest source due to their ability to deliver integrated, high-quality drone systems.

- End-Use Industry: Military and defense remained the primary end-user segment, utilizing drones for surveillance, reconnaissance, and mission-critical operations.

For more insights, request a sample: https://www.imarcgroup.com/drones-market/requestsample

Market Growth Factors

- Technological Advancements:

Adopting AR, 5G connectivity, and IoT solutions has turned drones into smart, agile tools with better user experience, data transmission, and navigation. Performance and flight time of drones have been greatly improved by developments in lightweight composites and battery efficiency, therefore aiding market growth. - Regulatory Support:

Worldwide, governmental agencies are carrying out forward-looking policies encouraging drone incorporation into restricted airspace. By setting down explicit operational guidelines and safety procedures, organizations like the US FAA are promoting innovation and commercialization. - Cross-Industry Applications:

Their problem-solving possibilities cause drones to be quickly embraced in many sectors. In agriculture, they help with crop health monitoring and yield maximization. In logistics, drones are lowering reliance on conventional delivery methods. Their usefulness is moreover increased by their growing participation in hard-to-reach territory investigation and emergency response. - Evolving Consumer Preferences:

Particularly in industries like adventure tourism, consumers are increasingly interested in experiential and immersive events. Beautiful aerial images and strengthened safety features help drones to improve experiences and so make adventure activities more attractive to Gen Z and millennial tourists who give eco-friendly travel first priority. - Social Media Influence:

The visibility of drone-enabled content on platforms like Instagram, TikTok, and YouTube has grown, therefore fostering drone-based trip and recreation involvement. The viral nature of aerial material and influencer marketing keeps increasing worldwide demand and awareness in both business and leisure categories.

Market Segmentation

By Type:

- Fixed Wing: Long-endurance drones used in wide-area mapping and surveillance.

- Rotary Wing: Ideal for tasks requiring stationary flight, such as inspections and real-time imaging.

- Hybrid: Combine fixed and rotary features, suited for versatile missions.

By Component:

- Hardware: Includes all core physical elements like airframes, motors, and onboard sensors.

- Software: Manages drone operations via navigation, mission automation, and data processing systems.

- Accessories: Enhancements such as advanced cameras, gimbals, and communication modules.

By Payload:

- <25 Kilograms: Suited for photography, surveillance, and light delivery services.

- 25–170 Kilograms: Mid-weight drones used in industrial and tactical surveillance.

- >170 Kilograms: Heavy-duty drones capable of carrying large cargo and equipment loads.

By Point of Sale:

- Original Equipment Manufacturers (OEM): Primary providers of integrated drone solutions.

- Aftermarket: Offers upgrades, spares, and accessories to extend system lifespans.

By End-Use Industry:

- Construction: Enables topographic surveys and real-time project tracking.

- Agriculture: Assists in precision farming through crop analytics and aerial spraying.

- Military and Defense: Utilized for high-stakes intelligence, surveillance, and operations.

- Law Enforcement: Deployed for public safety monitoring and search operations.

- Logistics: Accelerates last-mile delivery and inventory surveillance.

- Media and Entertainment: Key in capturing cinematic footage and event broadcasting.

- Others: Includes mining, oil and gas, and environmental impact assessment.

Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Regional Insights

North America held the largest share in the global drones market in 2024, largely driven by technological maturity and favorable policy frameworks. The Federal Aviation Administration’s regulatory roadmap has facilitated broad commercial drone usage, leading to high innovation and adoption across industries.

Recent Developments & News

The global drones market is evolving rapidly, with new breakthroughs in smart drone technologies. These include embedded safety protocols, autonomous flight systems, intelligent sensors, and compliance software. The evolution of such features is broadening drone applications across military, logistics, and commercial domains, making them safer, more capable, and increasingly autonomous.

Key Players

- 3D Robotics

- AeroVironment Inc.

- Birdseyeview Aerobotics Inc.

- Delair SAS

- Drone Deploy Inc.

- Intel Corporation

- Parrot SA

- Precisionhawk Inc.

- SZ DJI Technology Co. Ltd. (iFlight Technology Co. Ltd.)

- Terra Drones Corporation

- Boeing Company

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=2293&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0